What’s Inside?

- What are some forex day trading strategies you can use?

- Do you recommend any rules for day trading forex?

- Will I need particular skills to day trade the forex market?

A Personal Note From Me:

I’ve never been a trader who could only trade higher time frames, or only lower time frames. Technically I could, and I’ve had to depending upon where I live in the world + what time zone I’m in.

But when it comes to making money trading, you have to do what is most natural to how you think and perform. What I realized about myself 15 years ago while working as an FX broker, was that my mind likes to be active. My mind performs best when I’m be working on both short term and long term activities.

I also feel like having both skills gives me way more options and opportunities to pull money out of the market.

My suggestion for you is to find that which is most natural to your every day thinking, mindset and skill sets. For some of you, it will be day trading only. For many others, it will be swing trading or position trading on the higher time frames. And for a smaller portion of you, that will be a marriage between the two.

For those of you that are naturally attracted to day trading, or are interested in learning the skills and upsides to day trading – read on.

The Benefits of Day Trading

A healthy way to look at day trading is examine a parallel profession and skill – that of online poker players.

Trading and online poker have skill-sets which mirror each other incredibly (risk management, controlling your emotions, calculating probabilities, etc). Hence, if you have good skills as a trader, you most likely have a solid set of skills to make money in online poker (and vice versa).

I’ve spent many a nights with my trading friends playing poker in casinos and various private tables. 75% of the time, we make money. The last time I went into a casino poker room with another trading friend of mine, I doubled my buy in, and a lot of that success had to do with my skills as a profitable trader.

When you look at online poker players, you’ll almost never see a poker player only playing one table. Over 80% of them are playing multiple tables at the same time, with some I know handling 16 tables at a time for hours on end.

Now you have to ask yourself: why do online poker players prefer to play more tables vs less or just one?

The answer is simple: MATH! If I am a good poker player, and have an edge on one table, then if I can repeat the edge across multiple tables, I can make more money.

The same goes for day trading. If you have a profitable trading strategy and skill set, the more trades you make, the more money you make as that edge plays out more x’s per day.

More trades (technically) =’s more opportunities to make money. This is one advantage that day trading has over swing trading.

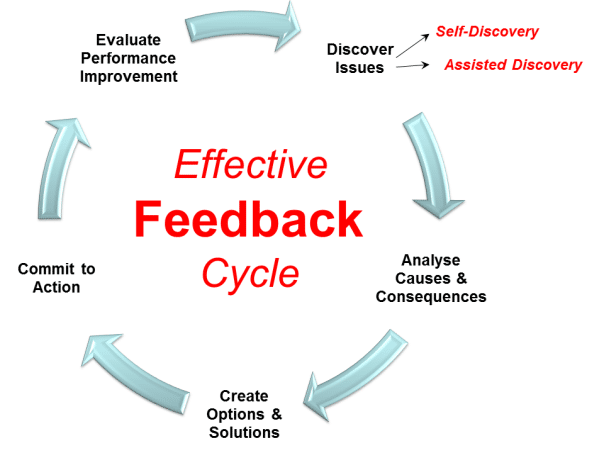

Another major advantage of day trading is you get more feedback faster.

The more trades you make with a particular strategy, the faster you learn the in’s and out’s of that strategy, such as what environments it works best in, and which ones it performs poorly with.

By also exposing yourself to a lot more candles, price action context and structures, you’re creating a more abundant data set to digest, memorize and work with.

I could list a whole host of other benefits (such as not having over-night risk), but for now, I’m guessing you can see why day trading has some serious benefits.

For now, let’s jump into a few tips, tactics and strategies for day trading.

Day Trading Tip #1: Do Not Trade Against These!

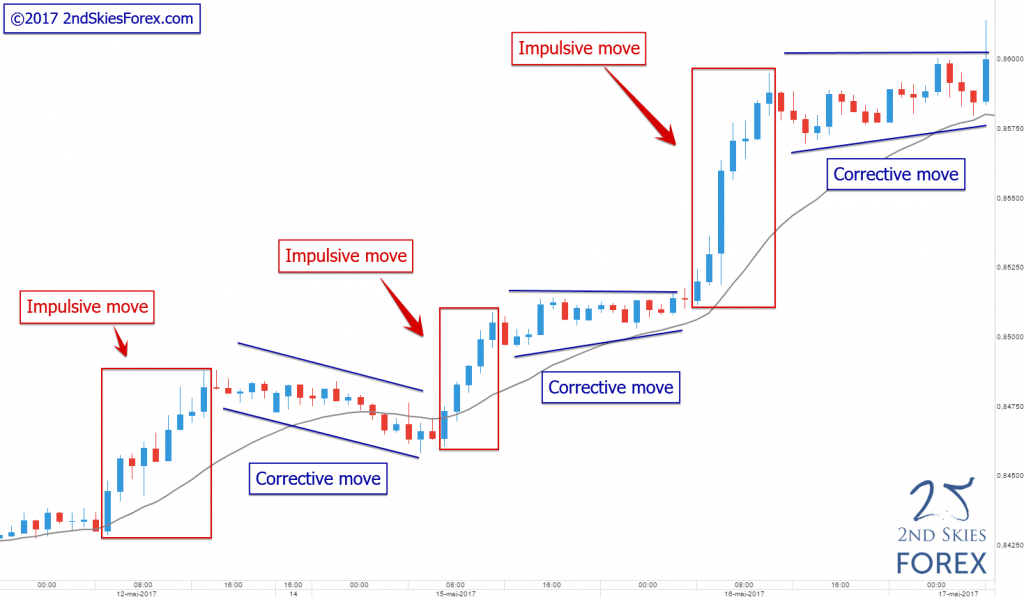

The first core model I use to trade price action context on any time frame, particularly day trading, is impulsive and corrective price action.

