Changing tack a bit here, I’m going to be covering a losing trade forex management analysis here to give you an idea about price action, trade management and what I learned from this trade.

In my weekly trade setups commentary, I covered the USDJPY which had just broken range resistance and the ‘big figure’ at 125, suggesting more bullish price action.

I trade more with trend vs. counter-trend and was definitely bullish on this pair, so looking to get long.

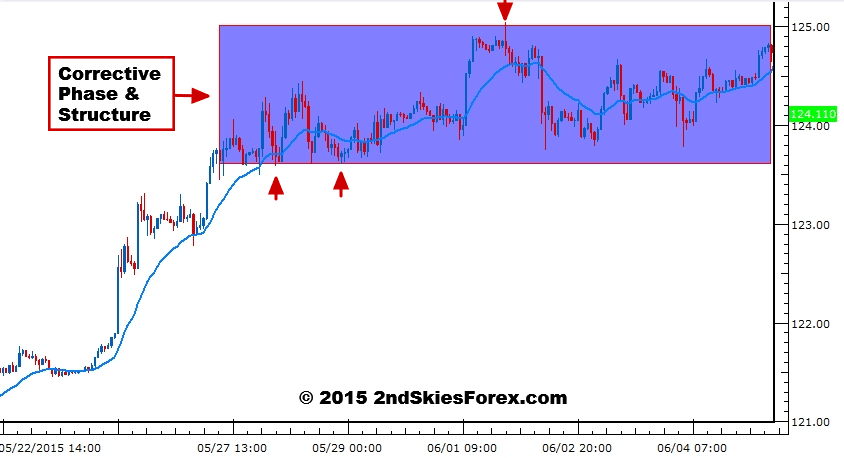

Below is a 1hr chart of the pair right before the breakout.

You can clearly see the uptrend movement starting from the bottom left of the chart, which eventually led to a corrective phase (blue box), or a period of balancing in the order flow.

Corrective phases at the top of a bull move and trend generally signal continuation, so was anticipating a breakout.

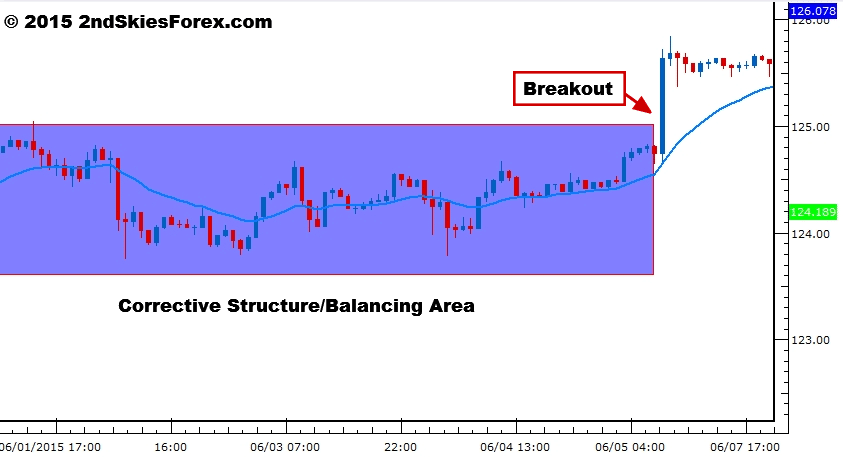

And the pair did just that, also forming an intra-day corrective phase at the highs (1hr chart below).

After this breakout, I was looking to buy on a pullback. I talked about my buy being in the support zone around 125.10 – 124.75 so this was my trade location.

I put a resting limit order at 124.81 with a 30 pip SL and target around 126.60 for a potential +6R. If my idea is correct, we should minimally get a bounce towards the recent breakout highs.

My reasoning was as follows:

1) Price Action Context = Bull Trend, Impulsive Breakout, Volatile Trend

2) Corrective Phase led to breakout = Strong Bull + Factor

3) Balancing area was clearly defined = Strong + Factor

4) Looking to buy on a pullback into top of balancing area/corrective structure

If all the above is correct and the bulls are in control, they should maintain the breakout and will want to defend any pullbacks, along with potentially adding to their position.

Breaking back into the corrective structure would be a sign of weakness on their part, so I do not want to be long if we break past the upper area of the zone.

