The REIT stock market is likely one of the best places to be for income investors because these companies are legally mandated to pay 90% of their income as dividends to investors. In other words, these companies exist to feed their investors. Medical Properties Trust Inc (NYSE: MPW) stock is one such company. And we believe this stock holds an edge over other REITs in the market.

Source: Jonathan Meyer

Medial Properties Trust is in the business of healthcare facility real estate. The company owns about 440 hospitals in the United States and Europe.

Dividend-wise, MPW pays a 5.73% yield to its investors and a dividend per share (DPS) of $1.16. This DPS has steadily increased for the past eight years. And while the company has not promised a further increase, business has looked good and there’s no reason not to expect it.

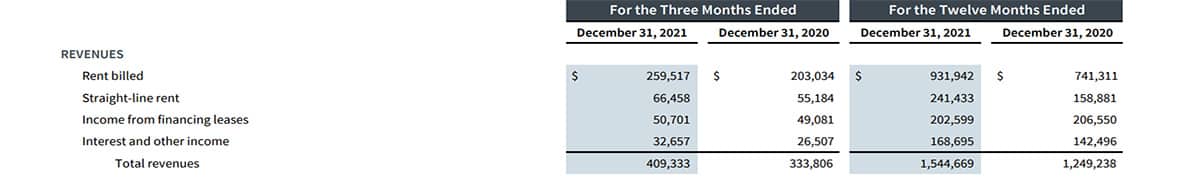

Talking about business, here’s what Medical Properties Trust financials look like.

In the most recent Q4 FY’21, funds from operations were $259 million, topping Q4 FY/20 by 35%. Revenues also grew year on year by 24% to $409 million. Earnings per share for the quarter also increased to $0.34 by 70% from the same quarter of the previous year.

Source: Medical Properties Trust

Despite these impressive figures, Medical Properties Trust is still relatively cheap compared with other stocks in its industry. It has a Price to Earnings (PE) ratio of 18.8X, while its industry has a 41.2 XPE ratio.

Another reason we believe Medical Properties Trust is an outstanding stock to invest in is that healthcare real estate is going nowhere, even in the future, something that can’t be said for some other REITs.

Many office building REITs face the threat of not being useful in the long run, as companies are taking their operations online. But because there’s only so much medical treatment you can receive online, the healthcare real estate scene is going to remain active long term.

Technical Analysis

Medical Properties stock has not seen the 2022 it hoped for, as it has dropped by almost 20% to where it currently is. However, this dip might prove to be a mere correction, as the stock now rests on the $19.4 – $20.20 support level.

Already a hammer candlestick, which is a bullish pattern, has appeared right on the support level, suggesting that there might be a reversal that sends the price bouncing off the level. And if this happens, there’s about a 20% upside for the stock to reach the $23.6 – $24.4 resistance level.

The current price level is an excellent place to buy the MPW stock for all investors.

However, if the price falls below the support level, we may see a further dip to the $16.1 – $16.8 support level.