For those of you that are new to trading impulsive and corrective price action, click on that link above.

Now assuming you know what an impulsive move is in the forex market, I’d like you to do an experiment:

Look at all your losses, particularly the ones where you opened the trade, and it pretty much went negative right off the bat and ended up a loss.

When you look at the charts leading up to your entry, and how the price action acted after, count how many of them you were trading against impulsive moves. I’m guessing in the majority of those losses you were trading against them.

If you find this to be true, then you want to be trading with impulsive moves as much as possible when day trading.

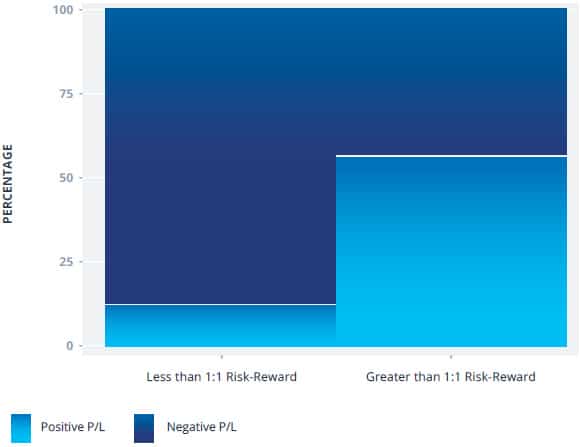

Day Trading Tip #2: Always Trade With A Minimum Risk vs Reward Over This

In one of my latest articles, I talked about 6 trading statistics you should know if you want to make money trading. One of them was from a study done by FXCM, whereby they noticed traders who had a 1:1 risk to reward ratio were 300% more likely to profit vs traders who used negative risk:reward ratios.

This statistic applied to all time frames and types of traders (day and swing traders). Because you are more active day trading, you’re applying your edge more often in the forex market. Hence you have to be super on point in making sure the math works out in your favor as you’re trading at a faster pace, and thus exposing your equity more often to risk.

Hence, use nothing less than a 1:1 risk to reward ratio when day trading.

Day Trading Tip #3: Limit The Number of Instruments You Trade

Because of the time sensitive nature of day trading, every calculation, analysis and decision you make must be done faster. This increased speed of processing in your brain also taxes your working memory and thus increases your cognitive load.

To reduce this strain on your brain, I’d suggest day trading a few instruments or forex pairs, possibly even one.

If you’re day trading only the forex market, I’d suggest one major pair, one minor pair, and one exotic to add some extra spice 🙂

Ideally you are choosing forex pairs which are most correlated with your region and time of day. So USD and European currencies if you are in the UK/Europe/North America. For Asia/Australia/New Zealand, I’d suggest at least 2 currencies from your region (JPY, AUD, NZD, CNY, SGD, KRW) and minimally one USD pair.

If you’re day trading stocks, I’d recommend one or two indices from your region, and at least one consistently volatile stock from your region. You can also look for an ETF as well.

If you’re day trading commodities, I’d recommend a natural resource, such as WTI/Nat Gas, one precious metal, such as gold/silver, and one agricultural product.

The number of instruments isn’t fixed. A good rule of thumb is to only trade as many instruments as you can mentally handle. If it’s too taxing and stressing on your brain, you’re likely trading too much.

Day Trading Tip #4: Have A Max Risk Profile

I’m guessing many of you struggling traders have experienced how easy it is to get carried away with risk, particularly when you’re on a winning a losing streak. To keep guardrails in place so you don’t start over-trading and going off the reservation, I recommend having a max risk profile as a day trader.

A max risk profile is simply creating a line in the sand that once your losses for that day, week, month are passed, you stop trading for the time being and regroup.

If you could only have one max risk profile, it would be a max risk per month. If you are open to having two of them (my minimum suggestion), it would be a max risk per month and a max risk per trade. A more robust risk profile would be to have a max risk per month/per day/per trade.

I always recommend risking a fixed % per trade, and generally do not recommend more than 1% per trade (in the beginning, ideally <1% per trade). Per day, I’d recommend no more than 4-5R, so 4-5x your max risk per trade. Per month I’d recommend a max risk of 9.9% per month.

Why 9.9%? Because the statistics show that for every double digit draw-down you have per month, your chances of recovering your account just back to break even decline exponentially.

Having max risk profiles will protect you long term and keep you in the game when things are tough so you can bounce back and get to profitability.

