We have been getting a lot of questions from newer traders to forex on what is price action trading, and how one can utilize a forex price action strategy. What we are going to cover is the traditional definition of price action, how we approach it differently than others, and how one can trade price action in the forex market.

What is Price Action Trading?

In the most traditional and technical sense, price action is simply price’s movement over time. This could be on any time compression from the 1min up to the weekly chart. Any price fluctuation for any instrument is a form of price action. Forex price action trading is the science and art of trading these price fluctuations over time with little or no indicators. By learning to read price action and price’s movement over time, one can;

- see where the institutional players are heavily involved

- where they are driving the market

- where are key support and resistance areas

- where to find precise entry and exits

- what is a key breakout

- how to catch reversals

- tops and bottoms

- get into trends

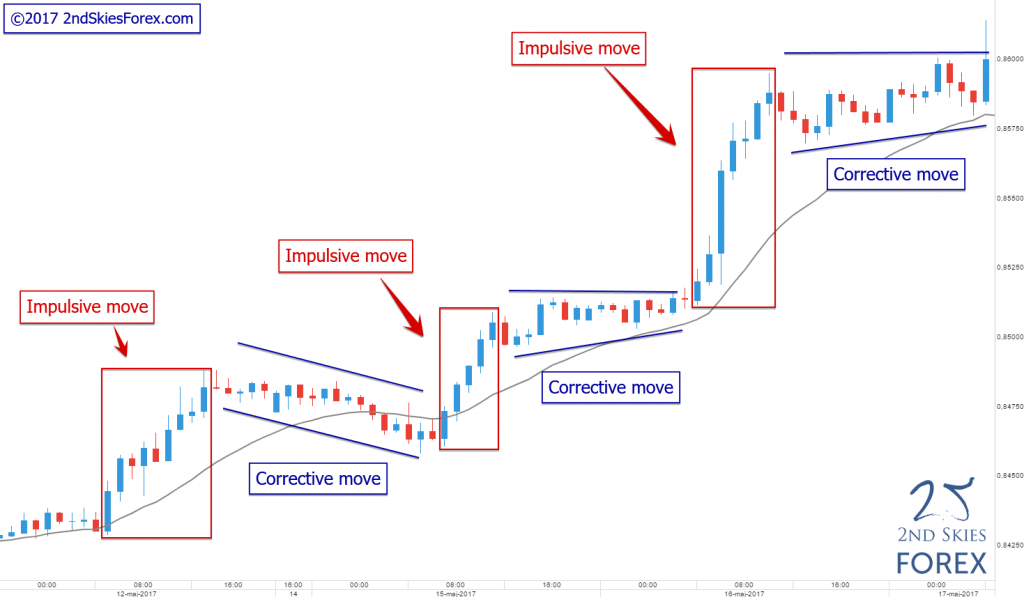

- what are impulsive vs. corrective moves

- what kind of market environment you are in

and more.

This is why learning to read price action can be a critical component of one’s trading.

However, based on one’s approach to it, there are key differences in how one can trade it.

Various Ways to Approach Price Action

For the most part, all of the vanilla forex price action trading techniques you find out there are based upon patterns. Some of these patterns can be flags, triangles, double tops and bottoms, pinbars, inside bars, etc. But if you are trading these patterns just because they are a pattern, then you are really failing to understand what price action is.

The proximate driver of price action is order flow which is the total summation of all buy and sell orders that are executed in the market. It does not matter whether the market is moving because of a fundamental or technical reason. Order flow is the most consistent force which causes the price action to change.

Because we do not have direct access to order flow, we have to learn how to read its sibling which is price action. Price action has the fingerprints of order flow all over it. Since the most common driver of market movements come from order flow, then we have to learn how to read price action. This is how we approach it.

We trade forex price action strategies and patterns, but we do so with the key understanding that all price action is the result of order flow. And since order flow is what moves the markets, then we have to learn how to read order flow through price action. This how you can take your trading to the next level.

Trading Price Action

Price action trading in the forex market is a learnable skill that anyone can do. With the proper training, mentor and study, one can successfully utilize a price action strategy. In the forex market, as it is such a highly liquid market, trading becomes a lot easier because as you have more liquidity, you have a more technically pure market. There are various ways to trade price action in the forex market and we will share one method while explaining the order flow behind it. We will compare this to trading the pattern by itself and show you how it fails.

