What’s Inside?

-Tell me about your instruments

-When not to trade breakouts

-Let’s look at where you take profit

In the world of forex trading, if you’re not making money now (over a decent period of time), most likely you have to make some changes. To make money with forex, you will probably have to change the way you think, the way you trade, and the way you perform.

In today’s article, I’m going to share with you 3 things that will make you more money trading. If you want to improve your trading performance and make money on forex, consider making these 3 changes to your trading now.

#1: What Kind of Instruments Do You Play?

As of today, I’ve seen over 10000+ myfxbook accounts. Now I have an important question for you.

Out of all the students who’ve given me a myfxbook account for their first time, how many of them were trading only instruments they profited with?

Any guesses?

If you said ‘zero‘, you were correct.

Think about that for a moment…the first time you use myfxbook and start tracking your trading stats, the chances you’ll profit on every instrument you trade is likely zero!

In other words, you’re trading forex pairs and instruments you are not profiting from, and most likely won’t.

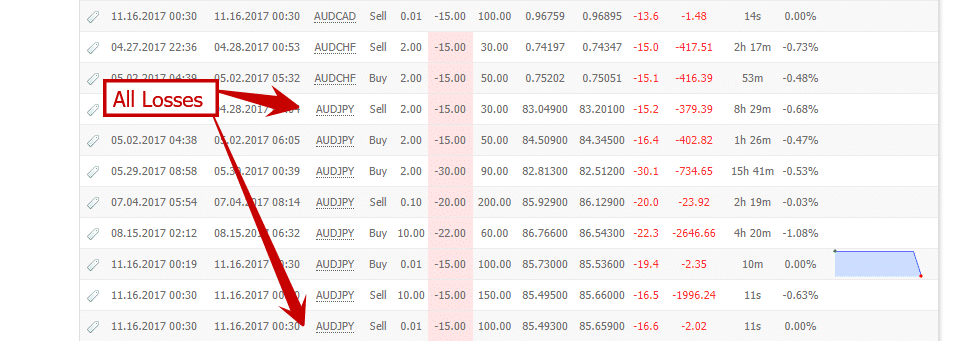

Below is a screenshot of a live myfxbook account for one of my students ‘Ahmed‘ (who’s well in profit).

Notice anything? He’s lost every trade on the AUDJPY.

Now as long as you have a decent amount of trades for an instrument, if that instrument you’re trading has all losses, you should remove it from your trading plan and not trade it again for at least one year.

By taking off the instruments you have the most losses with (from my experience), can add between +3-10% of profit towards your bottom line per year.

That can be the difference between losing money and making money trading. It can also be the difference between making decent money, making great money with forex.

Hence look at your trading instruments by clicking on the ‘symbol‘ tab under your myfxbook trades and isolate the ones you lost the most money on.

Make sure to a) record the number of trades per pair, b) total accuracy %, and c) total profit/loss {in %} for each forex pair. Those 3 metrics alone will likely tell you which pairs and instruments you need to stop trading.

