Key Talking Points:

- False Breaks Offer Great Price Action Trading Setups

- You Can Trade the False Break Strategy with Pin Bars and Engulfing Bars

- Look for False Break Setups Trading With the Trend

Ever tried to enter on a forex false breakout breakout setup, only to have the trade immediately reverse on you? I’m guessing this has happened to you many times (present trader included).

With the market volatility declining over the last several years, false breaks can and will happen all the time. The key to avoid getting stopped out, and actually profit from these false break setups, is to understand the price action context which often precedes them.

In this two part article series, I will begin today’s discussion by defining a false break. Next, I’ll go over a common false break setup, which is trading the false break with trend. Then I will go over a fundamental false breakout strategy, and conclude by recapping the key points.

What is A False Break?

I would prefer to define a false break as one of the following two scenarios:

- A break above/below a prior candle that fails to close above/below that candle

- A break above/below a key level, quickly reversing that level, and sparking a counter-trend move

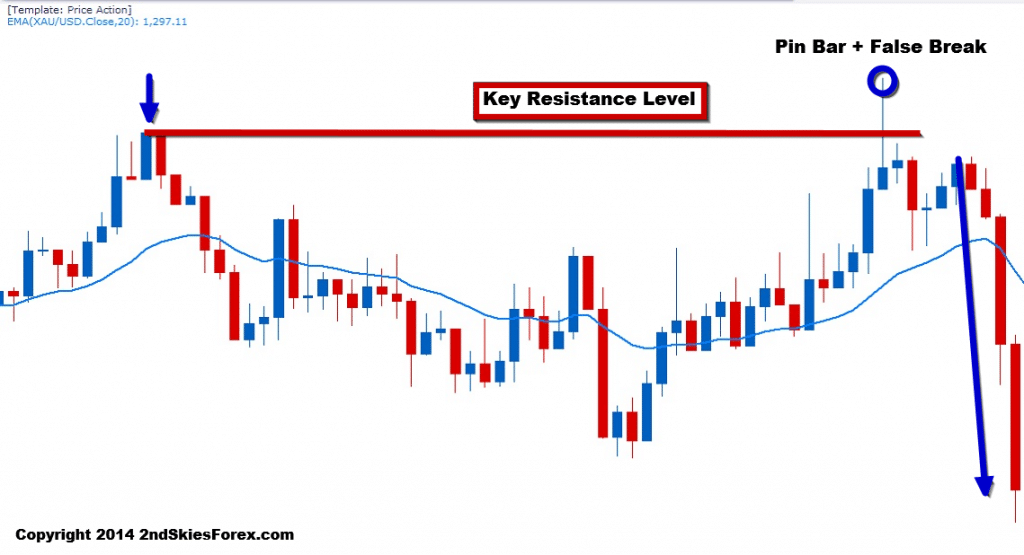

Below is an example of the first type with a pin bar + false break:

In the chart above, you can see the arrow to the top left, showing a bullish move running into resistance. The pair then settles back, and makes a second attempt to take out this key level.

But on the top right, you can see it forms a pin bar + false break.

From an Order Flow Perspective

Looking at this from an order flow perspective, the bulls were in control leading up to the level, and were able to push past it. Either there was massive profit taking on their part, or they ran into heavy sellers a few layers deep behind the level.

Regardless, the sellers over-whelmed the buyers, and pushed the pair back below the key resistance level. After a second attempt to regain the level, the sellers realizing they had control, sold even more, pushing the pair down impulsively.

Trapping Traders

In most false breaks, there are ‘trapped traders‘, meaning traders who are caught long when the pair is about to go short, or vice versa. Those trapped traders once the trade goes negative, will likely be stopped out, & further fuel the counter-trend move.

The more savvy traders will exit manually when they realize they are trapped, while the slower traders will likely get hit for the full stop. There are price action clues to tell when you’ve been trapped, but that is for another article.

Trading The False Break Setup With Trend

It should not be surprising, one of the best false break setups occur when trading with the trend. This is because the underlying order flow is heavily imbalanced, meaning it’s heavily bullish or bearish.