Hence this would invalidate my idea, and thus determined my SL location.

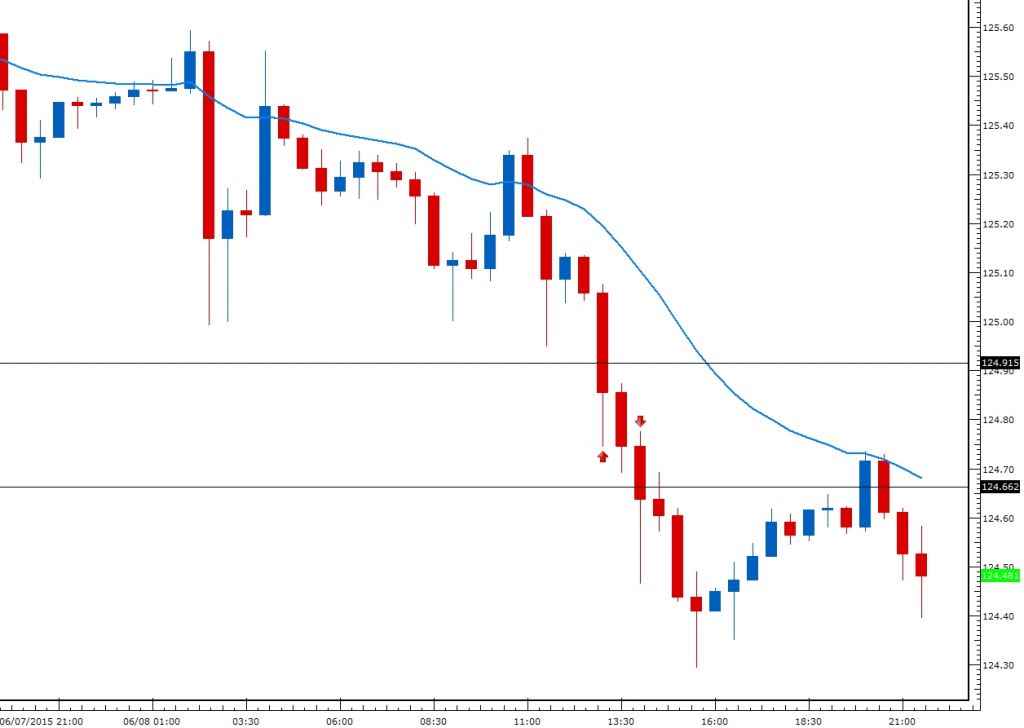

As you know, the trade resulted in a loss (see chart below).

However, I did not take the full loss as I exited early for about half my original SL.

Why?

I was managing the trade in real time. If I had used a pure set and forget style trading, this would have resulted in a full -1R.

Instead it was a -.5R.

Now this may seem like a small deal only saving .5R, but over 100+ losses, this could result in a +50R to my bottom line!

I don’t expect each trade I manage personally (or exit early) to be the right decision every time.

Ever heard the old adage from professional traders ‘let your winners run and cut your losses quickly‘?

Does that sound like they are using the ‘set-and-forget’ method to manage their trades? I don’t think so, and neither should you.

Regardless, in managing my trades actively, I do not expect each time for it to be the right decision.

What I do expect is that overall I will have a positive expectancy in managing my losses (and winners). I expect with my trades that letting them ride to the set and forget SL or TP will not be as profitable or provide a greater edge vs. managing my trades.

Before I get into that further, let’s get back to the trade, show you what I was thinking, and why I exited the trade early.

Below is the 15m chart the candle before my actual entry, along with my trade location (entry) and my SL.