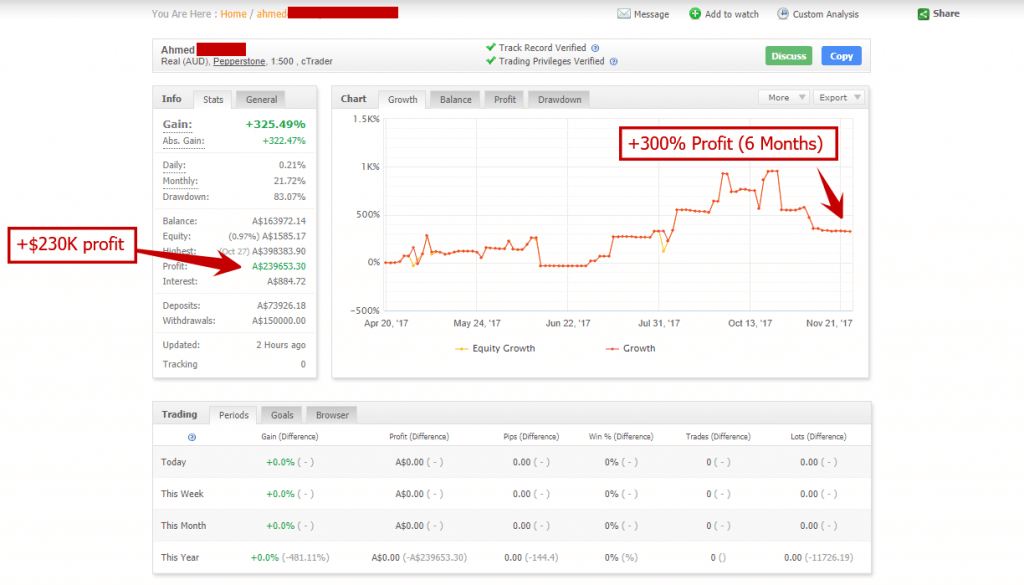

Oh and Ahmed whose trading stats you’ve been looking at?

He made a +300% profit in the last 6 mos (see below).

NOTE: Do you want to learn how to make money trading price action? Find out more by seeing our price action course.

#2: When Not To Trade Breakouts

I have many different trading strategies, but I definitely trade breakouts. And I’ve shown I make money in forex trading.

I have a unique approach towards trading breakouts which you can learn about here.

But there is a key time to trade breakouts, and places on your chart you should not trade breakouts. Today I’m going to talk about two places you should not trade breakouts from.

1. Don’t trade breakouts in the middle of a corrective structure (range)

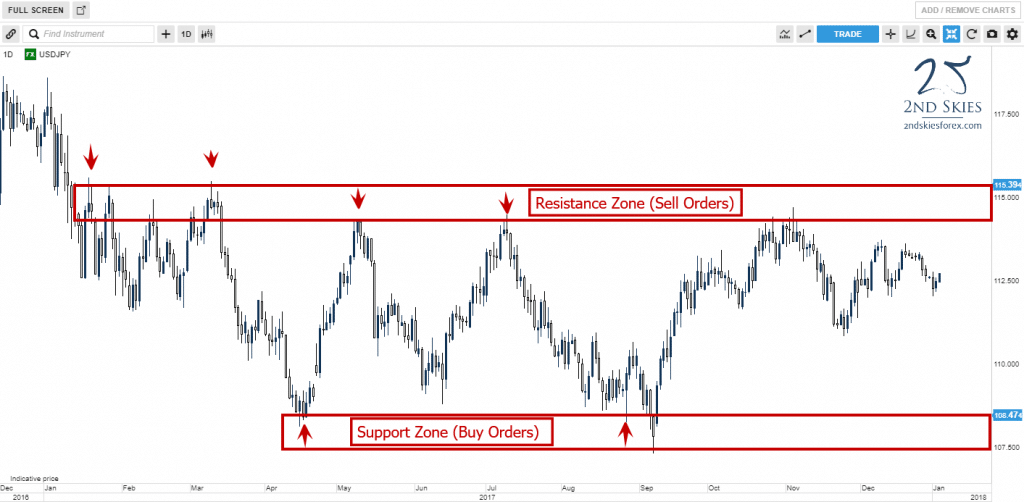

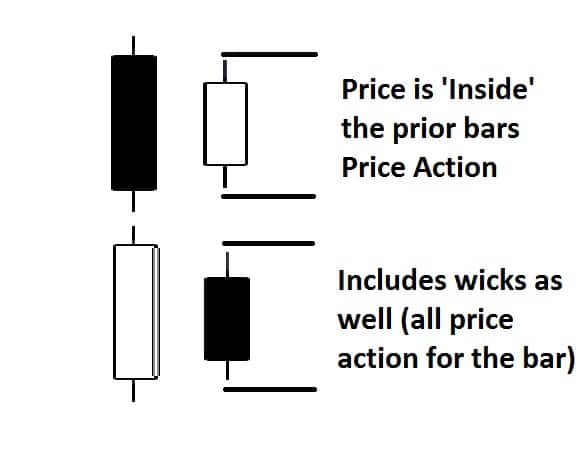

If you think about the order flow behind a corrective structure (see image below), you can see there is a balance between the buyers and sellers.

