What’s Inside Today’s Trading Article?

- Let’s talk about breakout strategies

- What are some consistent breakout patterns?

- When trading breakout patterns, how can I avoid false breaks?

Ever heard the statements “most breakouts fail” or “you should avoid trading breakouts“?

Let me just put the kibosh on that by sharing with you Exhibit A.

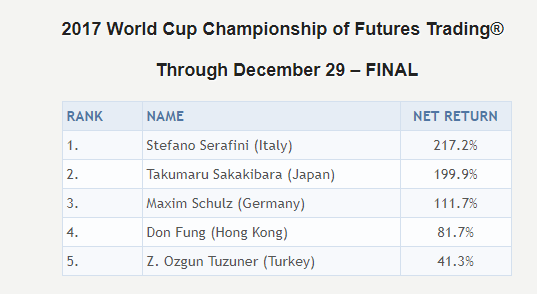

Behold…Exhibit A – winner of the 2017 World Cup Futures Championship, Stefano Serafini, who won with an impressive +217% return (see below).

What was Stefano Serafini’s main trading strategy to generate such an impressive return? Trading intra-day breakouts!

So do me a favor, the next time you see some fake trading guru telling you “most breakouts fail” or “you should avoid trading breakouts“, please share the link to this post.

For today’s article, I’m going to share with you two breakout strategies to help increase your accuracy & profitability in trading breakouts. I’m also going to share how you can use this to avoid any false breaks and getting stopped out.

Let’s jump in.

Breakout Strategies

While there are many types of breakout strategies you can classify breakout trades into two broad categories:

- The momentum breakout setup

- The breakout pullback setup

For today’s breakout trade article, we’re going to focus on the second breakout strategy (breakout pullback setup) as it’s much easier for traders to learn and execute because it requires less skill.

NOTE: If you want to learn how to trade momentum breakout setups, then check out my Trading Masterclass course where I teach you how to trade this for maximum profit.

The Breakout Pullback Setup

Before you can even make a breakout pullback setup, you’ll need to identify some of the consistent breakout patterns that manifest in the price action.

By learning these, you’ll be able to identify A+ setups which will increase your accuracy and profitability in trading them.

There are many things you can do to identify an A+ breakout pullback setup, but there are 2 things I’ll give you to work with for now.

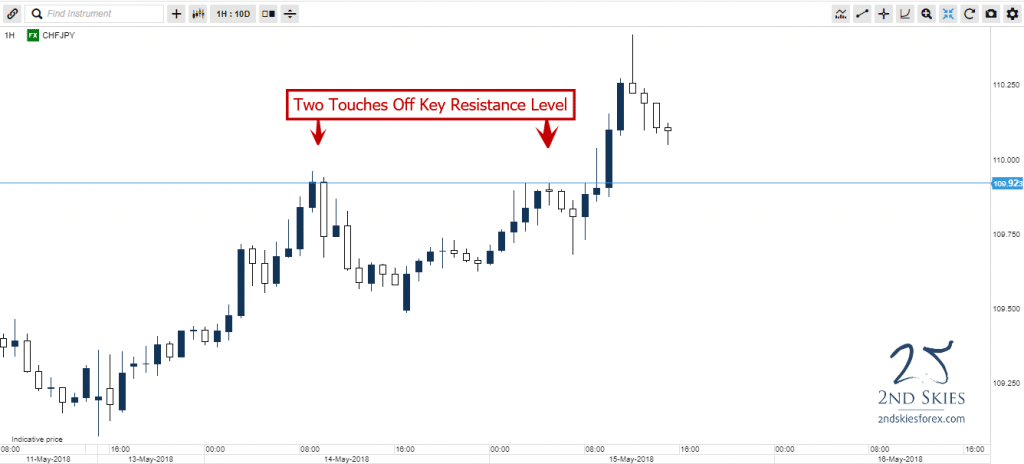

Breakout Pattern #1 – Finding a key support or resistance level with a minimum of two touches

Why two touches?

