Chris Capre’s current live open price action & ichimoku trades: USDMXN, EURRUB, EURMXN, BIG, SIG, DIS, ISD

New to Forex? Then check out my FREE Learn Forex Trading Course with videos, quizzes and downloadable resources

Top Trade Review: Watch this new Top Trade Review of my student making +177 points of profit on the Swiss 20 index

NOTE: To all our 2ndSkies Trading Community – Please be smart/safe/prepared with this corona virus going on.

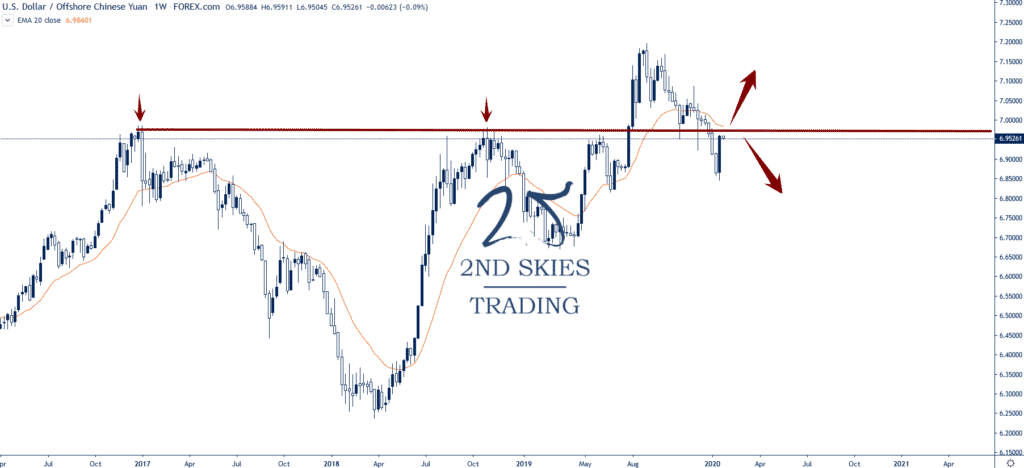

Forex Trade Idea: USDCNH – Strong Buying On Market Open, Key Resistance Just Above (weekly chart)

Price Action Context

With news out of China and the corona-virus continuing to spread, risk off has been the theme as of late, and the CNH has been suffering as a result (being ground zero of the outbreak).

For the last 4 days, the USD has gained strongly against the CNH and until this outbreak is contained, we expect this to continue.

Currently the forex pair is parked just below key resistance near 6.98. If we get a daily close above this level, then expect the pair to challenge the 7.05 and 7.15 levels which are the 2019 highs.

Trending Analysis

ST bullish and MT bearish. Need daily closing above 6.98 to turn MT trend analysis to bullish.

