With the US, Asia and Europe making serious efforts to quickly move towards a carbon-neutral future, many companies around the globe are fighting to grab a piece of the fast growing clean-energy market.

One of these companies is Plug Power (Nasdaq: PLUG) which focuses on alternative energy technology such as hydrogen and fuel cell systems.

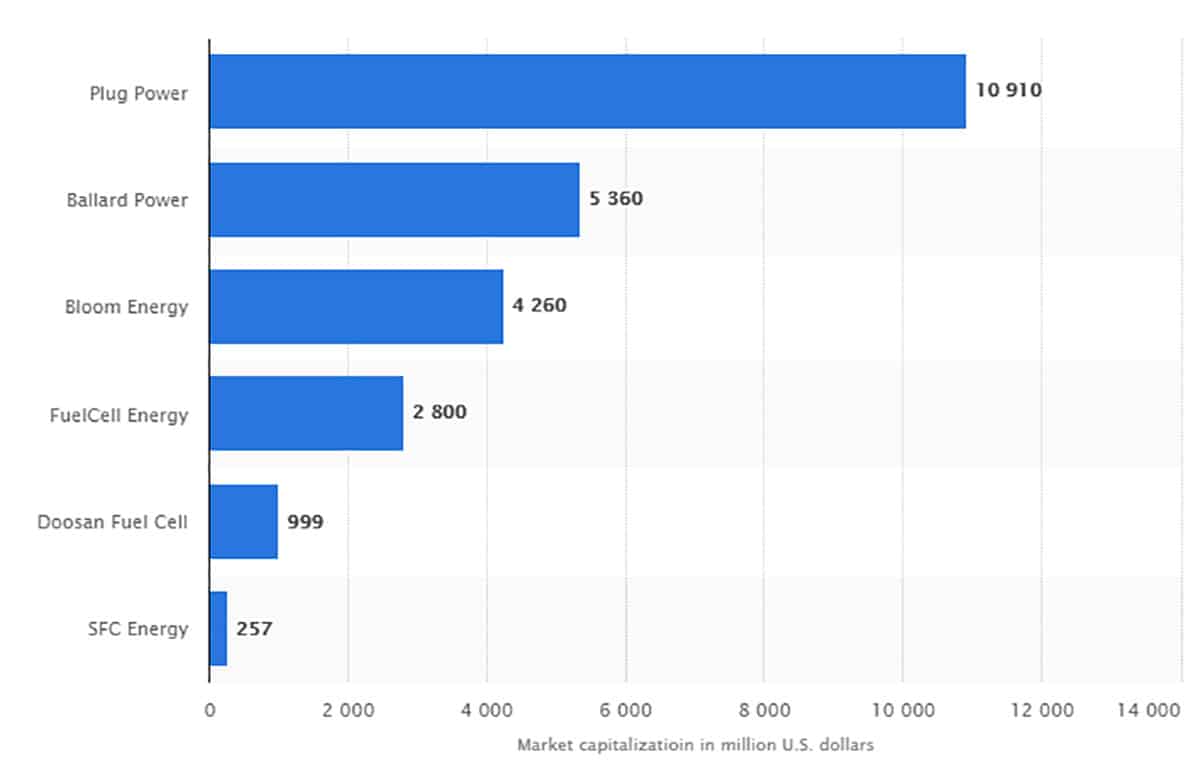

The company is a big player in the field and the global market leader looking at market capitalization.

(Source: Statista)

The bull thesis for Plug Power is very similar to that of most clean-energy companies which is the clear shift away from combustible-engine vehicles globally, a trend that is accelerating and likely wont slow down anytime soon.

Plug Power also has presented a bunch of good news recently, such as a $1.6 billion investment from SK group, raising over $2 billion in a bought-deal offering, a joint-venture with Renault, and more.

However, it’s important to note that the clean energy and EV stock company does still face significant risks, something that potential investors need to be aware of:

1) Profit – The company has been burning cash for more than two decades and presented a $99.6 million loss in its Q2 earnings report. The company yet must present how it plans to how it’s products can be sold profitably in the near future.

2) Adoption – Whilst hydrogen is an environmentally friendly fuel, it does have multiple downsides compared to other energy sources which has limited the adoption so far, a trend that might persist. To mention a few, hydrogen production is very expensive, storage and transportation can be dangerous and it’s still dependent upon fossil fuels such as natural gas.

In conclusion, we think that PLUG is a very attractive investment if all of the company’s plans come to fruition and global adoption can pick up thanks to the strong push globally towards clean energy. But for now, due to the risks mentioned above, we think investing in this stock is reserved for aggressive investors with a high level of conviction only.

If you’re a conservative investor and prefer to quantify the risk on your investments, Plug Power likely isn’t the stock for you.

Technical Analysis

The stock of PLUG took a heavy beating early this year, losing up to 75% of it’s value within a couple of months. Since, the stock has recovered slightly and is down 65% YTD.

Price did find solid support between $18.5-$22 from which it trading higher, a move which now is followed by a corrective pullback back towards this support zone.

We think this support zone, based on the price action, is a solid area for aggressive investors with a strong conviction in the company to look potential buy opportunities.

Option Positioning

Currently there are about 615K call and 511K puts out there in PLUG. About 60% of those options are expiring this Friday, so am expecting more headwinds for the stock. Option positioning suggests support coming in between $15-20.

FULL DISCLOSURE: Chris Capre currently has no stock or option position in PLUG. If you’d like to learn more about Chris’s trades and positions, you can get access via the Trading Masterclass where he shares his live trades, further investment ideas and daily market analysis.