When the slumping technicals of a stock are aggressively and continuously defying its strong fundamentals, it is worth observing. Such is the paradoxical story of PayPal Holdings (Nasdaq: PYPL), and we’ll be looking at it today.

Source: Anna Shvets

What Happened

The online payment company reached its highest peak in July when it topped out at $309. But since then, the stock has unforgivingly dipped by as much as 40%, despite strong earnings and revenues report in the quarters within its peak and now.

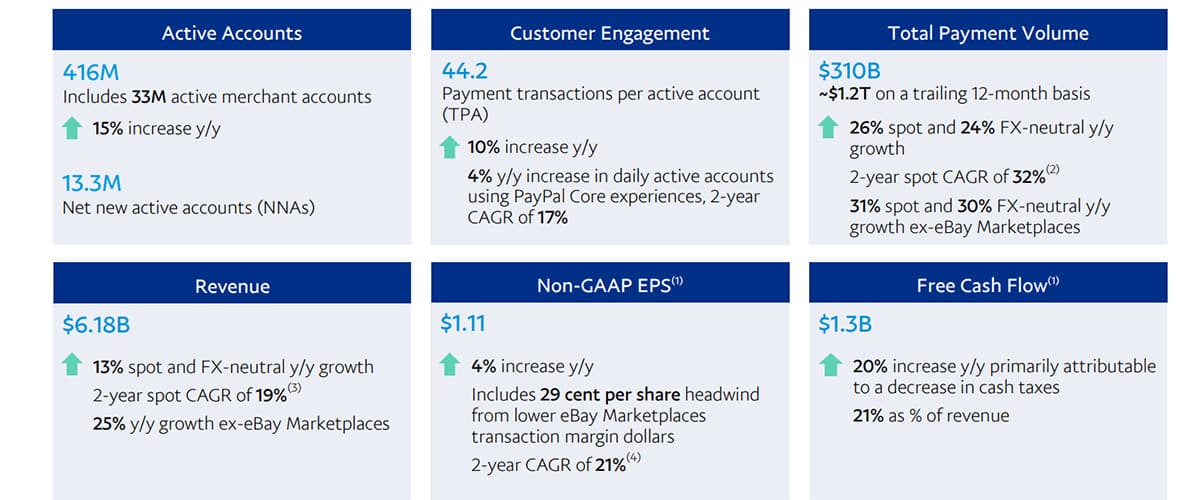

This same company with the dipping stock price gained 13.3 million new active accounts in Q3 FY 21, bringing its total number of active accounts to 416 million. Unsurprisingly, revenues grew by 13% year on year to $6.18 billion. Finally, the free cash flow of the stock rose by 20% year on year to $1.3 billion.

Source: PayPal

What Next?

PayPal has done a lot to maintain its strong fundamentals and also ensure that it remains relevant in the future amidst competition from companies, such as Square. The company recently announced that users of its subsidiary platform, Venmo, in the US, can use their accounts to purchase items on Amazon.

Maybe one of the most glaring efforts to remain relevant is in PayPal’s attempts to incorporate the potential future of money, cryptocurrency, into its platform. The company announced that its 400 million-plus users can now purchase cryptocurrencies via its platform. It also has an online trading platform for stock investors in the works, which the company hopes to launch in 2022.

With all these future investments and strong fundamentals, you may then ask yourself if this dip is merely the market sentiment for the short term. If so, where is the best place to buy the dip?

Technical Analysis

The PYPL stock has plunged since it reached its all-time high in mid-July after having risen by almost 260% since the beginning of the pandemic last year.

It has remorselessly shredded the $216 – $224 support level and now has the $166 – $174 support level behind its crosshairs. Having proven to be a key support level on three different occasions in the past, it’ll be interesting to see what the price has in mind for this level.

Most traders would, however, would like to see this stock dip even further before they prepare their investments for a buy. Already, the price-to-earnings ratio is higher than the industry and market values, making other stocks more attractive than PayPal. So, only a further dip in price, maybe to the $122 – $131 support level, could convince traders to buy PayPal.

But as for investors, a 40% dip on a fundamentally robust stock might not sound like an en entirely bad entry position. Nor does it look enticing, anyway. And just like traders, investors may await a potential further dip to get better entry points.

But from where we stand, there isn’t enough evidence to buy the PYPL dip at 40% as of the time of this writing.