There you are, it’s your 6th, 7th, 8th, 9th or 10th loss in a row. It sucks, it doesn’t feel good, and you haven’t had a winner in a while.

Right now, all you want is a winner, yet you seem unable to get one.

After losing the umpteenth trade in a row, you are now actively asking yourself any one of the following questions:

1) What’s wrong with me?

2) What is wrong with my strategy?

3) Do I not know how to trade?

4) I can’t understand what I’m doing wrong. Why do I keep losing?

5) Should I do the opposite of my trade ideas?

Has this ever happened to you? It’s certainly happened to me.

Ironically, none of these are the correct questions, nor are they accurate reflections of your trading ability.

In fact, you could lose 20+ trades in a row, and still be a damn good trader who can make money that year.

The issue isn’t your strategy, or time frame, or instrument, or your ability.

The problem is your muscles are weak and they need to be developed.

No, I’m not talking about any physical muscle.

What I’m referring to is your trading mindset is lacking.

What it is lacking is the muscle (and skill) to understand and accept variance.

What is Variance?

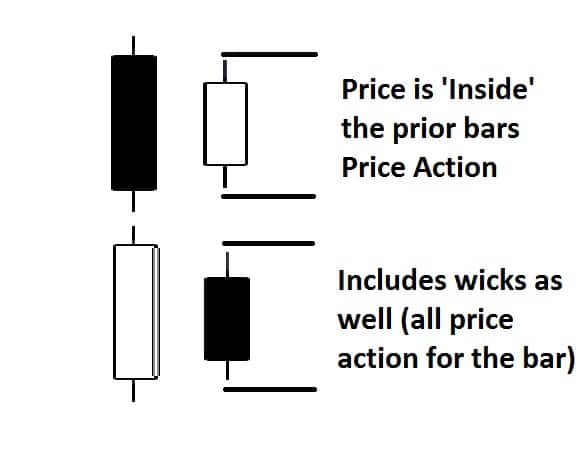

In poker, there is a concept called variance. What variance describes is the mathematical possibilities about how you can win and lose.

For example, assume I’m playing Texas Hold’ Em poker. I have pocket kings, while one other opponent has pocket 2’s. Statistically over 1000 flops, I should win 79% of the time.

Now this is where understanding variance is helpful. Just because I should win 79% of the time, doesn’t mean I’m going to win the next 79 out of 100 hands, or roughly 8 out of 10.

I could lose the next 30 of the next 100 hands, or even 50, or 21 in a row.

On a basic level, ‘variance’ means that any combination of wins and losses within the statistical norm can and will happen. So when we have a baseline expectancy or win rate, anything above or below this would be a representation of variance.

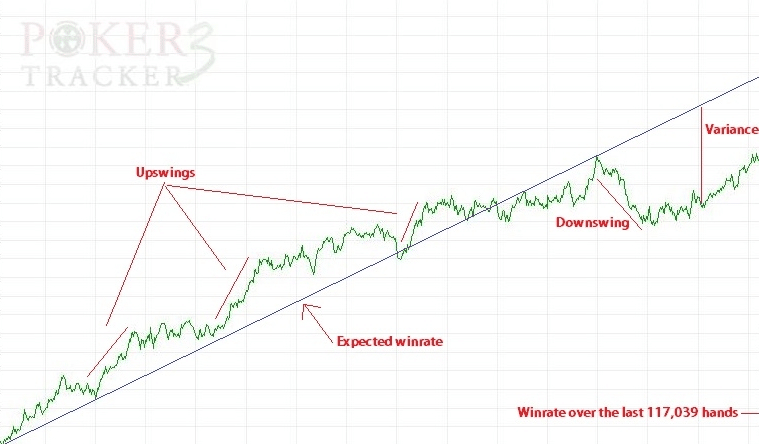

A good example of this is in a poker equity curve below.

It is this ‘variance’ and statistics that allows me to profit. It is also this variance which allows me to go on win streaks.