There is a ‘balance‘ because both sides relatively agree on where the price (or value) of a forex pair (or instrument) should be.

The bulls say the floor of the corrective structure is where they see the most value, and bears see this at the top. That is why the range persists, because both sides are participating at clear levels and zones.

This means their no directional winner in the order flow (bulls/bears). And this is what we mean when we say a corrective structure is ‘balanced‘.

In the middle of any range or corrective structure, there is the least profitability available for trading a particular direction (i.e. trading breakouts) because there is an approximate 50% chance the market will go up or down in the middle of any range.

So avoid the middle of the corrective structure and range for trading breakouts.

2. Don’t trade breakouts just before a major support or resistance level

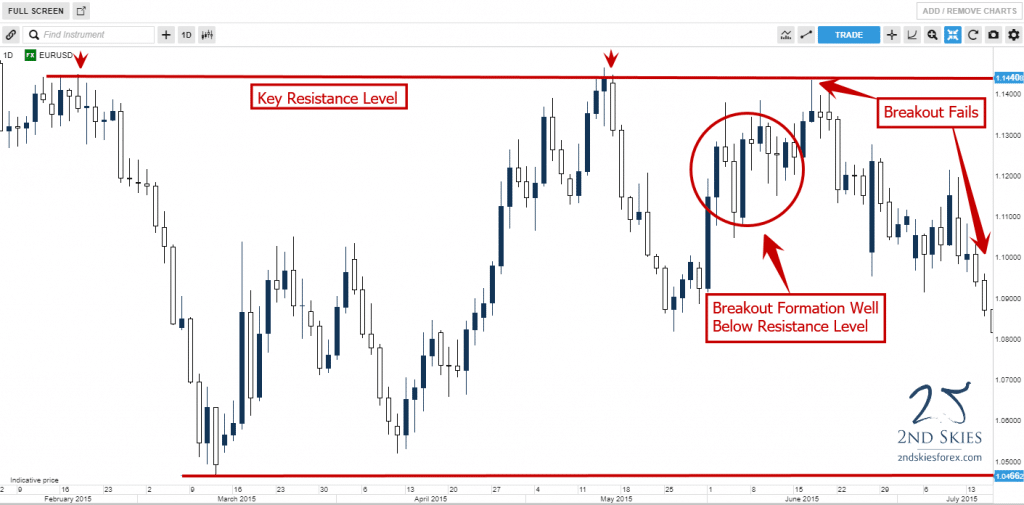

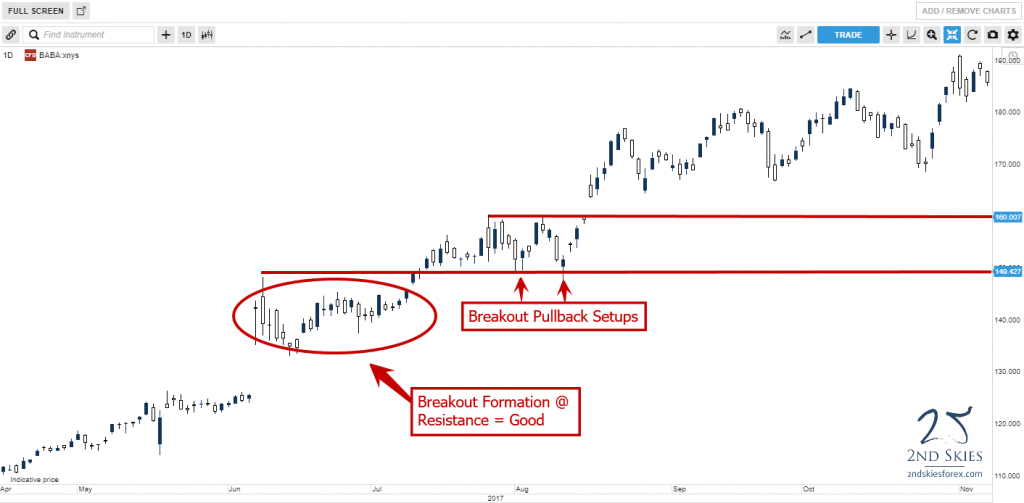

Looking at the chart below, you see the top line is a major resistance level, and just below it is a breakout formation.