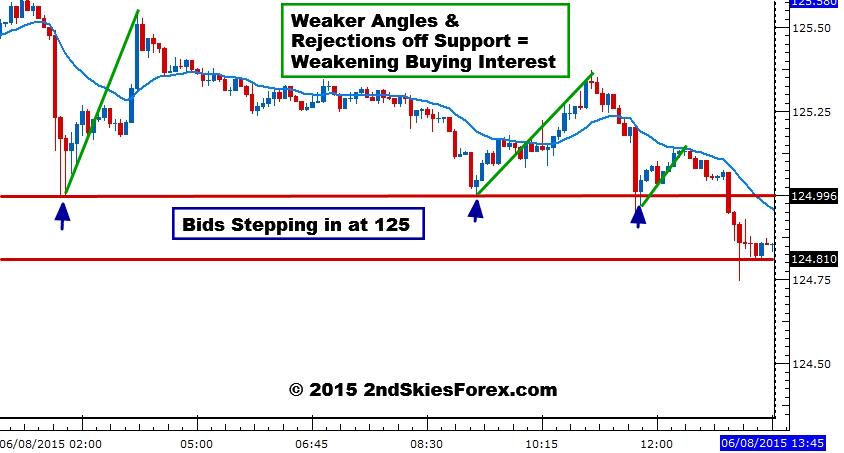

Now look at the 5m chart below and you’ll notice some greater detail on how the price action was reacting to the support zone.

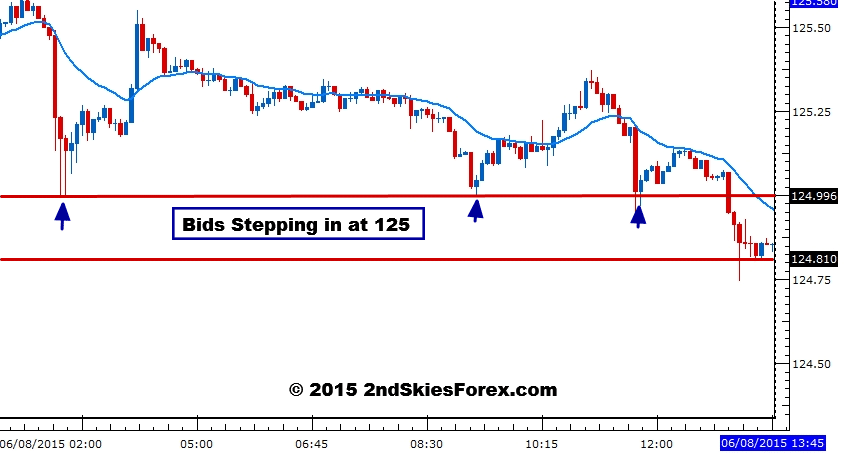

You can see there were 3 touches/bounces off 125 (blue arrows) showing where the bids were coming in.

However, you’ll also notice something else (see chart below).

Each reaction off the level is getting weaker.

This suggests the bears are pushing back the bulls and forcing them out of the market. The faster players are realizing this and getting out before it breaks.

I’ve talked about the importance of price action angles and how the PA is reacting to a level based on the angle it makes.

This is indicative of the underlying order flow, denoting the strength (or weakness) of the bids/offers in the market and around the level.

My original instincts were to just get out before the trade activated. I wasn’t totally feeling on my game yesterday, so was definitely slow to respond.

Shortly after my trade opened, there was a small consolidation (middle right side of chart above) which was also showing weakness.

Once the breakdown happened from there, I was out. If I was following my instincts, I would have either a) never been in this trade or b) exited early.

An off day mentally and it showed in my trade management.

Learning From Each Trade

Regardless, I learned something from it, and my philosophy regarding trading is either I win and learn, I lose and learn, or a I fail to learn.

The first two are wins to me because I learn something each time which translates into a greater edge and profits over time.

The last one is the real failure (and loss) IMO as there is something to learn (either about price action or my mental execution and mindset).

But this brings me to another key point.

Why Set And Forget Is Not Ideal or A One Size Fits All

Set and forget is one style of ‘forex trade management‘ and there are many trade management options available, all on sliding scale between passive and active.

If I’m a set and forget trader, and targeting a typical +2R, yet I can see the market is mostly likely to run for a +6, +8 or +10R, why would I just ‘forget’ about that?

Why would I not maximize my edge at every turn? Does a professional poker player just say ‘I only want to make x amount on this hand and that’s it‘?

Of course not – they want to maximize their gains from every single hand.

This is why stating the set and forget method is the be all end all of forex trade management tactics is a freshman idea.

There are a few instances I recommend trading the set and forget style of trade management (limited circumstances).

But I do not recommend it as a resting point or long term method.

You’ll limit your upside on runners, take full losses when you shouldn’t, and decrease your feedback loop over time.