And it is also the same variable behind me going on a losing streak.

The ironic thing is no trader or poker player complains about variance when they are on a winning streak.

But god forbid we go on a losing streak, and our world + trading mindset crumble on the quick.

How Does This Relate to Trading?

Tying it all back, variance is how trading works. There is another name for this in trading called ‘random distribution’. This describes how your wins and losses will be randomly distributed.

The reason why this is such an issue for traders is threefold:

1) most struggling traders don’t understand or accept how variance works

2) most of you haven’t built the muscle (or skill) to accept variance

3) most of you haven’t learned how to detect whether your losses are due to variance (or something actualy ‘wrong’ with you)

Do you have any of the above? If so, it will negatively effect your trading mindset and hurt your performance.

In today’s article, I’m going to show you how the first point is killing your profits and why. I’ll also share how you can build your muscles to accept variance and detect if you are experiencing variance or a problem with your strategy.

How Variance Works (example from a top hedge fund)

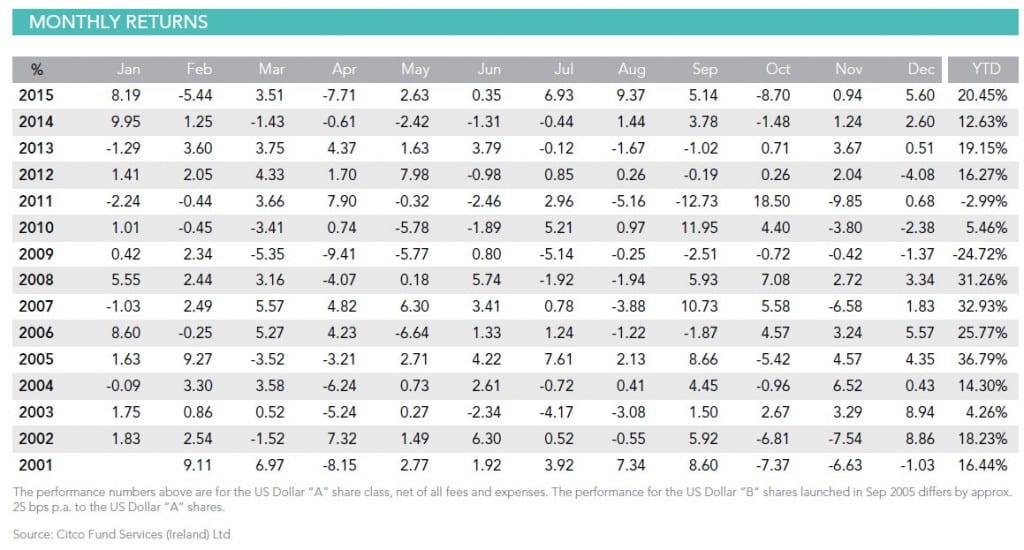

Have you ever heard of Horseman Capital? Probably not. Yet they are one of the top performing hedge funds over the last 15 years.

Since 2001, they’ve beat out about 95% of all hedge funds on the planet averaging about 15% per year.

Here is their performance since 2001 below (source: Horseman Capital).

$1 million invested with them at the start of 2001 would be almost $7 million today.

One would think with an almost 695% return, they’d never have a losing month, a losing quarter, and certainly not a losing year.

You’d be wrong on all accounts!

How many losing months did they have during this time? 64 total

How many losing quarters did they have? 17 total

How many losing years did they have? 2

What was there longest losing streak (in months)? 6

Now here are a few questions that have to be asked in light of this

How many losing months would you go before you change your strategy, try something new, or question your abilities as a trader?

Could you make it 6 months before you changed things up or questioned your ability? I’m guessing few if any.

And herein lies the proof in the chocolate pudding…that you’re not accepting variance or fully relating to how it works.

If you change your strategy, time frame or instrument too soon, you’ll never see the profit side of an equity curve.