Trading Just the Pattern By Itself

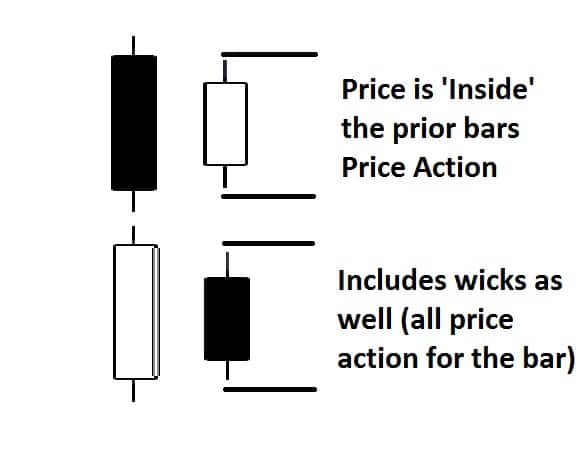

An inside bar pattern is a common price action pattern whereby all of the price action (body and wicks) of a candle are inside the range of the previous candle. Here is a picture below showing an inside bar pattern:

Now inside bars can be traded as both reversal and trend continuation techniques. If one was just trading the pattern itself without understanding the order flow behind it, one could be seriously misled into trading a lesser inside bar simply because it was a pattern. Just because a pattern or formation shows up does not mean we want to trade it. We will give you an example.

Not All Inside Bars Are Created Equal

Lets say it is 12hrs before a major announcement, or a Friday, or a holiday of sorts. During such events, order flow diminishes as the institutional players leave the market until the risk events are over. In these times, many inside bars can form since there is nobody in control of the market and no heavy liquidity or order flows. If you were just trading inside bars because an inside bar showed up, you could be trading during a non-optimal time because the market will not take a direction till after the risk event. So this is one example of how trading a pattern because it shows up could be harmful to your trading.

This is why it is critical to understand the order flow behind the market and why the price action is forming the way it is. This way you can determine who is in control (the buyers or sellers). You can determine if it is a powerful breakout or a false one. You can determine if the trend will likely continue or not. All of these are critical to trading price action and understanding how the order flow is creating such variables.

Below is a chart example of how not all inside bars are created equal and why you need to avoid some of them. Take a look at the forex price action trading chart below:

In this price action trading chart, you are seeing the price action from 9am EST up to 1am EST (a total of 18hrs). Take a look at all the inside bars above. Here you have a total of 3 inside bars, yet they produced no special reaction. Price was stuck in a virtual 50pip range for over an 18hr period.

If you were just trading inside bars because it was a price action pattern, you would have had many false breakouts and likely many losing trades. Now lets take a look at another example of how an inside bar can be used for a successful trade by reading the order flow behind it.

Taking a look at the chart below, we can see an inside bar forms after a very powerful with trend move. There could be several reasons for this but lets read the order flow behind it.

- Price has been climbing for 4 days in a row suggesting the buyers are clearly in control.

- The last candle was a very strong candle and the largest in this move suggesting strong participation

- The inside bar comes right at the parity level suggesting the market is respecting it

- However, the selling in the inside bar is quite weak communicating the sellers have little sway

- Thus, the buyers are likely to continue the trend after this weak push back

So empowered with all this information on learning how to read the order flow behind the move and inside bar, we can make a much more informed decision on trading this inside bar. We can trade this as a with-trend continuation move knowing the buyers are heavily in control. And as we can see, the market climbed for over 300pips over the next three candles.

In Summary

Forex price action trading in its most technical form is price’s movement over time. This is for any instrument on any time frame from tick charts up to monthly charts. All price action is the result of order flow which is the total summation of all buying and selling. All the price movements we see on the chart are derivatives of order flow. In other words, order flow is the cause of all price movement and its sibling is price action. Since we do not have access to aggregate order flow in the forex market, learning to read price action and the order flow behind it is key.

In trading the forex market, we can trade price action patterns by themselves, but we can easily see how dis-empowering this is. Patterns by themselves are meaningless unless we can read the price action and order flow behind it. When we can read the order flow, we can determine where the institutional players are buying and selling, the speed of buying and selling, where are key support and resistance areas, when the market will continue the trend, when it will reverse and when key breakouts are happening. All of these are critical to the forex price action trading strategy. Our goal must be to learn how to read price action and the order flow behind it.

For those of you wanting to learn how to read price action and the order flow behind it, take a look at our Trading Masterclass course, where you will learn rule-based price action systems to trade the market.

Do you mean order flow is another word of trend ? if so then that’s allright and very common understanding.

Hello Rahmat Hidymat,

Order flow refers to the underlying orders (buyers/sellers) that are activated in the market. Order Flow is the most proximate driver of price action. It can refer to the level of balance or imbalance between the buyers and sellers, momentum increasing or decreasing, transitions, exhaustion, and many other incarnations.

So order flow does not = trend. It can, but it also means many other things.