Day Trading Tip #5: Plan This Ahead of Time

As a day trader, you’re often using a lot of working memory + brain processing power in your pre-frontal cortex for all the decisions/calculations/analysis you have to do in real time with alacrity.

This can increase the cognitive load and thus tax your brain, leaving you with little bandwidth to make important trading decisions in real time.

Because of this, I’d recommend planning these two things ahead of time:

#1: Plan your trades ahead of time. This includes doing your price action context analysis ahead of time, along with identifying your key support and resistance levels and the types of trade setups you want to take ahead of time.

Of course, we’re always flexible to take new trades should they emerge, but we want to plan as much of this ahead of time so when it comes time to trade, you’re already prepared and can just pull the trigger.

#2: Plan If/Than scenarios ahead of time. Some examples of if/than scenarios you can prepare for are:

-your trend direction gets reversed

-you get stopped out and the market is showing a reversal setup

-the market breaks a key level you think will hold

By planning these ahead of time, you avoid being married to one side of the market, thus remaining flexible so you can take advantage should the market change directions when you least expect it.

Day Trading Tip #6: A Good Strategy Can Be As Simple As Targeting 15-20 Pips A Day

Since you are wanting to day trade, it’s important you are going for targets which can easily be hit within a day’s session, or ideally a 24hr period. What this translates to is going after targets which are consistently hit on any given day.

Thus whatever instrument you trade, whether it be forex, stocks, indices, or whatever, that the average daily movement and volatility for that instrument makes it easy for you to find trades that will hit those targets.

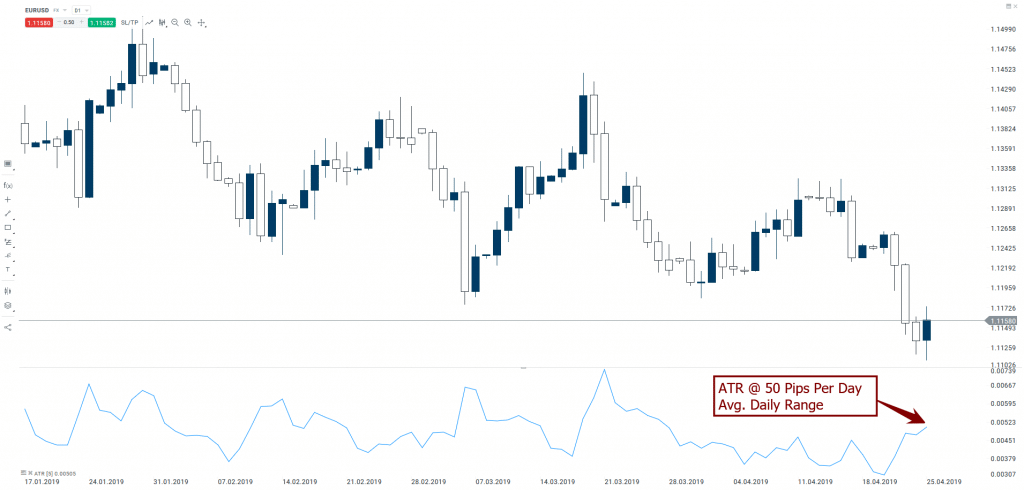

A simple way to do this is to pull up the ATR indicator on a daily forex chart for your instrument and set it to 5. This will calculate the average daily range per day over a 5 day period.

In the example below for the EURUSD, the 5 period ATR on the daily chart is 50 pips with a high of 69 pips over this year and a low of 30 pips.

What this means is, if you want to day trade the EURUSD pair, you could simply go for 15-20 pips a day which should be a relatively easy target to hit.

Obviously you’re going to need a strategy to help you capture those 15-20 pips per day, and we teach many strategies like this in our price action course. But as you can see, this is a relatively workable target to go for each day with the right price action skills in place.

In Closing

There is so much more I could talk about when it comes to day trading forex, or any market for that matter. But the key points to remember are:

- Day trading has some major advantages over swing trading when it comes to multiplying your income

- Day trading also has some specific challenges swing traders do not face with the time pressures involved

- Only day trade if it suits you personally and feels natural

- Don’t trade against impulsive moves whenever possible, and make sure to plan out ahead of time as much as possible

- Create a proper risk profile to protect you when you’re not performing at your best

- Go for reasonable targets that can be achieved easily within a day

If you learn to do this above well, along with all the tips and tactics I mentioned above, with the right training and mindset, you can find it a very profitable endeavor.

Some of my best trades were day trades that took no less than a couple hours to hit their profit targets. It’s a nice and rewarding feeling to grind out several profitable day trades over a few hours, then go out and enjoy the rest of your day as you made your money.

If you’re interested in learning more about day trading forex (or any market for that matter), in our price action course, we teach strategies and skills to day trade on any instrument, time frame or environment.

My hope with this article is that you who are naturally inclined to day trade find it much more workable and profitable through the methods and tactics we shared above.

With that being said, please make sure to leave your comments and feedback as we’re always looking to hear from our community.

Until then – good health and success to you in trading and life.