But there is an even far more grave issue with constantly changing your strategy, instrument or trading plan.

And that has to do with one word.

Consistency

If you are going to succeed at trading, you’ll need to execute consistently on a mental level.

Thus to trade consistently, you’ll need to develop consistency in your mind.

“You cannot be consistent in trading without consistency in your mind.”

This is how your brain works. Most of the time, you’ll execute the way your brain is most dominantly wired to do so.

If you are not executing the way you want to now – you simply haven’t wired your brain to do so.

The good thing is your brain has a key trait which allows you to wire and build the habits you need to trade successfully.

This trait is neuroplasticity.

There are two types (SDN & EDN). These stand for Self-Directed Neuroplasticity and Experience Dependent Neuroplasticity.

To read more about Using Neuroplasticity to Wire Your Brain For Success – click on the link.

Variance & Your Trading Mindset

Now let’s circle back to variance. If every time you experience a losing streak you change your strategy, you’ll wire inconsistency in your brain.

Again – you cannot have consistency in your trading with inconsistency in your mindset.

Have you changed your strategy after a 1-3 month losing streak? Have you completely doubted yourself after 10 losses in a row?

If so, it means you need to build your muscles. It means you need to develop your skill to understand and accept variance. And make no mistake, this is a skill in and of itself.

Hence before you go changing everything under the sun after a losing streak or drawdown, ask yourself if you are accepting variance.

Before You Can Accept Variance, You Must Be Able to Do This

Without a doubt, being able to accept variance will be critical to your survival.

It will mean not tossing out a perfectly good strategy just because you’ve lost 10 in a row.

It will also mean learning to deal with losses while focusing on process and execution, not results.

This will lead to building consistent mental habits to make money trading.

But there is a step before you can learn to accept variance and build up your muscles here. And that is, you’ll need to be able to understand the difference between variance and a problem with your actual trading or strategy.

What if there is nothing wrong with your strategy, but there is something wrong with your mental execution?

Or on the flip side of this, what if there is something wrong with your strategy, but you don’t know if it’s you or not?

How do you know? How could you know?

How Can I Learn These 4 Criteria & Build A Winning Mindset?

Luckily we’ve developed 4 criteria to help you with this. Using these you can know if your losses have to do with variance, or signal a problem with your strategy.

For those of you that want to learn more about these 4 criteria, then check out my ATM course.

This could mean the difference between winning and losing. It could mean the difference between you making money trading and giving up before turning profitable.

It could also mean the difference between a winning mindset and one that panics when things go south.

If you want to learn more about this critical subject, then check out my Advanced Traders Mindset Course. There are 20 total lessons like this which will change the way you think, trade and perform.

Now Your Turn

Have you had issues with consistency after a losing period?

Do you constantly change your strategy after a drawdown?

Do you doubt yourself or fail to pull the trigger after a few losses?

How many of these situations have happened to you?

Make sure to comment along with sharing any ‘aha’ moments you got from this article.

Until then, may you find consistency in your trading mindset which leads to confidence in your abilities.

What a fantastic read. I love how you separate different problems one at a time and teach us how to deal with them. I definitely doubted my skills when had a big losing streak and lost the trust I had in myself as a trader; one big problem for me was that I was getting more emotional after each losing trade and it was getting harder and harder to focus on the process, even though I knew losses happen and are natural. I guess that means weak muscles. see, I’m an athlete and I know the difference between knowing a specific tactic in your game, and actually going through with it in the heat of battle, is huge, and honestly needs an enormous amount of mental training, as well as physical training to truly be able to execute it. From now on, I’ll start learning how I can rewire my way of thinking. Thank you dear Chris for showing the way, like no one has ever had.

Hello Baback,

Yes, many people doubt their skills over a small losing streak. This has to be understood in terms of variance, one’s method and the context of the losing streak.

This is why it’s a key skill and muscle that has to be built.

