I got a forex trader psychology question from a new student of mine who’s been struggling for years. He’s experienced a common problem you yourself have likely faced.

Here is what he emailed me below:

“I know this varies greatly based on internal and external factors, but about how many trades do you take on a daily basis on average?”

The real question he was asking is under the surface. But it’s a common issue many traders face, which we’ll get into shortly.

Before I do, here is their response below to my follow up prodding and questions:

“One of my weaknesses that I battle with (although getting better) is over-trading and feeling the need to be in the market.

To combat it, I stick to the H4 and Daily time frames. But again I get impatient sometimes…“

Over-trading

This is something many traders struggle with. The reason why you over-trade has two major underlying reasons.

Befor we dive into those, I’d like to point out some key things they said.

They are:

1) “Feeling the need to be in the market”

2) “I get impatient sometimes”

Note those two statements down for now as they are critical for this article.

But before we get into the reasons why you over-trade, we need a working definition of ‘over-trading’.

My definition of over-trading is as follows.

Assuming you are working with a trading plan, ‘over-trading’ is either:

a) taking any trade/s outside of your trading plan, or

b) taking any trades which cause you to exceed your maximum risk limits

If you hit any of the two qualifications above, you are (in my book) over-trading.

Notice I mentioned nothing about a) the number of trades and b) the time frames. This last variable is highly relevant.

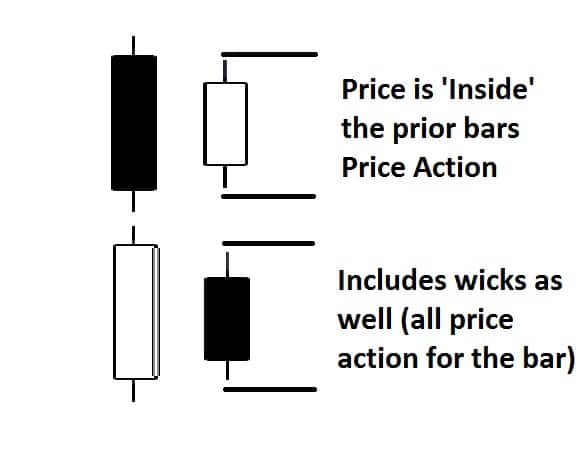

As I mentioned in my last article, there is a common trading psychology narrative around price action. This is because the majority of those ‘gurus’ teaching price action all copied what they learned.

They are derivatives themselves, or derivatives of derivatives.

One key piece of mis-information from this entire camp is ‘higher time frames are better than lower time frames’. They also state ‘lower time frames are just noise and higher time frames give better signals’.

Despite the fact professional bank traders trade intra-day, they still proselytize this meme.

(does he look like he’s being impatient and over-trading? source: smb-training)

GUESS WHAT? You can over-trade on any time frame. The time frame is not the root cause of over-trading. A lack of discipline is.

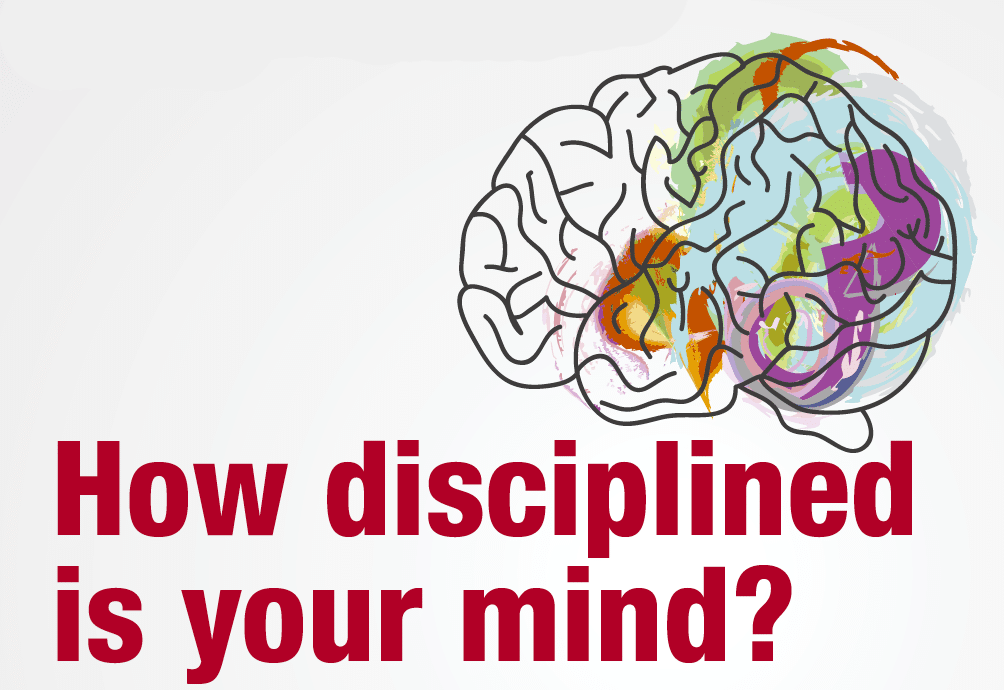

If you have not wired your brain to mentally execute your trading plan, the time frame will make no difference.

