Have you ever asked yourself why you close winning trades and take profits too early, but let your losses run to the full stop? Have you ever wondered why you feel the tension, emotion and desire to close your winning trades too early before hitting your take profit level – even though the trade is already in profit and moving favorably for you?

Today I am going to tell you the answer.

There is an underlying forex trading psychology explanation for this, which actually goes beyond your emotions, trading history or experience. It is always present, yet is like your shadow – always close following you, but not something you can pin down. Every time you are in a winning trade, you seem to experience this want to close the trade early.

You may have prepared mentally for your trading day, yet you still experience this desire to close your position early. You’ve heard the saying, ‘nobody every goes broke taking profits‘, which is completely false as demonstrated here.

You’ve told yourself hundreds and hundreds of times you’d never close your winning trade again early. That you’d hold the trade till your take profit level. Yet more often than not (despite your best intentions), still close the position early.

Why?

You’ve asked yourself this question dozens of times before. You’ve created rules for your systems, written out a trading plan, put post-it notes on your monitors, yet you still do this.

Why?

There is one reason which has been present with you since your first trade, and is there right now which I’m going to tell you about.

And the answer is a biological one.

From an evolutionary perspective, we were not built to be traders. We are biologically wired in our brains NOT to be successful traders. This is one of the main reasons why so many traders fail. To have a successful trading mindset, we have to actually UNDO millions of years of wiring and evolution.

Biologically Wired to Not Trade Successfully

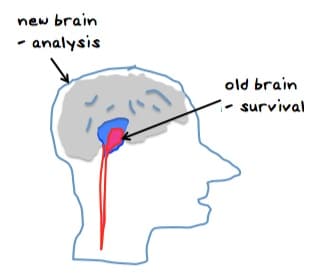

Our brain has gone through several evolutions which helped us to adapt to our environment. We have our older brain, which is referred to as our ‘reptilian’ (or lizard) brain. Our ‘limbic brain’ sits right on top of our reptilian brain & brain stem (where we send signals to the rest of our body).

It’s actually a brilliant design, because if we need to get the F-out of dodge (i.e. are running from a Lion that wants to eat us), it helps us send a quick signal through our body to fight or run. This is known as our ‘fight or flight’ mechanism, and it’s hard wired into all of us.

Now keep in mind, this system can react in less than a second activating all kinds of hormones giving us the feeling we will be in a fight to the death, or need to run in panic mode. It can control our emotions, fears and thoughts in the blink of an eye.

Unfortunately, it causes us to make quick and rash decisions, which in 99% of all trading situations does not help.

To top it off, there is another portion of our brain which hurts our trading performance. It is a portion of our brain called the ‘amygdala’, which is biologically wired to see the negative in our environments more than the positive.

Why?

Because negative threats represent a greater danger to our survival than positive ones. It takes us about half a second to notice a threat, yet it takes several seconds for us to recognize something that is good for us.

And there you have it. This is the reason – this is why you take profits too early. Every threat and ‘negative’ piece of information on the chart tends to activate this ‘fight or flight’ response in us and a potential danger.

This leads us to register it as a ‘threat’ to our winning trade. When this happens, our brain will create a rush of hormones, thoughts and emotions which produce a tremendous impulse for us to close the trade early.

The trade may be following all your rules for entry, have a ton of positive factors supporting the trade, yet one negative candle against us – and we panic. We worry it will go negative. We fear it will turn into a loss, and we close the trade early.

This is why so many traders fail and do not make money consistently. You are constantly fighting your biology and thousands of years of evolutionary wiring to trade consistently – to hold onto winning trades. We are swimming upstream against our biology to have a trading mindset that is geared towards success.

How Can You Change This?

Luckily, there is a way to change our forex trading psychology and the internal wiring we are all born with. There is a way to rebuild your neural connections to hold onto winning trades without the fear, worry or panic. There are ways to build new neural pathways to trade successfully.

We are building this program as we speak – to help you re-wire your brain for success, to rebuild your neural pathways. Instead of closing your trades early, you hold on till your full profit target for a large winner. Instead of making emotional trading decisions, you are wired for successful trading.

