Today I got a question from a student who’s only made a few posts in the course, so just getting started.

They asked a question which points to a critical aspect of trading.

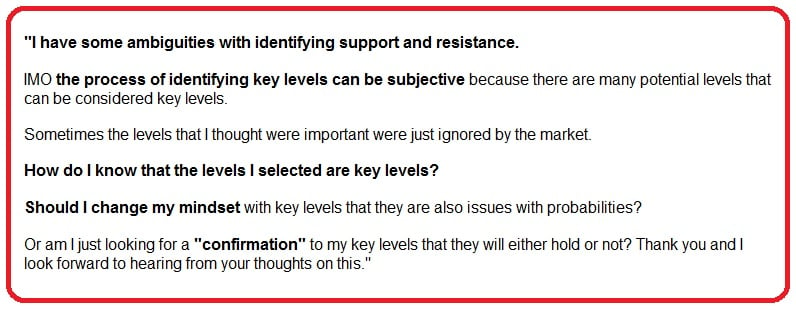

Here is what they asked below:

I think this is a fantastic question many developing traders struggle with.

How do you ‘know’ if the key level you’ve chosen is the right one?

What happens when the level you chose just got sliced through like Swiss cheese?

And do I look for ‘confirmation’ whether this key level will hold or not?

I’ll address these questions in this article to clarify your understanding of trading with support and resistance levels.

Isn’t Finding Key Support & Resistance Levels Subjective?

I think many beginning traders struggle with the more ‘discretionary’ elements of trading.

It’s easy to want things to be fixed, to be purely scientific or mathematical. That is nice because it means for every situation x comes up, you should do y.

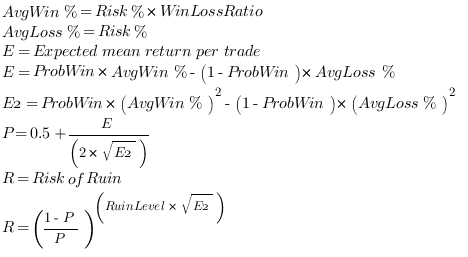

Lamentably, trading isn’t that simple, especially when trading price action. Risk management would be one of those components of trading which is purely scientific. It all boils down to math and the risk of ruin.

However, trading key support and resistance levels is part scientific and part artistic. This means there are rules to trading them, but part of working with them will entail a ‘discretionary’ call.

Hence the answer is yes, there will be a part of your trading with key levels that will be subjective which you cannot avoid.

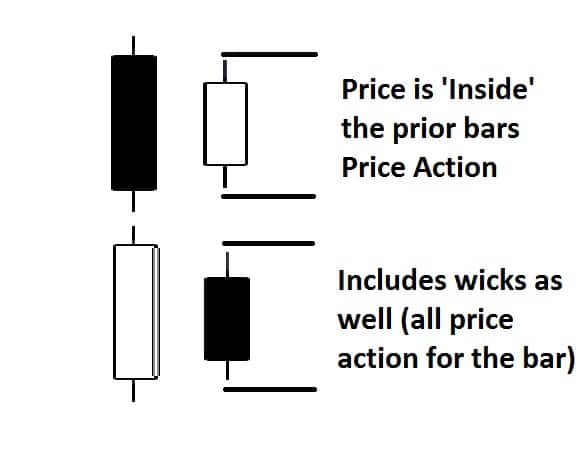

It should be noted I do not look at support and resistance levels as pure lines in the sand. I look at them as zones of order flow.

Why do I say this?

Because when you look at the order flow and liquidity around key levels, you’ll notice a pattern. That orders and liquidity vary at several prices above & below the key level.

This is because there are varying institutional players out there who will place their orders at varying prices above or below any key level.

A great example of this is when we consider time horizons for trading. If someone is trading intra-day, then they will likely have a smaller stop.

This will require them to have greater precision in terms of their entry price and trade location. Thus they will be as close to the level as possible.

However someone who is swing or trading long term will not be so concerned with this as a few pips difference on a +500 pip profit target and 150 pip stop loss.

Keep in mind, this is just ONE factor regarding how orders are placed around key levels (as there are many).

But when we look at the order flow around key support and resistance levels, we can see there are going to be orders at many prices above and below a key level.

This is part of the reason why I consider trading key levels to be more like zones of order flow. There are other reasons which I explain further in my price action course.

How Do I Know The Levels I Selected Are Key Levels?

This is another critical question that I often see amongst developing traders. The reason why I say ‘developing‘ traders is because this type of question & wording gives a unique insight into a traders mindset.