Just like if you have the habit of over-eating, you will do so whether you are at a restaurant or your own kitchen. The habit is within you and doesn’t just disappear when you change environments.

Neural networks are clusters of neurons in your brain. They take time to change. If you are dominantly wired right now to eat too much, you will regardless of where you are. The same goes for over-trading.

Notice what my new student mentioned earlier, “I stick to H4 and Daily time frames. But again I get impatient sometimes.“

For him, the time frames are completely irrelevant. His impatience takes over regardless.

I do not find it ironic that all those who copied their ideas about price action, also repeat the same notions about over-trading.

If there is no real engagement with their minds and the markets, one will never come to the idea that over-trading is not time frame dependent. That is why this meme is repeated.

If you want to dissolve the underlying root of over-trading (discipline & mental execution), you have to re-wire your brain.

Before we get into how you can do that, I’d like to address a few points about my definition of over-trading.

Having A Daily Risk Limit

For my members, I recommend having three to four risk thresholds as part of their trading plan. They are:

1) A max risk per trade

2) A max risk per day

3) A max risk per week

4) A max risk per month

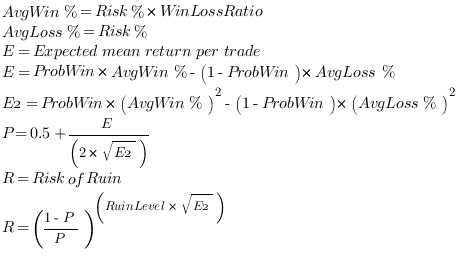

A max risk per trade should be based upon your risk of ruin.

NOTE: You cannot calculate your risk of ruin if you are risking a fixed dollar amount per trade.

I’ve written extensively why risking a fixed percent per trade is far superior to a fixed dollar amount.

If you have a risk of ruin that is zero, mathematically you a) cannot blow up your account, and b) will make money.

A max risk per day should be a daily risk limit to avoid losing too much on any given day. The max risk per week and month are also based upon the same concepts.

If any one of the above is ‘optional‘ in my book, it is the max risk per week. Keep in mind, none of the above defines how many trades you should (or should not) take in a day to avoid over-trading.

If a basketball player is on a hot streak, you keep feeding him the ball as those streaks are critical to winning. Professional poker players know this as well – when hot, keep putting your chips down.

The same goes for trading. Not pulling the trigger when you have a setup (with all conditions in place) simply limits your upside.

Why would you ever do that? If the price action context is prime for you to make a ton of money that day, you should be attacking the markets.

On the other side of the coin, I’ve had days where I started out with 6, 7, maybe even 9 losses in a row. But I’m not phased by this.

As long as I haven’t hit my risk limit per day, I’ll keep attacking the markets, sometimes buying and selling in the same day.

Ironically, on many of those days, one or two big winners either brought me back to break even, or helped me end up in profit for the day.

Had I succumbed to some notion about ‘over-trading = x trades‘, every one of those days would have ended in a loss. On top of that, each one would have ended with a much greater negative impression in my mind.

Yet how much confidence do you think I get from losing 9+ trades in a row, and still making money to end the day?

Just like a quarterback doesn’t stop throwing the ball because he’s had a couple interceptions and bad passes, the same goes for trading.

Your goal should be to win each and every day while maintaining your trading plan, risk limits and mental execution.

With all the above said, two things have to be addressed regarding over-trading.

Discipline & Wiring Your Brain

IMO, you should not be trading the markets without a trading plan.

Make sure to read my article ‘what if your trading plan is costing you money?‘ Inside this plan should be specified the 4 risk limits from above. On top of this, so should your strategies and instruments you trade.

“Your trading plan needs to define your actions & mental execution every time you sit down to trade.”

However, these plans are meaningless if you haven’t built the discipline to execute them.

In some sense, I get the reason why some ‘gurus’ say ‘avoid the lower time frames as you will over-trade there‘.

Part of the proselytizing here is because it fits their story about higher time frames. Saying lower time frames are the boogeyman for your trading is a way to continually market & perpetuate their narrative.

But in reality, telling you to avoid the lower time frames is based upon fear.

That you will be powerless if you enter the seductive Scarlett Johannson-like bedroom of the lower time frames.

That you will become a helpless meth-like trading junkie should you go there.

One of them even uses this image to portray what happens when trading the lower time frames (see below).

FYI, I trade the 5 min charts (sometimes the 1 min charts) when trading price action intraday, and I’ve never looked like that. My mind is as calm as a hindu cow whether I’m trading the 5m or daily charts.

The time frame is irrelevant because I’ve wired discipline into my brain. Many of my students also trade the intra-day time frames, and none of them look like this (SHOCKING!).

I met a prop-firm day trader at the Singapore Trading Seminar I did this July. Guess what?

He didn’t look like that at all! He was one of the nicest, most relaxed and intelligent guys I’ve met.

It is true, day trading does increase CL (cognitive load), but it doesn’t turn you into a crazy person.

