This growth stock has made its fortunes from the treatments of oncology patients. Its flagship product, Cabozantinib, treats metastatic medullary thyroid cancer, hepatocellular carcinoma, and advanced renal cell carcinoma (RCC). We’re talking about Exelixis, Inc. (Nasdaq: EXEL).

Source: Chokniti Khongchum

This same product has remained a growth driver for the company going forward. The U.S. Food and Drug Administration (FDA) approved the use of Cabozantinib in combination with Nivolumab, a high-performing drug from Bristol Myers, to fight advanced RCC. This exposes the EXEL stock to more growth opportunities.

Exelixis isn’t just depending on Cabozantinib to drive its growth, however. It has lined up several pipeline products that have the potential to boost the company stock should they make it to the market. XB002, for instance, is one of these pipeline products, and the FDA has approved its Phase 1 trial to treat Advanced Solid Tumors.

What do Exelixis’ figures look like?

Total revenues for Q2 FY 21 soared to $385.2 million by 48% year on year. This growth had so much to do with the increase in sales of the powerful combination of Cabometyx (cabozantinib) and OPDIVO (nivolumab). We expect the sales to increase going forward and maybe help the stock surpass its 2021 financial guidance of $1.3 billion in total revenues.

Source: Exelixis

We believe EXEL is a strong growth to invest in, even though it may have to squabble for patients with Afinitor and Sutent for its flagship product in the US. There are only about 14,000 patients in the U.S. However, Exelixis has other promising projects that may offset this slight problem

Technical Analysis

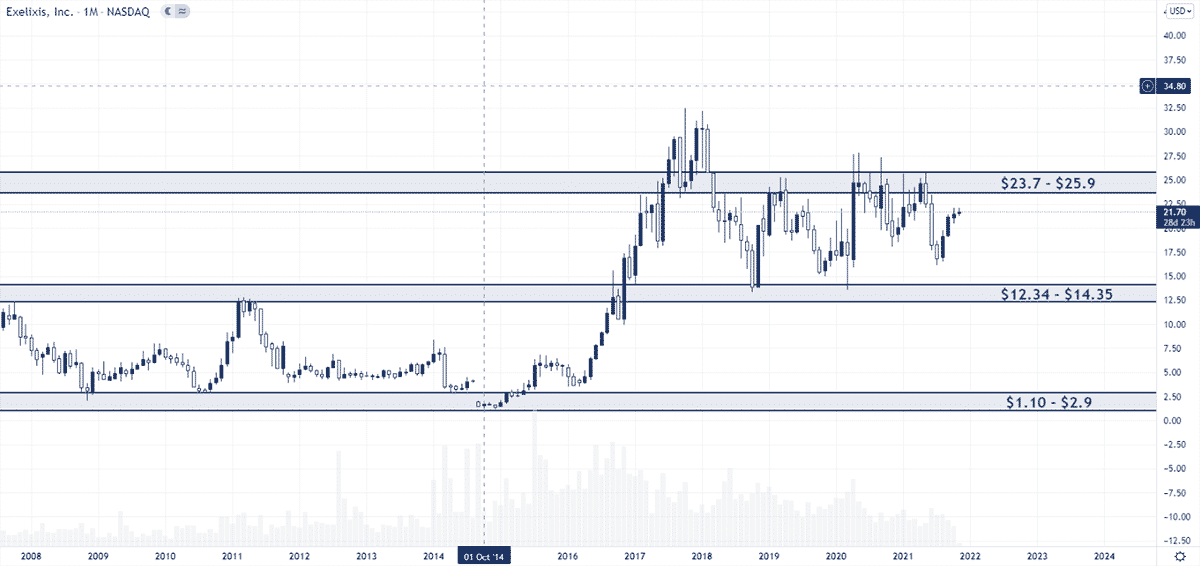

The only direction the EXEL stock has known for about two decades now is sideways. It remained in a consolidation it started in 2003 between the $1.10 – $2.9 support and $12.34 – $14.35 resistance levels. When it finally broke out of the resistance level in 2016, it only came back to get stuck in between this new support level (the previous resistance level) and a new $23.7 – $25.9 resistance level.

The stock now approaches this resilient resistance level that once again, having failed to break it after multiple trials. We’ll see how this attempt goes, but we currently don’t have many reasons to believe it will break it this time.

How then do you trade such a stock? You simply await a breakout or a return to the support level, whichever comes first. This places our Buy levels at slightly above the $12.34 – $14.35 support level price level or somewhere above the $23.7 – $25.9 resistance level.

Option Positioning

$EXEL is not a heavy volume option trading stock with only 27K calls and 14K put options out there, so our data points will only have so much ‘robustness’ to them.

With that being said, 61% of those options are expiring this Nov op-ex (19th) so we may have some headwinds lurking as we get closer to that date.

Option positioning suggests support around the $15 range.

FULL DISCLOSURE: Chris Capre currently has pending orders in $EXEL. If you’d like to learn more about Chris’s trades and positions, you can get access via the Trading Masterclass where he shares his live trades, further investment ideas and daily market analysis.

Or you can get access to Chris Capre’s entire trading portfolio by becoming a subscriber to Benji Factory.