Throughout the pandemic, many turned to pets for comfort, seeing pet ownership grow rapidly in the last 18 months. One company likely to benefit from this long-term is Trupanion (NASDAQ: TRUP), the market leading pet insurer in the US.

New pet owners can easily forget about the importance about getting an insurance for their new companion right away, but as soon as they get the first bill from the vet, that’s likely to change, which means the increase in ownership we’ve seen during the pandemic, likely slowly will spill over into the insurance market over time.

In North America alone, pet owners spend over $62 billion caring for their 180 million dogs/cats but despite this, only 1-2% of the total # of pets in the US/Canada are insured which is nothing compared to Europe.

For example, in Sweden a whooping 40% of pets are insured and in the UK this number stands at 25%. This should give you an idea about how much untapped potential there is available in the US market.

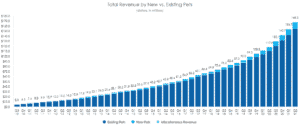

Even before the pandemic hit, Trupanion already showed impressive and stable growth over time, with a revenue growth of 20%+ for 55 quarters in a row!

(Source: Trupanion)

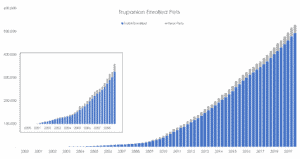

Also, the growth curve of pets enrolled in a Trupanion insurance is nothing less of impressive.

(Source: Trupanion)

In Q2 this year alone, the company’s income increased to $18.5 million, up 32% compared to Q2 2020 further confirming that the company’s consistency in terms of growth remains uninterrupted.

Another impressive metric of Trupanion is their incredible 98.72% monthly customer retention rate, a number most other companies only can dream of.

Trupanion not only looks like a very stable and well-managed company, but also impresses with a strong YoY growth in a market that is on the rise. Thus, we think this stock makes a great candidate for long-term oriented investors.

Technical Analysis

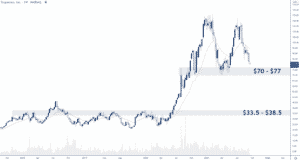

Following the massive 300%+ bull run in Q3/Q4 last year, the stock topped out with at around $120, forming a long-term range between $70 and $120. Price is now closing in on the long-term support zone between $70-$77 which we think is a solid first location to look for potential longs.

However, should this support fail, the next structural support does not come in until $33.50-$38.50 which is our second buy zone for this stock.

Option Positioning

This is an incredibly low option volume stock with 2K calls and 8K puts, so our option data comes with a grain of salt. Support should start to build around $70/75 in congruence with the technical analysis.

FULL DISCLOSURE: Chris Capre currently has no stock or option position in TRUP. If you’d like to learn more about Chris’s trades and positions, you can get access via the Trading Masterclass where he shares his live trades, further investment ideas and daily market analysis.