The biotech industry is one that’ll continue to be profitable for as long as sickness and diseases exist. Sad, but true. But not all biotech companies are worth observing. Seagen Inc. (Nasdaq: SGEN) isn’t one of them.

Seagen is a biotech company that is known for the research and development, manufacturing, and commercialization of transformative oncology medicines. The company has had Adcetris, Hodgkin lymphoma medicine on the market for a while, and it generates most of its revenue from this drug. Other drugs the biotech company took to market from 2019 till date include Padcev (for bladder cancer), Tukysa (for breast cancer), and Tivdak (for metastatic cervical cancer), and they’re all beginning to pull their weights.

Source: Anna Shvets

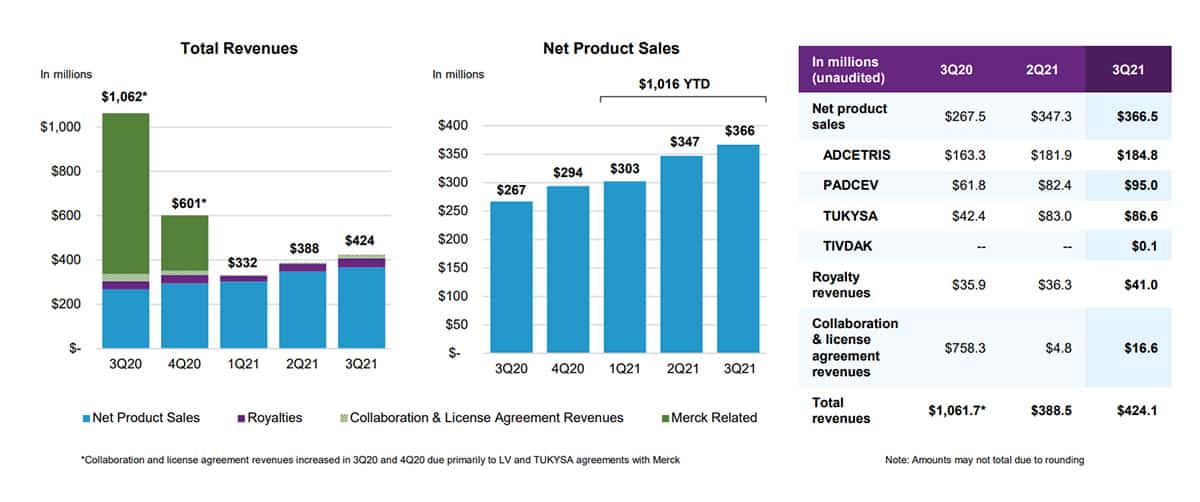

With these drugs on the market, Seagen could generate upwards of $1 billion in revenue from the beginning of FY ‘21 to the third quarter of the same FY year.. While Adcetris saw a 13% year-on-year increase by the end of Q3 FY 2021 to $184.8 million, Padcev and Tukysa contributed massive 54% and 106% respective growths in revenues. Total revenues for the quarter were up by 37% to $366 million.

But when looking to invest in a company, revenue figures alone are not enough to help you arrive at a decision. You need markers of potential future growth, and you would find Seagen’s in its pipeline drugs. Tisotumab vedotin and Ladiratuzumab vedotin are two pipeline medicines closest to the market, pending FDA approval. Tisotumab vedotin is aimed at recurrent cervical cancer while Ladiratuzumab vedotin is undergoing trials in the treatment of solid tumors. And if Ladiratuzumab vedotin makes it to the market, it may become a revenue magnet for the company, as it could be used to treat various cancers.

Source: Seagen

Profitability is yet a problem for Seagen, however. The biotech company lost $293.8 million in its most recent quarter, over three times what it lost the previous quarter. Seagen pins this huge increase in loss on R&D expenses. But on the positive, the company still has $2.4 billion in cash (without debt), so it has a wealth of cash to burn to support R&D expenses.

Technical Analysis

Seagen has not known a substantial upward or downward movement since 2020. Rather, it has been moving in a range between the $130 – $140 support level and the $199 – $208 resistance level.

As we speak, it is closer to the support level than it is to the resistance level, which could cause the stock to see an upside of about 30% if the bounce between these levels persists. However, we don’t expect the stock to consolidate forever. At some point, it’s going to force a breakout. And from where we stand, this potential breakout favors the bulls as the fundamentals of the stock are solid and long-term prospects look solid.

Although Seagen is not without its risks, many of which may anchor the price to lower price levels short term, we believe the prospects of the stock long-term are more promising. A sentiment we share for this biotech stock.