We have already created one program for this via our ERT training, which many traders have already taken, and are noticing huge changes – both in their trading, and in their lives.

The second program for this will be announced shortly with the same goal – to re-wire your brains for successful trading.

19 thoughts on “Why We Close Winning Trades Early”

Comments are closed.

Chris,

I like to think of it this way:

When you’re in the jungle, and you don’t win, you don’t get to eat today.

When you’re in the jungle, and you lose, you get eaten today.

Ray

Interesting Article!

Another option is to take partial profits as the trade moves in the desired direction. This will take the pressure off wanting to totally exit and is also good for your account. How many times has a trade gotten close to your TP level, the reversed to your SL. Taking patial profits along the way and sometimes also moving the entry to BE (if safe to do so) are good ways to trade and doesn’t need the help of a neurologist or deep brain analysis!

Hello Frank,

So what you are offering here is a ‘conceptual’ solution to a problem that is biological, and built into our nervous system. It’s one thing to build a conceptual idea of how to do it, but our biology and chemistry can be quite powerful in affecting our behavior. The goal of this article is to a) make traders aware of it, and b) offer solutions to deal with it beyond a purely conceptual suggestion.

It’s one thing to say, ‘take partial profits as the trade moves in the desired direction’, but this could be playing exactly into the biology of what I was talking about in the article. So it’s not just as simply as applying a conceptual idea.

This is why I cover what I do in the article, but I appreciate your comments.

Kind Regards,

Chris Capre

thanks again chris

i think you are not only a trader , but more than that , you are a perfect psychologist and

Neurologist.

majid

Hello Majid,

Thanks for the positive comments. Hopefully I can have an impact on the field of trading psychology and mindset as well.

Kind Regards,

Chris Capre

Very interesting article. This is something I have to fight against frequently. It is especially difficult if the trade initially goes into some profit and then heads back to BE or negative territory. If I allow myself to watch the trade and I see if losing profitability, I do hear that voice telling me to take some profit.

Steve

Hello Steve,

You are not the only one whose had to fight against this as it takes some time to unlearn and re-wire. But you definitely can and we teach methods in the course to build your mind to deal with this.

Looking forward to working with you in the course.

Kind Regards,

Chris Capre

Fantastic information. Thanks Chris

Hello Brandon,

Glad you found it useful.

Kind Regards,

Chris Capre

Hello Tua,

That is what I’m hoping to do – provide unique quality on forex trading and a successful trading mindset, so hopefully I accomplished this here.

Kind Regards,

Chris Capre

Hello Suresh,

Yes, ERT has helped many traders with this and several other trading issues, so looking forward to releasing it soon.

Kind Regards,

Chris Capre

Another good article.

Thanks Chris!

Hello Shane,

Glad you liked it.

Kind Regards,

Chris Capre

Hi Chris. Thanks for the biology/ psychology lesson! I think the most important thing as a trader is to have a trading plan written down, and stick to that no matter what. I usually have my target profit set before i enter any trade and i won’t change it after i am in the trade. Looking forward to know more about your ERT training.

Hello Kam,

Yes, having a trading plan written can be highly useful, but when we operate from the lower portions of our brain (lizard brain), those often go out the window, no matter what’s written down. This article was to talk about why this happens, and how we can avoid it (which is what the ERT training is for).

So keep an eye out as we’ll be bringing it out soon.

Kind Regards,

Chris Capre

This is a great article Chris. We cannot find similar ones on the internet and you have nicely addressed the common issue faced by the traders.

Hi Chris,

Very interesting article. Practically every bit you explained is true while in the trade.

It is great to know that ERT can help to solve the problem.

Thank you

Kind regards

Suresh

Hi Chris

great article .

No link to the ERT training where we can see what it invloves,time frame and cost.

Warm Regards

prem

Hello Premnath,

Email me via the Contact Page for details.

But glad you liked the article.

Kind Regards,

Chris Capre