These often form to create the illusion the market will keep going higher through the major resistance level. It can also form by bulls encountering the first layer of a resistance zone which is why the market kept pausing just below the level.

Whichever the reason (or both), I do not recommend trading breakouts just below/above a key level.

Better to wait till the price action is just below/above the actual support or resistance level. If you have less experience with this, we recommend taking a breakout pullback setup (see below).

#3: Let’s look at where you take profit

There are many components to your trades you’ll need to study, analyze and refine. One of those is where you take profit, or your TP.

Now I’d like you to do a little experiment with your own trading account (demo or live):

I’d like you to look at every trade you made money on. Now look at the data in myfxbook, and see how many of those that a) closed at your TP, b) closed manually before your TP.

Record how many trades you made of each (close manually/hit TP), and see which one made more money.

If it’s ‘a‘, then you likely have a solid grasp of finding good targets you can hit consistently. So no need to close them early.

This is what is called set and forget trading.

If it’s ‘b‘, that means you have a good grasp of when your profitable trades are going to turn around, and should continue manually closing your trades.

One last final metric is to look only at the ones you closed manually before they hit their TP, and see if they would have hit your TP anyways before hitting your stop loss (SL).

If that is true, then you’re missing a lot of profit (losing money) by not holding them to their full take profit and should stop manually closing your trades.

In Summary

We covered 3 main points in this article. They were:

1) Analyze your performance for each forex pair and trading instrument

2) When not to trade breakouts

3) Examine your take profit targets

Now that you know why you need these 3 things to make money trading, it’s time to do the work and find leaks in your game, while increasing how much money you make per trade.

Do you want to learn several more ways to increase your profits and how much money you make per trade?

Then check out my Price Action Course where you get life-time membership, access to the members trade setup forum, market commentary and a free skype session with me, so quite a lot.

To learn more about making money with forex, click here.

Now make sure to tell me what you thought about this article and if these 3 things will help you make money trading.

That’s a good lesson how to trade break out properly is clear. Thank you for article.

Thanks, glad you found it useful.

Great article and important stuff to work on! Although for what you are talking about the student example you have chosen is decent, I think the fact should not be ignored that he almost wiped out his entire account according to the max DD. It is not very likely to gain 300 % in a few months without taking exorbitant risks. I wished you had pointed out this for more transparency. Overall still a great article, thanks.

Hello Malte,

Am glad you found some important stuff to work on.

RE: Student Example

I think there is a confusion here.

The goal of this article is not to spend massive amounts of time analyzing his account across risk, accuracy, avg wins/losses, ROR, or other various metrics.

He was only mentioned to highlight one specific point (about looking at your instruments).

Hence it wouldn’t have been appropriate for us to go further in depth to his stats when we’re just focused on one point.

That + the fact we’ve already got in the pipeline another article about this student example makes the point redundant.

Hopefully that clarifies it.

Sure, but many people who lack experience in trading could only see the +300 % – you probably know what I mean. This is the only thing that is strange for the more trained eye. Of course I get your point and know you only have best intentions, but then imho it is also not necessary to hint towards the + 300 % in profits.

Hello Malte,

While I can certainly see your points (and feel like you make some good ones), I still don’t see this as an issue for 2 reasons:

1) I already have content planned to talk about his account in detail, covering both strengths, and weaknesses, and why these are important to know.

2) Whether someone wants to come in the front door with us because of them seeing ‘300%’ to me isn’t an issue. My job is to open doors to traders and find energetic ways to work with them.

Sometimes that means speaking to their wisdom, and sometimes it = speaking to their confusion.

My job is to change the mindset and improve the trading of anyone who listens to our message. Them having confusion about performance isn’t an issue to me. I want to help people who are confused. Turning people’s failures into successes, and confusions into wisdom’s is what I’m trying to do here.

Hopefully this clarifies it a bit further.