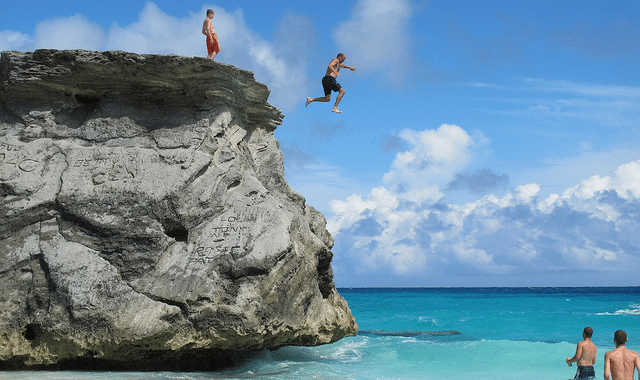

They make it seem like placing a trade around a key level is like jumping off a cliff that is only 15 feet above water 😮

As a general rule, you will never ‘know‘ anything about trading, let alone price action. This isn’t like poker where you have a fixed number of cards in the deck and can ‘know’ the probability of a hand or card being hit.

There are an infinite amount of possibilities -1 that can happen in the charts. You will never ‘know‘ with 100% certainty and you cannot avoid this.

The desire and want to ‘know‘ comes from a beginning traders mindset…of wanting pure objectivity in trading.

“Beginning traders want certainty because they are uncertain of their abilities and skills.”

The want for certainty is an attempt to compensate for their lack of skills and confidence. The problem is, certainty is an illusion in trading, so you are wanting something that does not exist.

I do not ‘know‘ a key level I’ve chosen will work or not. I’m just going on probabilities & my read of the price action context.

I’m guessing an olympic biathlon shooter doesn’t ‘know’ when the wind will blow. But they can take measurements, read the wind speed and direction (constantly in flux), then make the best shot they can.

Trading is very similar.

And professional traders will never ask this question about ‘knowing‘. Why?

Because professional traders trade and think in probabilities. They know that certainty is an illusion. They know what you are really working with is ‘probability‘.

Hence the best you can do is align the probabilities in your favor as much as possible.

Are There Ways to Improve Your Ability To Read Key Levels?

Yes, I have an entire lesson dedicated to this in my price action course. We cover how to work with key levels across multiple time frames and context.

Do I Look for Confirmation Whether The Key Level Will Hold?

I’ve talked about this how hedge funds do not trade confirmation price action signals. They give you a worse entry and actually lower your overall profitability and accuracy.

Hence I do not look for confirmation signals at key levels. You can read more about why I don’t trade confirmation signals at key levels here.

In Conclusion

Until the Hal 9000 is available for trading, I’m not sure we will have an ‘objective’ way to trade key support and resistance levels.

It’s important to understand where this mindset comes from and why you should trade and think in probabilities.

It also helps to think of support and resistance as a zone of order flow, not pure lines in the sand.

Most often, traders who struggle with the probabilistic nature of trading are wanting certainty. But this is an illusion in trading. We have to get comfortable with certain parts of trading that will simply be ‘unknown‘.

Your ability to read key levels will improve over time, and there are many things you can do to improve your ability in this. We teach these methods in my advanced price action course and how to increase your skills trading key support and resistance levels.

Eventually you’ll develop the confidence to trade them without confirmation. And when you do, you’ll see your profits, accuracy and profitability increase tremendously.

Your Turn

Have you been wondering how you will ‘know’ if a key level will hold? Do you find yourself constantly looking for ‘certainty’ and ‘confirmation’ around a key level?

Make sure to comment below and share your thoughts.

Yes certainty is an illusion in trading..

Generally, support and resistance level at a higher time frame is probably more “certain” than one in the lower time frame..

Hello Lawrence,

More ‘probable’ would be a better operative word, but that doesn’t necessarily mean more profit per se.

You’d be missing a great edge by ignoring S/R levels on smaller time frames as they offer plenty +R profit. You just have to learn how and why.

Kind Regards,

Chris Capre

Hello Chris,

I have read several of your articles and I am getting a little better with your advice. At least you point out what is wrong with how I think about trading. It’s a start to fixing my trading faults.

In this article, you point out there is an uncertainty in trading that we must live with. In reality, there is always uncertainty. Will I make it home from work? Will the power go out and take down my trading software? Will the economy crash and wipe out the company I work for? In general, we ignore these uncertainties because they seem to be small; because we face many of them every day and are never threatened. I am an engineering technician. I work with electronic components. Every part has a tolerance, a range of variation, so that any part you use will NOT be guaranteed to be exactly its nominal value. Even if you measure it, there is an uncertainty to the measurement AND variation in the part due to temperature and other factors. This experience hasn’t helped my trading. I have lots of experience with electronics and these uncertainties are relatively small compared with function of the circuit that contains them. There are dozens of well established methods for compensating for these imperfections.

I am new to trading, so my “toolbox” for working around uncertainty is so minimal as to be nonexistent. I do struggle with price action. I feel I am looking at a language I do not know. There’s obviously information there, I just can’t access it completely. I like your articles and want to take your price action course but my resources are currently at an ebb. Unfortunately, my trading will have to wait. Fortunately, I am in a demo account and there is time to fix my trading faults before they become costly.

