Digital advertising has long taken over from where traditional advertising methods seemed to have peaked. Our smartphones and personal computers have now become what billboards, prints, radios, and TVs of those days were to advertising. And it is in this new dispensation of advertising that Pubmatic, Inc. (Nasdaq: PUBM) makes its living.

Source: Mikael Blomkvist

The Million-Dollar Question

Pubmatic owns a cloud infrastructure that automatically connects potential advertisers to ad spot owners (content creators). This way, content creators can get the best price for their ad spots. Soon after it went public in December, Pubmatic soared by over 200% to $77. However, the stock has returned to a more humble $38. But is there more to this stock than the spike in price?

The Case For Pubmatic

The financial reports Pubmatic has been dishing in the recent quarters have been nothing short of being impressive. In its most recent quarter, Q3 FY21, the adtech company raked in $58 million in revenue and $13.5 million in GAAP net income. The former was a 54% increase year-on-year, making it the fourth consecutive year the company would make 50%+ year-on-year growth in revenue.

Source: Pubmatic

For small companies, gaining customers may be an issue. But it doesn’t seem Pubmatic has such problems. With a net dollar-based retention rate of 157%, Pubmatic has not only succeeded in getting new customers, but it has also given them reasons to spend more in their second year of dealing with the company.

The digital advertising market where Pubmatic dwells is touted to be a gigantic one in the coming years. In 2020 alone, the spending in the industry summed up to $378.16 billion, according to Statista. And by 2023, this figure is estimated to have risen by 71% to $646 billion by 2024. Although Pubmatic faces fierce competition in Magnite, the company has a larger room to grow than its opposition judging by the market cap.

With those strong figures in financial reports, customer retention rate, and market opportunity, it isn’t hard to see why many investors favor this stock.

Technical Analysis

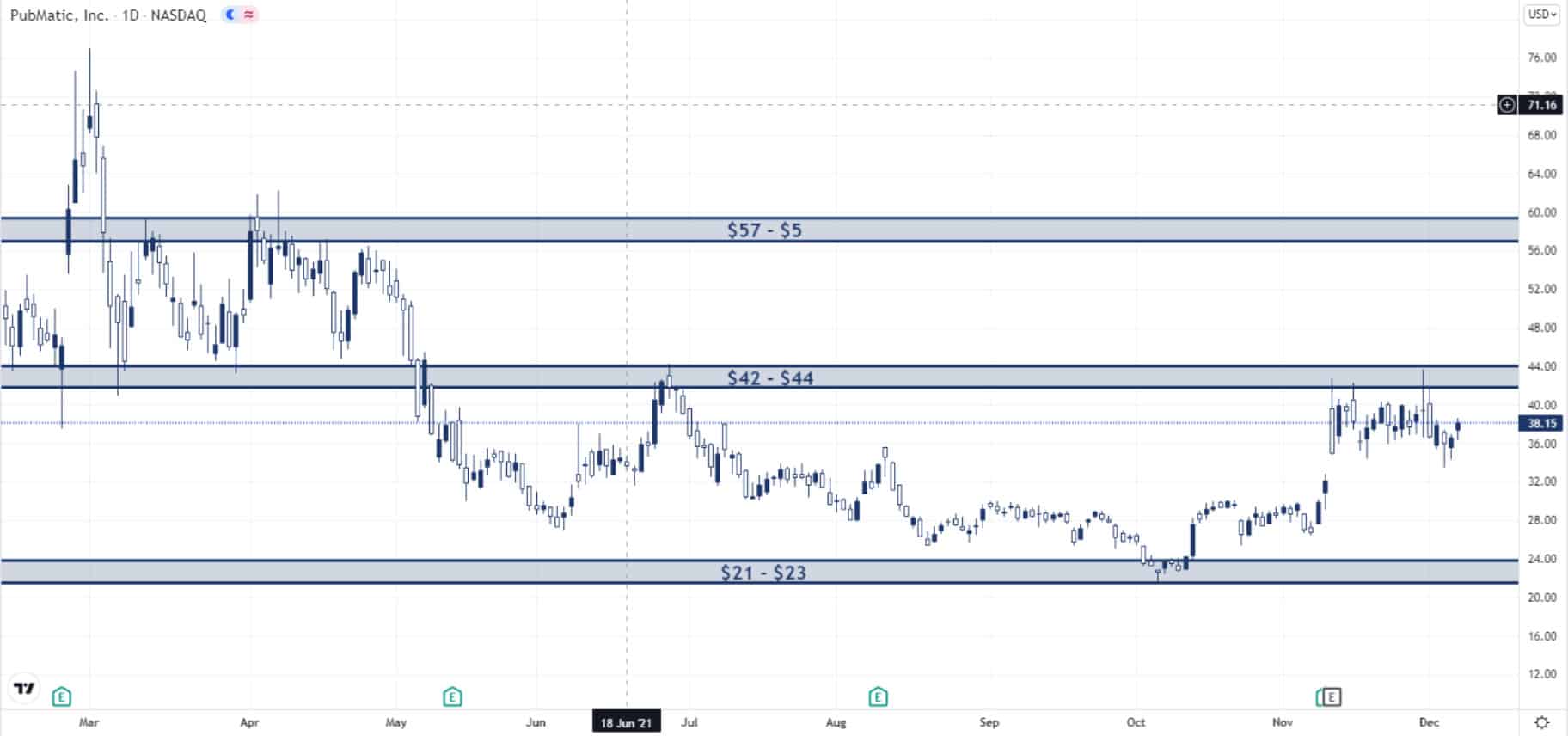

Having been on the volatile side for the first 6 months after it went public last December, PUBM has been rather uninteresting for most of the remaining 6 months. All its price movements were within the $21 – $23 support and $42 – $44 resistance levels.

It is closer now to the resistance level than it is to the support level, looking to orchestrate a breakout. If this breakout is successful, it could see the stock rise by 50% to the $57 – $59 resistance level. Otherwise, the price may return to the $21 – $23 support level. Technically, the return to this support level or the breakout from the resistance level would make good position entry points for Pubmatic.