This is part 3 of a 4 part series. Listen to the last one here: Don’t Fight or Trade Like This, or if you missed the previous one, checkout The Blind Entry (How It Will Leave You Trading Blind)

I’ve shown over the last few content pieces how the idea of confirmation in price action is an illusion. This video demonstrates that when retail traders are getting in the market, professional traders are already in profit.

Here’s the transcript for the video:

“Hello, traders here.

Chris Capre, 2ndSkiesForex.com.

So I’ve recently shown over the last few content pieces how the idea of confirmation in price action is an illusion and it’s not what professional traders are looking to enter the market.

I’ve also shown how entering on a 50% retrace tweak entry on a pin bar is a sub-optimal or retail entry.

I think it can be easily said that when retail traders are getting in the market, professional traders are already in profit.

This video further demonstrates this about the pin bar entries, such as the 50% retrace entry, or the sell on break being also a retail or sub-optimal entry.

Now, I’m going to use an example here from a live trade I’m in right now and this is one that I’ve discussed in my members trade setups commentary in the price action course.

So, I sold right at this resistance level.

I felt like we’re still in a range type structure and that if the market protruded up to this resistance right over here, that sellers or offers would enter the market and push the pair back down.

And that is exactly what happened. So I got in at 1.4975 and literally it was about 6 pips off the intraday high.

And so I put a stop just above these little wicks right over here, particularly this one here, which left me with a 30 pip stop.

Now, I’d like to compare this entry versus the 50% retrace entry or sell on break so that you can see the differences.

Now, going to another chart here, first off using the 50% pullback entry here, you would’ve missed this trade completely.

So according to the faux authorities on price action, particularly Nial Fuller, the next entry would be the sell on a break of the lows here.

In fact, pretty much every other person who teaches the cut and paste or carbon copy version of price action that you see out there, especially around the pin bar, would all say you either sell on a retrace or you sell on a break of the lows.

Now, this gives you a much worse entry, and about as late or a retail entry as you could possibly get. So that puts you in at about 1.4943, roughly.

Now, assuming in most cases we’re going to have the same stop, just above this here, most of the time we’re gonna have the same stop on the same type of entry.

You are going to need a 70 pip stop compared to my 30 pip stop which is at 1.5003. So you need 70 pips, I have 30.

Now, just from a risk to reward perspective, when you are hitting +70 pips or +1R which would put you at 1.4863, that’s right about… that’s actually below the intraday lows.

So this right here is your intraday, that would be your +70 pips or your +1R.

When you are hitting your first +1R, my entry at 1.4975 is up already 112 pips, is at +4R. So now the moment you’re getting your first R, I’m already up 4 times that.

In fact, by the time your entry in the market right here at 1.4933 which is a pretty razor sharp entry if you’re selling on break, I’m already up +40 pips from my 1.4975 entry. Or in this case, +1.33R.

Again, coming back to the perspective that it is

“more often a professional is already in profit when a retail trader is entering the market”

you can see the differences quite clear here between the two entries.

But let’s play a little fantasy here. Let’s say that the market pulled back magically to your 50% level perfectly.

Let’s say you got the absolute highest uptick on the pullback. The best possible entry in the trade. It just happened to go there. That would be 1.4958.

Now, again, assuming most of the time we will have the same stop loss placement, your stop loss is 47 pips if you put it at 1.5003 whereas mine is still 30.

So when you are hitting your first +1R at 1.4910 which is right about here, there, so when you’re hitting your first +1R, at 1.4910, I’m already up 65 pips or +2.16R.

So, with that being said, it should be very clear, especially with all the other content I’ve posted before this, it should be very very clear the differences between a professional trader’s entry and a retail entry, especially being offered by the faux authorities on price action.

If you want to continue to have sub-optimal retail entries, then you can use the 50% retrace entry.

But if you want an entry location that gives you better accuracy and a higher +R per trade, many times double the +R available, then you’ll want to adjust your entry method.

And this is what I teach in my price action course, particularly how to get plus high R trades like this.

Now, if you found this video lesson useful, please make sure to like, share and tweet it below, and I’d love to hear from you what “a-ha” moments you have from this video.