Your articles are a bit unsatisfactory in that you don’t seem to provide an “answer” but you do provide a concept from which I can attempt to derive my own answer. It’s not as fast as being taught but in some ways it can be more satisfying (my consolation: I figured this out). Even so, I know I could use some help mastering Forex. I would rather be like Isaac Newton who said ( and I paraphrase loosely ), “If I am great, it is because I stand on the backs of giants.”

Thanks for your advice and Best regards,

Tabb Mayo

Hello Tabb,

Am glad to hear you are getting better with your price action trading from the content on the site.

It’s pretty honest (some good self-reflection) that you realize your skill set for working with uncertainty is limited at this point. The good thing is this skill can be built up.

RE: The Answer

Actually we do provide an answer in the articles and videos as of late (at least part of the answer).

However for the rest of it, that is for the members of the price action course which you are welcome to join.

Hope this helps and that you can join soon.

Kind Regards,

Chris Capre

another great article, thinking in terms of probability ease tension of drawing accurate line for key levels. As much as traders would have like to have key level in terms of one single line in sound, but the really is a lot of factor plays their role in making an area on the chat a key level. Chris i have been able to transformed my self from my former understanding of trading to a higher level from just reading your articles only. Well-done.

Hello Kuye,

Yes, every trader would like to have key levels be the only lines in the sand. That would be more convenient and easy. But trading isn’t easy.

But am glad you are starting to increase your level of understanding price action from these articles.

Kind Regards,

Chris Capre

Hi Chris, this article (as well as with your mindset) is really helpful for us developing traders. Certainly, we are wanting for “certainty” but we are not seeing it as illusion. And yes I want to think differently and trade with probabilities! Yeah, trading is similar to outdoor sports that you can’t just know what to expect the outdoor conditions…Very nice article.It will take decades for us to harness trading skills but with constant exposure and practice, we can be profitable in trading!thanks Chris!=)

Hello Louie,

Yes, many traders in the beginning want certainty. Those that get past this realize there is only probability.

So good of you to notice and glad you liked the article.

Kind Regards,

Chris Capre

This is a very interesting subject, as I am currently back testing a price action strategy using Japanise candlesticks, around pivot points in the market with currency pairs. I am looking for shooting star / hammers around key support / restiance levels for reversals at end of day expires. Although I am averaging a good ITM results I have difficulties in understanding why one day a key level will hold on price and another day it won’t ?

Hello Lawrence,

Good luck with your back test.

As to understanding why one day a key level will hold and the next fail, you have to learn how to read and trade price action in real time.

Kind Regards,

Chris Capre

Outstanding article Chris. Mark Douglas could not have said it better himself!, with respect to not knowing, and to think in probabilities. In fact, to quote Mark:

he said ” Thinking this way (in probabilities) is virtually impossible unless you’ve done the mental work necessary to “let go” of the need to know is going to happen next or the need to be right on each trade! He goes on to say: “In fact, the degree by which you think you know, assume you know, or in any way need to know what is going to happen next, is equal to the degree to which you will fail as a trader” !!

I know for a fact that those statements are true!! How do I know?

Needing to be right, or have certainty has been the bane of my existence for the last 10 years in trading 🙁

It is a tough one to get over and I am still working on it.

Having said that….your courses Chris are a great help, both the forex course, and the advanced traders mindset. Thank you for that.

PS …in case some were not aware, Mark Douglas recently passed away (Sept 12th/15 apparently). My heart aches over this as he was one of my trading heroes, and I got to meet him in Arizona last Dec/14. A more gracious and humble man you could not find. He literally was embarrassed when I asked him to autograph my beat up copy of Trading in the Zone.

Yeah, heard about MD. Sad to hear as he was a great contributor to the subject. How nice you got to meet him.

It’s good though you learned from him and were able to see how you need to work on these things about probability and certainty…tis a tricky thing for the brain to overcome.

Kind Regards,

Chris Capre

Just a couple of issues with your article Chris.

First, that cliff is at least 25 feet.

And I really think a quantum computer will be needed. I don’t think Hal will be able to cut it.

(Oh, I hope you and others are getting used to my weird sense of humour)

Other than that, great article!

Everything IS all about probabilities. Grasping this allowed me to ease my apprehension about my trades.

Not fully there yet but well on my way.

Hola Bob,

Too funny! I actually got what you were saying…and am still working on that quantum computer 😉

Yes, many people have an apprehension when grasping onto things which are not certain since so much of our daily life ‘is’ certain.

I think that is why trading is so challenging, because it plays with this uncertainty.

Those who can transform this mindset are the one’s who succeed at this so good comments here.

Kind Regards,

Chris Capre

Great article Chris. Your PA Course has helped me tremendously with this. Thanks

Hello James,

Good to hear from you and that the price action course has helped with this challenging subject.

Kind Regards,

Chris Capre

I have developed two method of determining the top

of a trend and a high in the over all markets, which I hope

to put out in a book one day soon.

Hello Gary,

Ok, not sure what this has to do with the article, but thanks for sharing.

Kind Regards,

Chris Capre