While the market may hit a key support or resistance level once, which indicates at least some potential order flow and institutional players wanting to hold that level, two touches indicates a greater probability and amount of order flow behind that level.

The more buyers/sellers you have at that level, the greater the chance the breakout trade will succeed.

Why?

One reason is those same players who, when they get stopped out after their support or resistance level is broken, them getting stopped out clears out some of the order flow against that breakout, thus making it easier for the breakout to continue.

On top of this, smart money players after they’ve been taken out (and spot a good breakout) will often flip sides after they get stopped out, thus providing further momentum to your breakout trade.

Hence it’s important to identify a level that has a minimum of two touches (the more, then better) to increase your probability of a breakout setup forming.

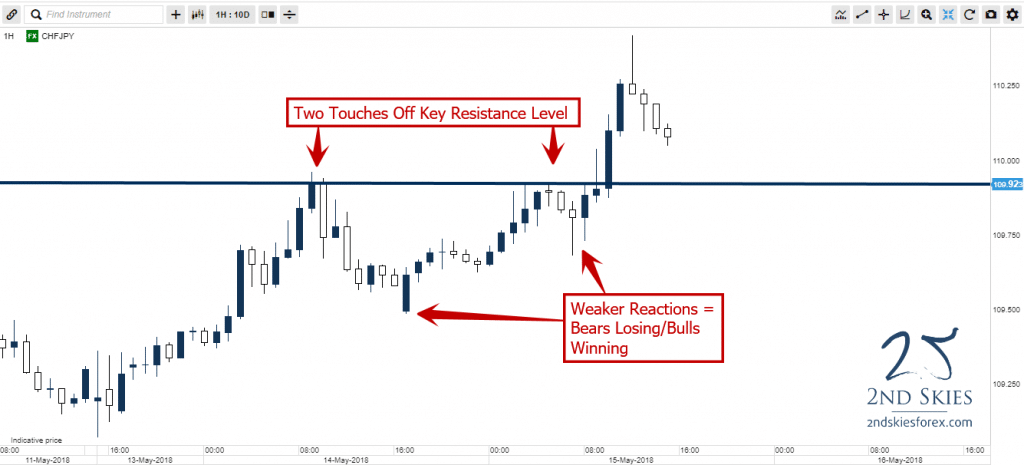

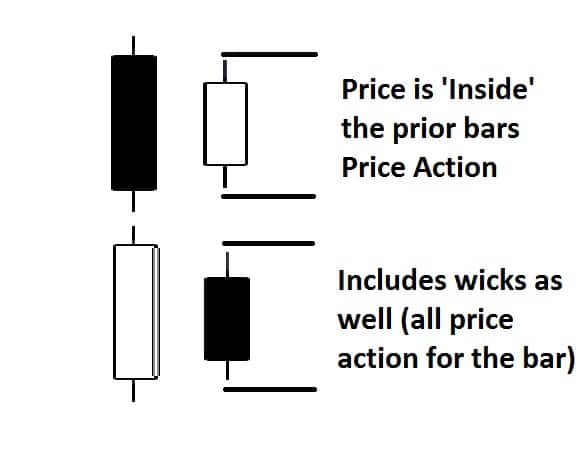

Breakout Pattern #2 – A reduction in the reactions (or pullbacks from that support/resistance level)

Why does a reduction in the pullback from a key support or resistance level help your breakout trades?

Let’s say the market is in a bull trend and it’s encountering a resistance level where there are likely bears with offers up at that level. If the bulls hit the resistance level the first time, and the market pulls back say 50 pips, then when the 2nd time the price action hits that resistance level, the market only pulls back say 25 pips, this indicates a weaker reaction by the bears at the level.

A weaker pullback from the bears = less order flow and strength on their side. As their side continues to weaken, this a) gives the bulls more confidence a breakout is becoming more likely, and b) communicates their side is losing the battle.

Looking at our prior chart, notice how the reactions/pullbacks to the resistance level were weaker the 2nd time around?