We have a price action + order flow webinar where we go over this in more detail which you can view here (https://gammalevelcorp.wpengine.com/price-action-webinar/).

Hope this helps.

To be fair, the inside bar pair(s) you refer to are, in candlestick trading, known as Bullish or Bearish Haramis. Any candlestick trader worth his salt would not actually take this pair over-seriously unless the pair appeared in the most correct location on the chart. For example, a bearish harami has some value at the top of a trend and likewise, a bullish harami at the bottom of a trend.

If you want to further clarify “trend”, this could be something as simple as above/below trend indicating moving averages, or, overbought or oversold regions indicated by being beyond the upper or lower extent of a trend channel, outside the upper/lower bounds of a Bollinger Band or, the overbought/oversold area of a Stochastics indicator.

Again, a candlestick developer who saw a bullish/bearish harami in some kind of trading range or sideways market or even in the midst of an up-move or down-move would not assume that this pair gives rise to a change of trend direction.

Moreover, there are many other candlestick pattern (2/3 bar [patterns] or consecutive bar patterns) that are much more potent to indicate a reversal of trend or market sentiment (again, when found in the correct chart context/location) than haramis or, inside bars.

Please don’t think I’m banging the drum for candlestick developers over price action! I’m very intrigued by price action and want to learn and understand what you are teaching. However, I just wanted to point out that like most things, you have to put price action into its appropriate context.

Hello Chris,

I appreciate your response.

#1 So Candlesticks have been tested quantitatively, and all of them failed, but 5 patterns. The ‘harami’ was not one of them and testing revealed it to be ‘near random’ in terms of its predictability (link: http://thepatternsite.com/HaramiBear.html).

Hence I can’t really give weight to candlesticks, nor your statements about the harami as its ineffective performance wise (as are most candlestick patterns).

But a few more reasons why I dont endorse candlestick trading:

#2) they create ‘passive’ skills, meaning if you dont have any candlestick patterns, you aren’t really doing much. That’s passive and just waiting for these magical patterns to form.

Meanwhile, price action context (which is what I teach) is not a passive skill, and doesn’t ignore any price action. It takes the gestalt and gives you a read on the underlying order flow, something candlesticks dont, especially if you dont have any patterns in play.

#3 candlesticks dont occur too often, so reduce your overall profitability and trade expectancy (which is partially determined by ‘trade frequency’).

So if you’re in a good trend, but have no candlestick patterns, you’re on the sidelines. That wouldn’t happen if trading price action contextually using our models.

#4 if you have to use oscillators such as stochs, BB”s or any other indicator to determine or further ‘clarify’ the trend, then how effective is candlesticks in and of themselves to have to use such dubious indicators?

thus its not a complete system. Meanwhile, you can use price action context to not only determine the trend, but what ‘type’ of trend you are in. You can use it to determine the level of imbalance in the order flow behind the market, and work on any time frame (which candlesticks cannot).

so based on the above, i find candlestick patterns to be ineffective, create more passive skills, not a complete system, nor able to give the amount of information pure price action context can, nor as many trading opportunities as PA context.

Now if you’d like to learn more about how I teach price action context, you can watch this webinar I did on it (https://gammalevelcorp.wpengine.com/price-action-webinar/) , along with this article (https://gammalevelcorp.wpengine.com/trading-strategies/forex-strategies/trading-price-action-context/)

Hope this helps.

Kind Regards,

Chris

Great article. Thanks

is it possible to trade swing 1 to 5 min using PA ?

if i trade with PA for long, i need to check on monthly for trend, S&R, then for entry and exit, for 1H ?

is there a way in PA to trade gaps ?

For sure…

would you mind to share ?

Learn price action context and it’s 3 pillars, ideally for intraday and higher time frames.

Kind Regards,

Chris Capre

Wow! I learned more in this one post than months of starring at charts. Thank you. I believe you will be getting a new student.

Hello BP,

Yeah, we take a completely different approach to price action that most out there so hope to be working with you soon and see you learning tons of new material in the course.

Kind Regards,

Chris

Hi Chris,

I am happy to learn more from you. Your articles gives me more understanding. may God richly bless you.

Happy to have you here as well Salman.

Kind Regards,

Chris

I am always wowed by your articles

:-)))

This article just confirm me that i did the right choice getting aboard with you!

Hello Kebex,

Am glad you’re feeling positive about the choice as I have great pride in my work. Looking forward to working with you.

Your explanation is straight forward

Hello Audu John,

Glad you found the explanation straight forward and easy to understand.

Hi Chris! Opened my email today and this is what I got for breakfast. It’s an eye opener. I am not a big trader, I am just doing demo as of the moment and I don’t really know if I can afford the forex market. But I know that I just have to learn it. And you’re website is the best place to start for me. Thank and you and more success for years to come.

