Regardless of how high inflation is or what economic conditions we find ourselves in, some stocks are always going to be safe havens. While business may sometimes seem slow for these companies, you can bank on them 9 times out of 10. One such stock is Easterly Government Properties (NYSE: DEA).

Source: Michael

Easterly Government Properties is a Real Estate Investment Trust (REIT) that acquires and develops properties and then leases them to the United States government. And that is exactly why we believe Easterly is one of the safest stocks there are. What other way is there to guarantee your safety if it isn’t by having the government itself as one of your customers?

Being a REIT, DEA does well for its shareholders with a dividend yield of 5% and a payout ratio of 71%. While this payout ratio is high enough to scare off anyone from any other company, this one is just characteristic of a REIT. Also, the company has enough earnings from business to keep up with this high payout ratio.

In the fiscal year ending in 2021, DEA received $124.2 million in funds from operations (FFO), and a net income of $34 million. In that same year, it acquired 12 properties at $412.3 million. What these figures mean is that the company has a solid financial base and is expanding its business.

Also, DEA has been keeping its tenant, dear Uncle Sam happy, with a very meager 2.4% as the total annualized lease income expiring.

The only issue with this SWAN stock is that it has no staggering growth potential. The stock price can be stuck within the same range for years. But the good thing about this is that you don’t have to worry about volatility. You also don’t even have to worry about buying cheap because the stock may not be significantly cheaper than it is in the next few years.

Technical Analysis

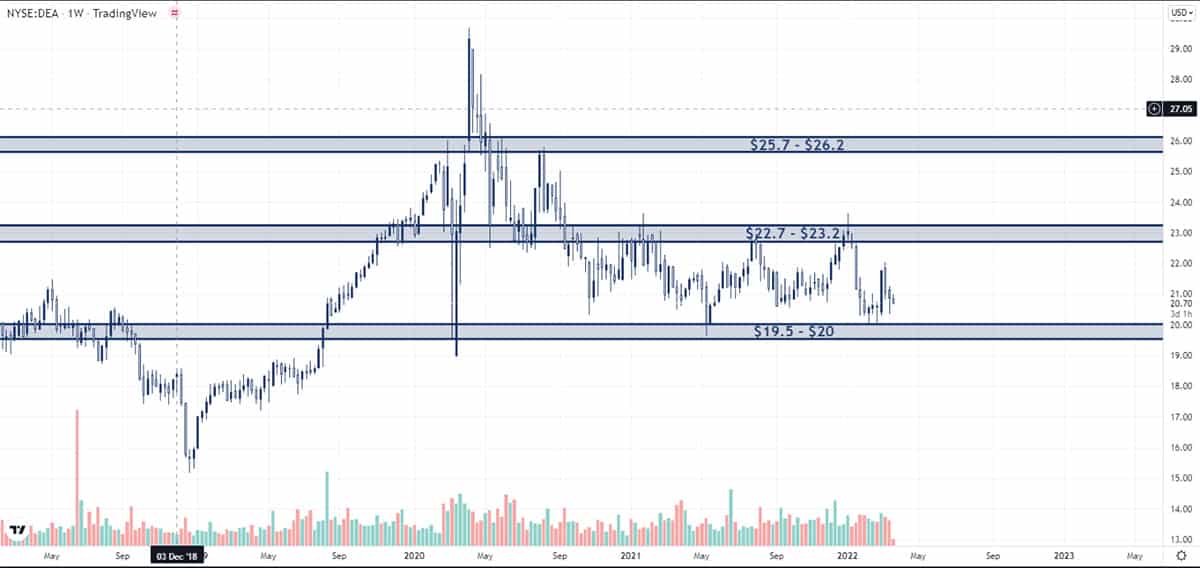

Since the DEA stock saw a kind of see-saw pattern in 2020, it has since settled in between the $19.5 – $20 support level and the $22.7 – $23.2 resistance level. There aren’t many signs that anything spectacular will happen to this stock. Another resistance level awaits the price at $25.7 – $26.2 in case the bulls are inspired. Otherwise, we expect the price to continue to consolidate for a while.