So please come over to see this video on my website as well at 2ndskiesforex.com where all the discussion is happening and leave your comments there.

But thank you for watching this video, again my name is Chris Capre at 2ndSkiesForex.com, where I teach you how to increase the way you trade, think and perform.”

Now that you’ve seen the video and had a chance to analyze the two methods and how they perform differently, which one wins?

What do you think? Please share and comment below.

This is part 3 of a 4 part series. Listen to the next one here: Don’t Fight or Trade Like This, or if you missed the last one, checkout The Blind Entry (How It Will Leave You Trading Blind)

I could agree about confirmations when trading in obvious s/r zones because those zones ar known in advance. I’m not so sceptical of confirmation when trading price action without obvious s/r levels because you cannot possibly tell where will the demand or supply be fromed. Maybe it’s predetermined or maybe a fundamental aspect shifts gives the push and the trend or goes ahead.

Hello AU,

Just because there isn’t an ‘obvious’ S/R level doesn’t mean you can’t read price action or the order flow behind it. You simply need to learn new skills to go beyond just obvious levels and 1-2 bar patterns.

Food for thought.

Thank you, Chris, for your comments. It is so true that switching to thinking in probabilities is vital and my most difficult challenge! I am so wired to work with certainties and verifications in life, that when it comes to trading, these habits die hard.

Hi Chris,

I definitely see that your approach has an advantage over trading the pinbar, especially if you can read PA to help you spot the reversal levels.

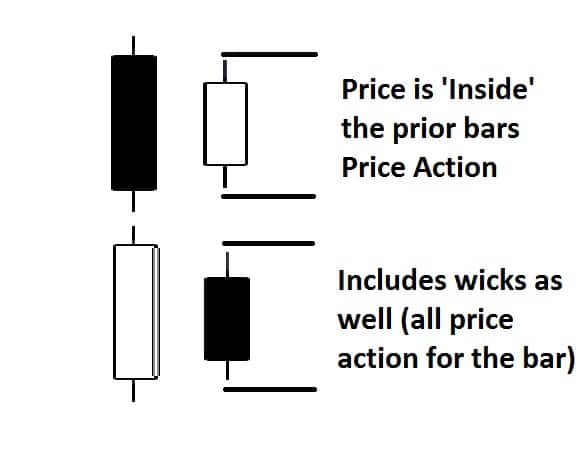

However I am not clear on one point. Let us say that a pin bar does form at a level where you have entered a level early per your video above. Now as you know, a good pin bar is expected to have a long tail, the more protrusion beyond a level and more rejection, the better. We never know how long the tail will be before hand and it could easily take out your stop on the early entry and then come all the way back below the level, to close , as a tradeable pin bar.

With your method, you have just lost a trade, that could be winning trade, for a pin bar trader, no? Do you have a plan B in your arsenal to address this situation?

Thanks,

As a pin bar trader, I definitely see

Hello Kailash,

This scenario you describe has way too many assumptions to say anything with certainty.

First off, S/R ‘level’s are not lines in the sand, but ‘zones’ of order flow where institutions get in.

Secondly, of course we can never know how long a rejection will be in any bar, whether it be an eventual pin bar or not. This part is irrelevant because any description of this is vague and hypothetical at best, hence not something I can answer with that much vagueness.

Also your scenario assumes my stop is taken out, when in fact it may not. When it doesn’t, I’m getting way better +R for trade that would more than make up for any winners the retail pin bar entry would give you.

As to plan B, there is always a plan B (or if/then scenario), but again, with a situation this vague, it’s really pure speculation in describing it.

What is interesting to know is you mention ‘know’ in terms of the sentence ‘will never know how long the tail will be’.

Trading isn’t about ‘knowing’, it’s about trading and thinking in probabilities.

Food for thought.

Kind Regards,

Chris Capre

Excellent video. You’re right about candle patterns. My A Ha moment was when you said ” They come in many names, such as pin bars, inside bars, fakey/false break setups, or engulfing bars. ” I was watching and listening to another speaker who not only agrees with you; he believes candle patterns make it harder to trade and make a profit. Again great video

Gp

Hola GP,

Yes…you’ll find many traders who aren’t using cookie cutter setups notice how candlestick or 1-2 bar price action patterns reduce profitability and accuracy, so glad you noticed.