When a false break setup forms counter-trend, it usually runs into buyers or sellers who are happy to take the pullback getting a better price. Their overall strength in the market makes it harder for counter-trend false breaks to be maintained.

This is why false breaks present such great trade opportunities.

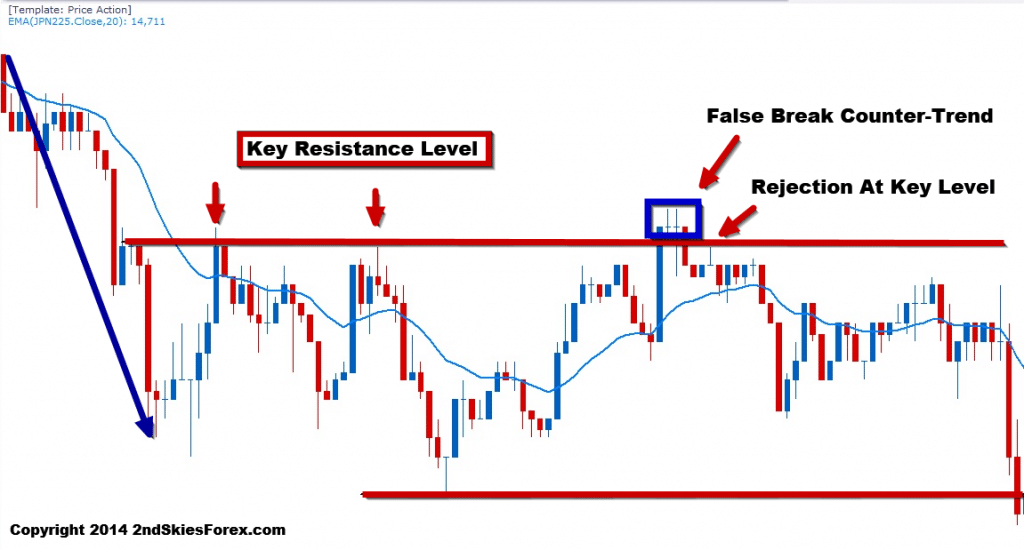

Below is a classic example of trading the false break setup with trend:

In the chart above, starting with the top left, we can see the heavy impulsive selling. Eventually this leads to a bounce which hits the key resistance level 2x (marked by two red arrows). After forming a new low (red line at bottom), the pair bounces to retest the bears at the same resistance level.

Now note how the pair breaks above this level with a really large blue bar, closing at the highs. Ask yourself, if the bulls were really in control, how come they did not produce any follow through?

The next two doji candles showed no real strength or follow up buying, which should have been a warning sign to any bulls already long. Bears wanting to trade with trend, should have been looking for the false break and close below which they got on the 3rd candle.

Entry, Stop & Take Profit

With such a clearly defined trend and resistance level, there are two general entry techniques;

- Sell on Break back below the key level

- Wait for pullback setup to the key level

More aggressive traders who feel confident in their price action skills may sell on the break back below the key level. This may or may not offer the best price, but you may not get a second chance to enter if the sellers came in hard on the false break.

More conservative traders can wait for a pullback setup to the key level. If the false break is real along with the level, then the trade should hold and not go much into the negative.

I generally recommend placing the stop above the high (or below the low) of the false break by a few pips, depending upon the volatility and liquidity of the instrument.

The first target should be the other end of the consolidation. If you want to go for multiple targets, then the next key support or resistance level would be suggested.

To Recap

In today’s forex false breakout article, I talked about the price action and order flow behind a false break setup, and why it can be a powerful trade opportunity. I discussed the two types of false breaks and how to generally define one.

Lastly, I covered why to look for with trend setups trading the false break, giving the entry, stop and take profit methods.

When you learn to read price action in real time, you will begin to spot these false break setups more easily. As you get skilled in identifying them, you will avoid the common traps, and profit heavily from them as they offer great opportunities.

In the second part of this article, I will talk about using a false breakout strategy with pin bars and engulfing bars.