Hello Michael,

Am glad to hear you found this a good article. I hope you keep the passion and interest because it’s a powerful and rewarding skill to learn.

An eye opener, I can hardly wait till learn more. Very good article, making good sense. Thanks.

Inside bar has been ‘abused’ in a way by many as key to a move. Many ‘systems’ have been based on an inside bar and you have demonstrated convincingly that there is far more to the Inside bar strategy than the bar itself.

Thank you for this clear illustration.

Am yet to covere your article, however i ve read your post on babypips on price action definition find it interesting.

Hello Collins,

Good to have you here. Make sure to read some of my recent articles on price action so you can see how we approach things differently.

Kind Regards,

Chris Capre

You are always wonderful, looking forward to have your course

thanks for the article

Hello Adebisi (cool name btw),

Looking forward to working with you as well.

Kind Regards,

Chris Capre

hello dear chris

i just compare your article with my real time charts and

think what happened?

real time charts are confirming your article as well

i will buy your price action asap.

thanks again my dear friend

seyedmajid masharian

Hello Seyed,

Yes, when you learn to read price action, they work across several time frames, instruments and environments.

But glad you liked the article and looking forward to working with you as well.

Kind Regards,

Chris Capre

hello

that is an excellent article

thank you so much dear chris

Very good expose on Price Action. Picked some helpful tips. Please, do you have a free ebook of your Price Action course for download? Thanks man, you are a bomb!

Hello Jonah,

Glad you liked the article and found the information helpful.

I don’t have a free eBook of my Price Action Course which is a paid course. That would defeat the purpose of offering a paid course while having a free eBook out there.

I have some free eBooks which you are welcome to download either by signing up for my newsletter, or signing up through my facebook page.

Hope this helps.

Kind Regards,

Chris Capre

Please send me through my e-mail some videos

of great interest relating to ADVANCED Price Action

Strategies in order to enable me to take

a decison to join in your course.

Hello Shankar,

All my videos are on my site and you can view them as much as you like. Here is a link to some of the top articles and videos on Advanced Price Action.

Feel free to peruse them and then let me know what questions you have.

Kind Regards

Chris

No need to reply to this one, Chris! This is just praise of the way the website is set up…. I have not spent time here since initially recognizing my own interest in your work, but now that it’s getting closer to signing on, I’m here. Finding signs on the right hand side when I’m watching a video or reading an article, of a proposed next move, is much appreciated. I know there is a lot to find. I’ve not seen any other site set up like this, nor such an uncluttered one where the master trader stands ready to reply in a short time and lend a hand. The site is a seamless extension of you. My eyes and brain are comfortable with this particular shade of blue, and white print.

am really glad you are finding the new site helpful as we put a lot of time in it to be the most engaging site for developing traders so thank you for the kind words

cc

Still not clear on “order flow.” The article describes it as the “total sum of all buy and sell orders executed in the market.” What seems opaque is the motivational structure within the order itself, e.g., UBS buys yen, a secondary bank shorts it, a hedge fund goes both ways, a third bank bets against it. I guess you could say price action represents that “order flow,” but, in a perfect world it would be nice to understand exactly who the players are and why they do what they do in certain circumstances. Then you wouldn’t have to be on the other side of the fence, guessing. Still, article was good.

Hello Pigbat,

You bring up some poignant issues. To give an alternate or amplification on the definition of order flow;

expanding on what I already wrote, it involves all players in the market, the total summation of all the buy and sell orders from all around the world. This creates either an equilibrium, or an imbalance (i.e. bullish or bearish) whereby the price responds to this balance or imbalance, hence creating price action which is the price fluctuations that are the result of this order flow.

Its important not to think about this as a perfect world because the market is both order and chaos so that would not apply. Furthermore, I think it would be a wasted effort to try and understand all the players and why they are doing what they are doing because there are soooo many players in this market who are in it for various reasons, using thousands of different strategies, so its a futile and fruitless venture to try and understand all of the ‘why’s behind them. What is more important is learning to read the balance in the price action and find opportunities to be trading it. There are many ways to do this without any ‘guessing’. And even if you did know all the players at any one moment (10’s of thousands, up to several million), if I gave you 10,000 different reasons for why people bought or sold the euro at that moment, would you be able to make sense of it?

My guess is not, but if I give you patterns which are repeatable with a strong degree of success based on the underlying principles in creating a balance or imbalance in the order flow, then you can make money regardless of the why which will always be for a kaleidoscope of reasons.

Just my thoughts on the matter

Kind Regards

Chris Capre

Twitter; 2ndSkiesForex