Key Support & Resistance Levels

R: 6.98, 7.19

S: 6.86, 6.7

Stay apprised with our member market commentary for updates

******

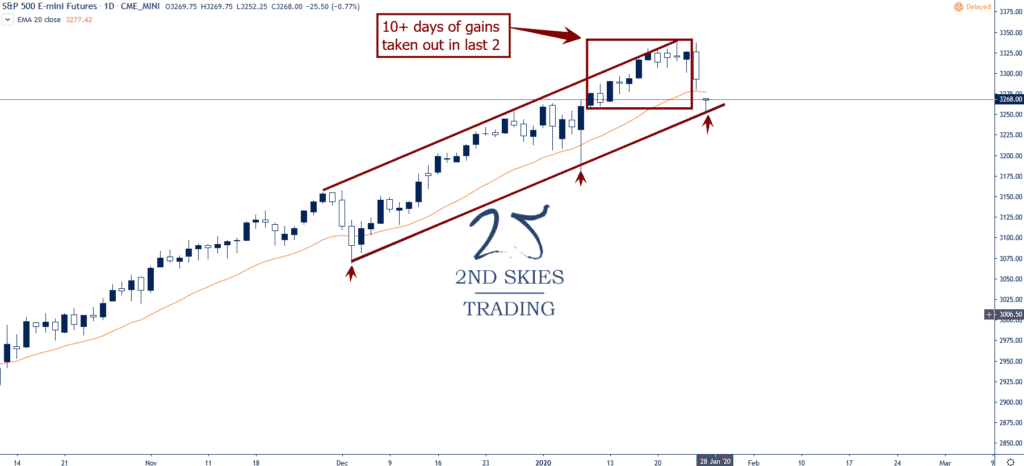

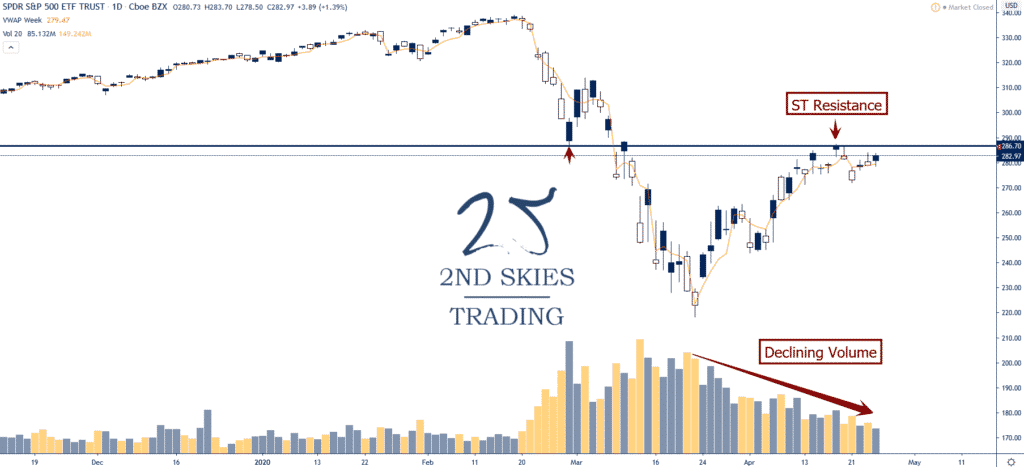

Index Trade Idea: S&P 500 – Potential Bull Trend Channel Break (daily chart)

Price Action Context

In one of the strongest bull trends in history, the S&P 500 has become rather of a joke amongst traders lately with its inability to actually sell off.

However with the corona virus starting to become more of an issue, the US index sold off about 30pts from open to close on Friday, and has gapped down below the 20 ema to start the week.

Looking at the bull trend channel on the chart, traders will be watching for a break of the channel and daily close below the 20ema as the last 2 days of selling have taken away the prior 10+ days of price action.

Trending Analysis

ST bearish with the current risk sentiment while MT bullish until the channel is broken.

Key Support & Resistance Levels

R: 3336, 3400

S: 3244, 3154

******

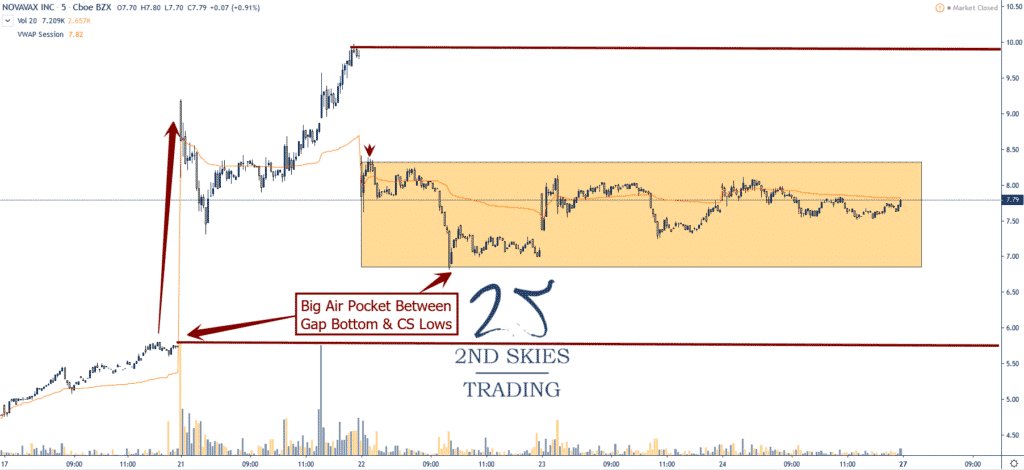

Stock Trade Idea: NVAX (Novavax) – Watching Gap + Spike Highs For Fading Opportunity (5 min chart)

Price Action Context

With the corona virus taking the top headlines globally as of late, biotech stocks have been going gang busters with vaccine makers getting huge spikes in volatility and value.

NVAX (Novavax) jumped by over 80% on the 21st last week and has been holding its gains since.

Current spike high at 10 is the target for bulls, so any break above could create some trapped bull traders should it slam back below this.

Meanwhile we got a corrective structure betwee 6.84 and 8.34 which has been dominating the price action since the 22nd.

Any break of this higher will target the 10 handle while breaking below would likely fill the air pocket to the gap bottom near 5.60

Trending Analysis

ST & MT bullish while above gap bottom around 5.60 on a daily closing basis.

Key Support & Resistance Levels

R: 8.34, 10

S: 6.87, 5.81