Hi Chris, Nice article. Just trying to understand here why did we wait till 3rd retrace to Key resistance level to considering entering. Why not 1 & 2nd retrace as there was a similar rejection at key level.

hello chris..

great work as always.. is the second part of the article available?

thanx

Hello Mahmood,

Sure thing. Here ya go:

https://gammalevelcorp.wpengine.com/forex-trading-strategies/forex-strategies/forex-trading-strategies-trading-false-break-part-2/

Kind Regards,

Chris Capre

how do i go about ?

Hello Keith,

I’ll email you instructions in the next few mins on how to join.

Kind Regards,

Chris Capre

hey ! if you were to get into a 15M position. would you look at other intra day timeframce for overall trend ? or just look at 15M timeframe’s trend ?

Hello Keith,

That is more towards information I’d share with the Price Action Course members, which you are welcome to join to get access to my daily market commentary, trader quizzes, private member webinars, trade setups forum, course lessons, and more…

So hope you can become a member soon.

Kind Regards,

Chris Capre

thank you for getting back to me

Hello Keith,

My pleasure.

Kind Regards,

Chris Capre

so as long as im targeting a 2:1 profit i should just leave it to the Stop Loss and Take Profit ya ?

Hello Keith,

Its hard for me to say as I’m not familiar with your trading plan and overall risk management profiles. When trading intra-day, you have the option of managing the trade in real time, having a fixed target, or other options which we discuss in our price action course that you are welcome to join, get access to the live trade setups forum, and have your trades analyzed by me.

Kind Regards,

Chris Capre

thanks alot for your quick response. read somewhere that we should not hold off a position for too long.

yes !

Hello Keith,

In some sense, the time should not be relevant. What I mean by this is, if your trade is going for a runner, and you want to maintain the position, then there is no need to cut off profits based on time.

You have a stop and a TP, and there is no set amount of ‘time’ that it should get to either as conditions change.

There is the method of using a time stop, but you’d need a baseline before you could employ this.

Hope this clarifies it.

Kind Regards,

Chris Capre

how long can i hold on a 15m position?

Hello Keith,

I’m not sure I understand your question.

Are you asking how long you can hold a trade using the 15 minute charts?

Kind Regards,

Chris Capre

thanks for replying me !

Hello Keith,

My pleasure – a very good question, so glad you asked.

Kind Regards,

Chris Capre

can i just ask which timeframe are u trading ?

Hello Keith,

I trade multiple time frames, all the way from the daily, the 4hr, the 1hr, the 5m, sometimes the 3m and 1m.

When you learn to read and trade price action, that skill can be applied to any time frame.

Hope this helps.

Kind Regards,

Chris Capre

Excellent article Chris. Very clear, concise and useful. One of the best I’ve read for ages. I really like price action strategies on the daily timeframe such as this

Hello Mike,

Yep, big fan of trading PA myself, particularly learning to read the nuances and order flow behind the price action.

Glad you liked the article and found it clear + useful.

Kind Regards,

Chris Capre

I was actually doing this ignorantly in tester 2 last week never heard it from any where and its work better than reall breakout its self hear this from you now hve giving me a gut feeling that i m in the righr path,thanks for your great wisdom

Hello Ryud,

Yes, when you learn to spot false breaks and use the false break strategy, you can catch a lot of good with trend moves, counter-trend moves, and spot some great trading opportunities, so glad you liked the article.

Kind Regards,

Chris Capre

I was actually practicing this ingnorantly in tester2 never hear this from anyone and its work better than trading breakout its self and now your giving a gut that i am actually in the right part, thanks for your great wisdom n

Great article Chris. If you have time would you mind answering this question for me please? With reference to “Below is an example of the first type with a pin bar + false break:” is it not also an example of the 2nd type at the same time? ie. “A break above/below a key level, quickly reversing that level, and sparking a counter-trend move”. I’m a bit confused between the two types? Thanks.

Regards Mark

Hola Mark,

Glad you liked the article. In regards to your question, technically it is not, because it is not a with trend trade setup, but counter-trend. It does have some of the other components, but that one it does not.

Hope this helps clarify it, and good to hear from you as always.

Kind Regards,

Chris Capre