Once traders make the shift, they see a huge difference in their performance.

Kind Regards,

Chris Capre

So in this trade example I presume you would look to close at the next support / major support level?

Ok. So what your saying is, that once price hits a level/major level (daily) and if this level shows that in the past it has held then we should place an order on a reversal? Or if it breaks through the level and re-retests that level we should place an order that is in step with the direction of the market?? NO TRADE SIGNAL?

Hello Robert,

That is not how I’describe what I’m saying.

I’d suggest watching and going through the entire series again and fully digesting it because there is another key (critical) point being made here.

What I will say is what you understand to be a ‘trade signal’ is likely not the trade signal you think it is, that there is another trade signal well before the typical ‘trade signal’.

On top of this, what is commonly made out to be a ‘trade signal’ actually does not increase your edge, but diminishes it.

Hope this helps.

Kind Regards,

Chris Capre

Great video

Isn’t entering a trade after confirmation gives higher probability of success than this method? both entry techniques have pros and cons. But you only talked about pros.

Hello Jung,

No, it doesn’t give higher probability of success. Please share with me where you or any of it’s proponents can demonstrate with actual stats from a live acct that this type of entry increases accuracy?

I’m happy to have the best students of such ‘confirmation’ setups compare their stats with my best students and see who has the far greater edge. I’ll take that bet any day.

The bottom line is entering after confirmation doesn’t give you a higher probability of success. Even those who use it claim only 30-50% accuracy in their own trading. That’s not an increase in accuracy or probability. That’s the same at best.

Because of that, it’s edge is lower.

On top of this, you’ll miss hitting certain targets because the entry is much worse, which means a losing trade, and thus decreasing accuracy.

So not only does it reduce your edge in terms of profits, but it lowers your accuracy.

Hence there are no real ‘pros’ to the ‘confirmation’ myth. Only cons.

If you really believe in ‘confirmation’ giving you a higher probability – try the litmus test:

Walk into 3 prop firms, hedge funds and banks and ask them the following two questions:

#1: Do you not take this trade because there is no confirmation pin bar?

#2: Are you going to load up more because there is a confirmation daily pin bar?

I’m quite confident you’ll get a big ‘NO’ for an answer, let alone people laughing at you.

But go ahead and take the litmus test. I’m guessing it will be 3 lifetimes before you get anyone who says ‘yes’ to both.

That should answer your question for you.

Kind Regards,

Chris Capre

Hi Chris, Great video!

Thank you for all these valuable lessons

Oh snap! Did I hear a burn on Nial Fuller there? I didn’t know there were FX wars! So classic.

You said, “So I got in at 1.4875 ” You meant So I got in at 1.4975 right?

@Greg,

Thanks for the heads up…yes…as per the chart 1.4975.

Kind Regards,

Chris Capre

This is just another trading method and like price action with confirmatiom candles, it’s up to the trader to stay focused and manage the trade. If this is done properly, any method can be very profitable.

Hello Thomas,

If any method could be profitable, it would have been done right now. Some methods don’t have an edge, and that can be demonstrated quantitatively.

Yes, this is a method with price action, but there is no ‘confirmation’ via candles or 1-2 bar patterns, which this video clearly shows the difference in the edge and profitability.

And even if it were true that ‘any method could be profitable’, there is a huge difference between one having a 2% edge over 3 years and another have 100%.

So the point is rather mute.

But thanks for sharing.

Kind Regards,

Chris Capre

Love it love love it. Here is my take. Price enters a resistance zone you sell. Price breaks the resistance zone wait for a pullback and you buy. If it’s a false break you sell again. Wash rinse and repeat. ( the inverse is applied if price enters a support zone.) Use this with appropriate stops and that’s your “Holy Grail” in my book. Trading from S/R zones and using impulsive vs. corrective is where the “Holy Grail” is at. Most people just don’t know it yet hehehehe.

Hola Andrew,

Yes, most people don’t know this yet because of the narrative that has been spun around price action.

Hopefully this changes the conversation.

Kind Regards,

Chris Capre