It is true that managing a trade in real time takes more skill, psychological confidence and mental strength vs. the set and forget approach.

But that doesn’t mean we should avoid such a skill, venture or challenge.

Why put limits on your upside growth and performance? No elite performer does this.

What I do recommend is starting off with a set and forget style forex trade management strategy.

But once you’ve built up your skills of reading price action context in real time, then it’s time to move onto trade management methods which allow you to take advantage of long running trends.

Want to Build Up Your Price Action Skills?

My Price Action Course is specifically designed to help you build up your price action skills so you can learn when to stay in a trade, let it run for a large profit, or exit for a small loss.

This course is skill-based, meaning we teach you the core price action skills from the ground up. These can be used on any instrument, time frame or environment, and is the core skills I am always trading my live money with.

Did you find this forex trade management strategy article useful?

What style of forex trade management do you use, and have you ever wished you could learn when to cut your losses early and let your winners run?

As always, I want to hear from you on this one.

Thank you for reading this important post, and please do forward this to anyone you think can benefit from it.

Hi Chris, thanks for sharing. I agree with what you are saying but there are several other details to look into : a) why are you going long when PA is below your 5 or 8 EMA, n) why are you not concern with the swing low and the time cycle but only concentrate on swing high to go long, c) do you have a timed-out candles rule? Thank you. best regards. Kim

Hello Kim,

There are always ‘other details’ to look into, however one has to choose which ones are a part of their method and approach.

I don’t use the 5/8 ema. I also don’t concentrate on ‘time cycles’. And I do not have a ‘timed out candles’ rule. I have a price action basis for managing positions.

Hopefully this clarifies things further.

beautiful

thx chris

Glad you enjoyed it Shay.

Thanks, Chris.

your article is a helpful read as it puts in the appropriate perspective the reason why trading needs full commitment. Trading is neither gambling, nor a hobby: it is made professionally or it is not trading. What this all means in terms of mindset, you are better than me at explaining. I am only a dedicated apprentice.

Thanks,

Luigi

Hello Luigi,

Yes, it is not a hobby – if it is, it’s something different.

Trading is a profession and needs to be approached as such.

But good to have you on as an apprentice.

Kind Regards,

Chris Capre

Like your explanation on trade Price action reaction wise. Nice to learn the skills.

Hello Sanjay,

Glad you found the explanation of price action and trade management useful as these are important skills.

Kind Regards,

Chris Capre

Very helpful article for me. Unfortunately, I don’t yet possess the tech to manage my trades full time: I still have to work. I have been in a demo account for 1.5 yrs and I am still struggling for reasons your articles underscore. I will attempt to manage more actively when I can and learn from it. Thanks

Hello Tabb,

The skills to manage trades can be learned over time. Just have to build up the base skills and wiring.

Kind Regards,

Chris Capre

Excellent article Chris .I was in the same trade and lost 1R .By the way I am learning discipline

Thanks for your coaching

The discipline is something to be built and learnt but is useful and helpful in situations like this as it can increase your edge over time.

Kind Regards,

Chris Capre

Great article Chris, thx a lot.

Thanks Roger – appreciated.

This article demonstrates perfectly the immense power of smaller timeframes. If only you had seen it sooner.. Anyways, your trade analysis does show a great deal of lucidity from which everyone of us can learn i guess. Very useful post ! Thank you very much !

Hello Simon,

Yes, it shows the power of using a multi-time frame analysis and not buying into the false idea that lower TFs are just noise.

They are information and a different perspective – just a different lens into PA – that is all.

So glad you noticed.

Kind Regards,

Chris Capre

Excellent article, Chris. Alongside a system that has a positive expectancy, trade management is key. Not too many talk about it, but I’m glad you decided to with an insightful article. Using the UJ trade as an example was a nice touch.

Correct – not many talk about trade management – they try and teach a one-size-fits-all approach, all based on fear that we cannot learn the discipline to manage our trades.

Kind Regards,

Chris Capre

Great and useful article, Chris!

Thanks amigo – much appreciated.

Thanks for this article Chris. For years I have been using set and forget. My targets were always limited to 100pips. And I take full losses most times if a trade goes against me. Time to rethink all of this. Thanks again.

You have enough training now to learn the trade management skills, so would start moving into this slowly but surely.