Those weaker reactions were communicating how the bears were less able to push back while the bulls kept their foot on the gas, producing an eventual breakout.

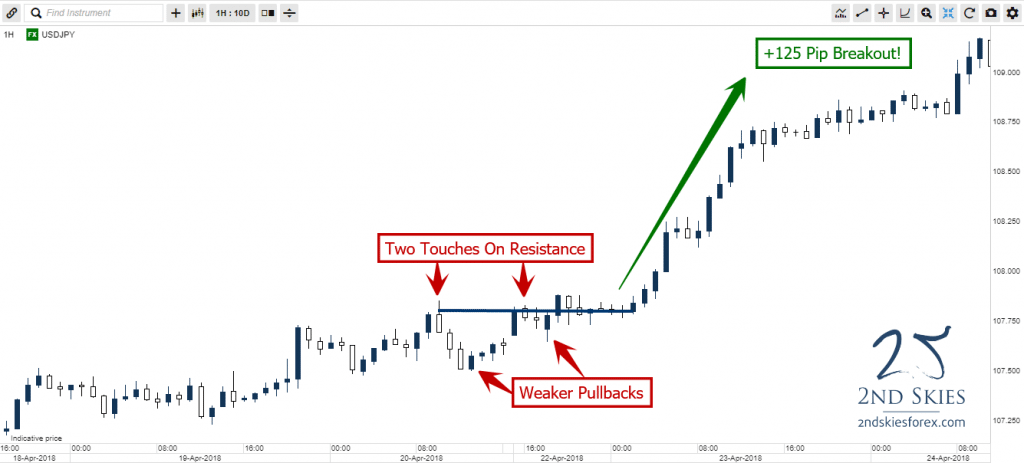

Below is another good example of the two touches + weaker reactions to the resistance level on the USDJPY, producing a +125 pip breakout.

Hence, make sure to look for weaker reactions each time off a key support or resistance level to identify a high probability breakout.

Key Tip: One additional pattern you can apply in the price action is to look for breakout setups that are forming with trend vs counter trend.

Now that I’ve shown you two underlying components of a breakout strategy, let’s talk about how you can get in on a breakout pullback setup.

The Breakout Pullback Setup

Assuming you’ve found a situation whereby you have the minimum two touches off a key support or resistance level, along with weaker reactions to the level each time, let’s talk about how you can get into a breakout pullback setup and how I trade it.

Once the market and price action has closed above your key support or resistance level, I’ll place a limit order on that particular support or resistance level to trade in the direction of the breakout.

NOTE: I am not waiting for a confirmation price action signal to form on that level. If you’ve read the price action context correctly, and found a legitimate breakout, any confirmation price action signal will only give you a weaker entry, and thus reduce your profitability.

If you learn to read the price action correctly, you won’t need any confirmation price action signal to get in the market, because the underlying order flow from the big players will already be there.

When I’m trading a breakout pullback setup, once I’ve qualified the breakout, I’m placing my order to get long/short on a pullback to the level.

If the order flow at that level is legit, there will be larger players willing to get long/short at that level without the need for any pin bar, inside bar or ridiculous tailed bar.

Case in point, watch this video on me doing a live breakout pullback trade on the NZDUSD for +100 pips of profit with only a 29 pip stop loss.

Notice how there were two touches on the support level near 6625, along with each bounce getting weaker. Once the market broke through the level, I placed my order to get short.

After pulling back to my level, and barely going negative, the pair took off for over +100 pips of profit.

Had you waited for any confirmation price action pin bar signal, you would have a) gotten a worse entry, and b) had less profit potential.

You can see another example of a live trade using a pyramiding trading strategy where I get in on the breakout pullback setup to the level on both trades, stacking onto the same with trend move for extra profit.

After watching the two videos, hopefully these examples give you a good idea of how to trade the breakout pullback setup.

How to Avoid False Breaks?