Photos from the Singapore Trading Seminar

Me showing a live trade and explaining the price action behind it

I’m guessing the proof is in the pudding. Many of you are already trading the higher time frames, and still have issues with over-trading. The underlying root cause is discipline in trading, and that comes down to how your brain is currently wired.

If you haven’t wired it into your brain yet, you won’t be able to execute discipline while trading. It’s as simple as that, regardless of the time frame.

If you fear something will happen, you create psychological tension around this fear. This only INCREASES your negativity bias, which further perpetuates this behavior.

In Conclusion

We have to adopt a different working definition of ‘over-trading’. We have to get beyond the time frames cause over-trading notion.

I define over-trading as a) taking any one trade outside your trading plan and b) taking any trade which causes you to go over your risk limits.

When we look at over-trading in this context, the time frame you trade, nor number of trades matter.

Your goal should be to execute your trading plan as is (and nothing more). And that needs to include your risk limits while pulling the trigger when you need to.

Do you want to increase your price action skills to trade on any time frame? Check out my Trading Masterclass Course which teaches you the same trading psychology strategies I use every day, regardless of the instrument or time frame.

Need to become disciplined in trading? Visit my Advanced Traders Mindset Course to learn specific forex trader psychology techniques on building discipline.

Now Your Turn

Have you noticed you over-trade even on the higher time frames?

Does this new definition of over-trading help change your perspective?

Make sure to share your thoughts on signs of overtrading below.

Until then – may good trading and a successful mindset be with you.

awesome article.. cant wait to join ur course..

Hello Hope,

Looking forward to you becoming a member.

Kind Regards,

Chris Capre

Hey Chris, how do you view a concept known as “decision fatigue” in relation to trading? How can we as traders ensure we do not become mentally fatigued by making trading decisions on a day in day out basis? Sometimes I catch myself not in an optimal state of mind because I’ve become mentally weary – because trading (for me anyway at this stage) is an endeavour that requires lots of mind focus and energy.

Hello Gloria,

I cover most of this in the ATM course, so you are welcome to join that when it re-opens in a few weeks.

Kind Regards,

Chris Capre

I agree with your points. I think as long as you’re on a hot streak, why in the world would you want to suddenly say ‘oh, I’ve taken 15 trades today, it’s time to call it in’ No way! it’s like poker, if you are on a winning streak, you stay!

Thanks Chris!

Howdy Gloria,

Definitely – why ever limit one’s upside? It’s the most ridiculous idea. Poker players know this, professional sports players know this, and the same should go for traders.

Kind Regards,

Chris Capre

Het Criss mi hermano….

Just like you mention, don´t give a $!#$%$(&…. last webinar settles it down and this article consolidates all around. Confusion is gone, and now I trade without getting desparated and managing risk is easier all the way. Before your course I can say 1 trade was overtrading, now different story, my demo acc. way bigger, my real acc. increasing little by little and Forex tester helping me a lot to understand cycles in trading….. Thanks amigo

Hola Luis,

Como te va?

Yes, the last webinar for members was a pretty big one so glad you caught onto the main points there.

Also good to hear you are having a completely different perspective on over-trading.

Kind Regards,

Chris Capre

Since I am the one Chris quoted at the beginning of this article I thought I would comment. I think his feedback on overtrading is spot on and is definitely different than what other PA courses will teach you. That graphic of the guy bugging out in front of his computer is from one of those other so-called PA courses that I wasted money on, whose initials are NF.

It’s not over trading unless you are trading outside your rules/system or not following your risk management. This is totally different way of thinking about this that will help maximize results while keeping risk under control.

Hello Brian,

Good to have you comment as this article was for you. I was considering for a while doing one on over-trading, but your email was the final coup de gras.

Yes – the way we approach trading price action is a completely different way of thinking, so am glad you noticed.

And yes – you could take 10-15 trades in a day and it not be over-trading as long as you are staying within your trading plan and risk parameters.

The fact you are seeing this change in mindset, thinking and perspective is a critical shift to have, so thank you for sharing as this article really is in due part to you and being willing to explore these questions.

Kind Regards,

Chris Capre

Just want to ask,

do you consider discipline a limited resource?

As in the sense that each day you have a limited amount of willpower/discipline so it is better not to deplete it with less important activities?

Good question

I see willpower as mostly limited. Discipline however can be wired in to where it’s subconscious and automatic. So no, you don’t have to worry about spending too much of your discipline bank acct on trading 🙂

Kind Regards,

Chris Capre

Hey Chris,

Another great article, thanks.

My problem, and I realize it is a mindset problem, is quite the opposite. I have a difficult time pulling the trigger.

But it was good to read this just in case I end up getting carried away….strike that, so I don’t end up getting carried away.

The underlying tone of the article, for me, is mindset. Still working on that.

Bob

Hola Bob,

Pulling the trigger is definitely a mindset problem, but not too different from over-trading as they have a similar root cause, and likely have similar neural engagement in the brain.

Yes – the underlying tone is mindset as trading has to go through your brain and mindset to be successful.

The good thing is you can re-wire your brain to pull the trigger.

Are you singing up for the Adv. Traders Mindset Course when it launches in a few weeks as we focus on this?

Kind Regards,

Chris Capre