So glad to hear you’re catching onto this.

Kind Regards,

Chris Capre

I have changed strategy a lot of times, and I have asked myself the questions raise in this article, but now I know better, consistency starts from the mind, I will strive to build my mental muscles henceforth, thanks for this inspiring write up Mr Chris!

Hello Elijah – yes many struggling traders have encountered this problem in changing strategies too quickly. You’ll have to learn to build this muscle to deal with variance, while also being able to recognize it.

So I’m glad you honed onto this key point from the article.

Chris, this article makes so much sense to me today! I have been practicing poker for past few weeks and in spite of a consistent growing equity curve – I go into doubt in middle of a losing streak and wonder if my strategy is right. Ties so beautifully with trading! Learning poker is helping me to learn to accept losses…I struggled with it for the longest time. Now I am increasingly accepting it. Its been no less of a miracle for me. And now this article only reaffirms what I have been experiencing past few weeks. Thank you!

Hello Kiran,

Yes poker is a great method and practice to help build these muscles for trading.

Am glad you are using this and noticing the difference.

Hi Chris

I enjoyed your article while I am holding a loosing position in forex

I liked the hedge fund track record I compare to mine I think I should accept to loose in the way to learn from it . thanks a lot

Hello Daif,

Learning how to lose well in trading is a skill and muscle you’ll need to build.

It is a necessary part of the game and requires training to build this mindset.

So am glad you are finding this article useful in this regards.

It could also mean the difference between a winning mindset and one that panics when things go south. thanks for this great article on trading psychology as you seem to have a gift in this area

Some great pectoral muscles you got there Chris 🙂

When i read the title i thought you were going to hand out powerlifting routines.

Without kidding, this article was very much helpful. What i got out of it is.. tough times will make you doubt yourself, a strong and disciplined mind will get you through this period. Also the knowledge you gave me about random distribution and variance really changed my way of thinking about DD.

Thanks for the article.

HA – definitely not me. You don’t get those from working at a computer for hours per day!

RE: Tough Times

Doubt happens to the best of us. What we do with that doubt is what separates one from the next.

But glad you liked the info about random distribution and variance as it’s a key topic every trader has to learn about.

Hi Chris,

Thank you for writing this article. Couldn’t be more timely as i’ve been experiencing draw down for the last 2 months. In fact, i’m on the verge of self doubt in my ability and strategy. Your article is a mind saver as it reminds me that what i’m facing is part and parcel of trading. Focus on my execution and let the variance plays itself out! Thanks again

Hello Kelvin,

Almost every trader on the planet who makes money will have a 2 mos dd. It happens and is a part of variance. Just make sure you know the difference between variance and a problem with your method.

FYI – we cover this in the ATM course.

But glad to hear you found this article timely and helpful for your trading.

Very timely article! I recently began to post trades based on a simple methodology to show newbies that it ain’t rocket science, and I’ve managed only 3 out of 14 profitable trades! The losses have been very small, because I only risk 1.25% on any trade, so the drawdown isn’t worrisome… but the variance toward negative aberrant behavior has concerned me. Thanks for the reminder!

Hello Dennis,

Yes our default wiring is tilted towards a negativity bias, which you’ve noticed. Even trading small risk, we can see our mindset being affected by not understanding losses and the context of variance. So all going points you noticed here.

BAM! You hit the nail on the head… several times. Love this article!

Accepting variance has definitely been one of my biggest hurdles to overcome and I am still training this muscle. Like lifting weights in the gym, progress takes time. But as long as you put in the daily effort the results will come.

Thanks to your ATM and APA courses I am now calm as a hindu cow while trading which is great since a few years ago I struggled because of emotion based trading.

So one step at a time I am re-wiring my brain and training my trading- and mindset muscles.

Hola Sascha,

Yeah it’s a skill and muscle that takes time to learn. Am glad you are finding the ATM Course along with the APA training have helped you build these muscles.