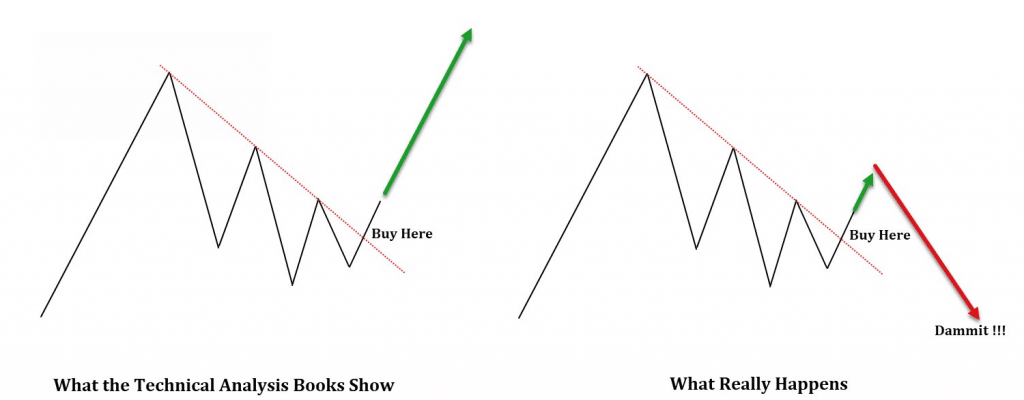

There is a lot that can be said about avoiding false breaks when trading the breakout pullback setup, and there are many breakout patterns that often fail.

To keep it simple, the best thing you can do is:

a) learn to read price action context, and

b) trade with trend as much as possible

By learning to read price action context, you’ll have a better grasp at finding key support and resistance levels where there is a lot of order flow around that level. You’ll also be better able to spot with trend environments, which are much more favorable for breakout trade setups. This is because there is a greater amount of order flow in your favor to support your trade.

In Summary

To recap, trading forex breakout patterns can be a highly profitable trading strategy when you learn to identify A+ breakout setups. There are two classifications of breakouts, which are a) the momentum breakout setup, and b) the breakout pullback setup.

There are also key breakout patterns you can spot in the price action which will help you find higher probability breakout trades.

In the beginning, try to trade breakout pullback setups as they require less skills, and will help you build your confidence in trading breakouts over time.

Lastly, when trading the breakout pullback setup, make sure NOT to wait for confirmation price action signals as they’ll give you a worse entry (trade location) and reduce your profitability.

Now Your Turn

What did you learn from this article that helped you with trading breakouts in the forex market (or any market for that matter)?

Did you find this useful and give you some increased confidence to trade breakouts?

Are you currently trading breakouts and struggling?

Please make sure to leave your feedback and comments to help us create better trading articles and content for you.

Until then, may good trading setups and karma be with you.

Kind Regards,

Chris Capre

Hi Chris,

Thanks for the explanations which are really helpful. One question: are you only looking for horizontal breakouts or also for non-horizontals?

Thanks.

Hello Martin,

Nice, am glad you found the article helpful.

RE: Horizontal/Non-Horizontal Breakouts

The only non-horizontal structures we trade are channels (i.e. with parallel lines).

We trade those breakouts, but a tad differently.

Hope this helps and all the best.

Oh God, such an amazing article, especially the “DAMMIT” pointing,in every site about patterns they show the same thing, only here i see “true reality” 😉

HA – I liked that photo as well.

HI Chris

the minimum of two touches you say has a probability of a higher break out but this can be false break and fall back either way so the strategy is post breakout wait for retest to enter. is that correct?

Hello Sinu,

You can have a false break with 1, 2 or 3 touches. The difference is, on one touch, the probabilities increase for a false break.

Can you guess why?

hi Chris.

great question Sinu…

so Christ,, why is that?

because I also have seen two touches where the price goes counter trend.

Hello Tito,

Think about the order flow, and what that means if a resistance/support level has one touch/rejection vs. two touches/rejections.

Let me know what comes to mind.