Tell me if this trading situation below has happened to you before.

You’ve just had your largest loss ever (or big one), and you are feeling incredibly risk averse, almost to the point where nothing looks good to trade. With each new setup that comes, you find yourself still recalling that big loss and hesitate, or fail to pull the trigger.

This common experience amongst traders has a biological root, and most often creates a negative psychological effect on you. These biological and psychological causes can have a tremendous impact on your trading mindset, perhaps writing the future history for your trading career. The good thing is, your brain and trading future can be changed.

Biological Reactions to Stress in Trading

Losses no doubt can have an effect on your trader psychology, but also your biology and brain. Cumulative losses can create a huge increase in cortisol in your system. Too much cortisol over a long enough period can cause neurons to fire, where you can no longer concentrate effectively to make a good trading decision.

But take a huge loss, and now your brain is likely re-wired for more losses – minimally in a poor state for trading.

What Happens When You Take A Huge Loss?

There are two regions of the brain that work together in remembering stressful events. They are the ‘hippocampus‘ and ‘amygdala‘. We’ve actually talked about the amygdala and how it impacts your trading which you can read about here.

To clarify between the two, the hippocampus will record the factual details of the big trading loss, while the amygdala will encode the emotional significance of it. Both of these are affected by stress, which releases stress hormones that can heavily affect brain performance.

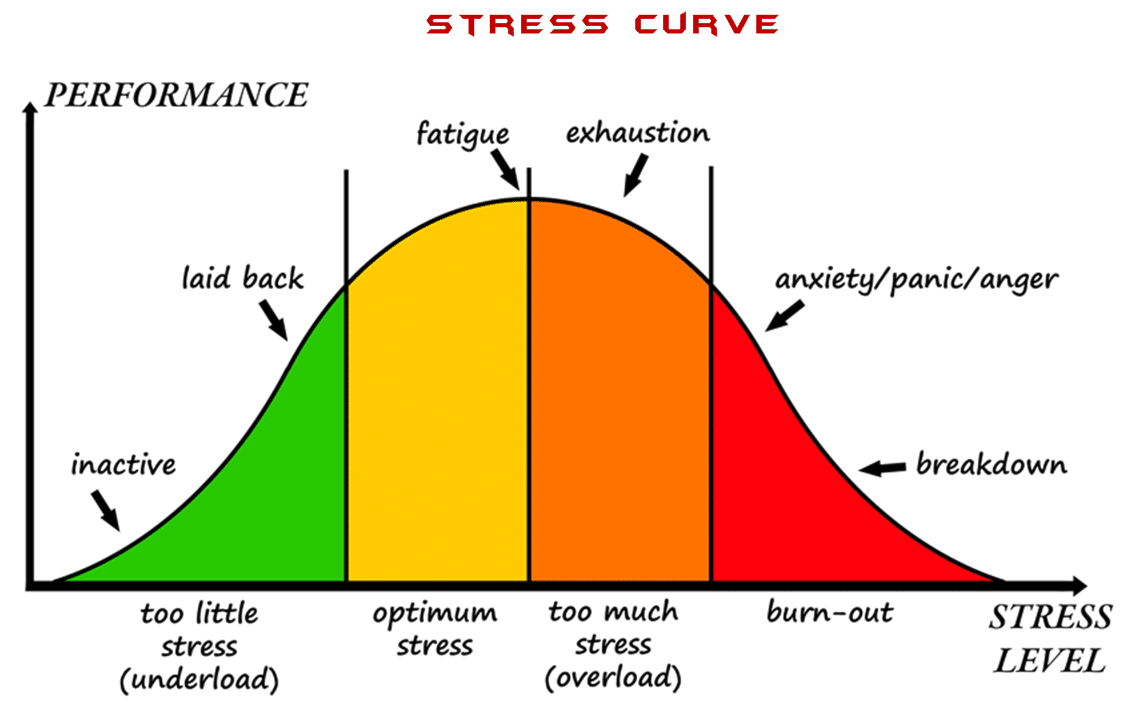

Now as stress and cortisol levels rise, with continued exposure, our tendency to recall any trading events stored during this neurological state increases.

For a really good graph about performance and a stress curve, see the graph below.

Getting back to the big loss, the experience becomes quite intense emotionally, almost as if it was burned into your brain. This is because of the intensity of those hormones present during this loss. This imprinting in your mind becomes corrosive to your trading, particularly your mindset.

You start to remember negative experiences, that may or may not have anything to do with trading. Just recalling these memories will affect your performance, but there are additional consequences.

Anytime you are analyzing the price action in real time and a new setup forms, you will with greater intensity, draw upon those negative feelings and memories, one of them being the big loss itself. This only makes you increasingly risk averse and afraid to lose, almost to an irrational level. This could happen despite a high-quality signal being right in front of you. In essence, you become paralyzed by this risk aversion, unable to pull the trigger.

Another scenario could be that you are ‘shell-shocked‘ from the trading loss, yet still are able to make a trade. Unfortunately, your trading decisions are totally off kilt. You think you see setups, and start making trades, only later to realize there was no price action setup at all. While reviewing your trades, you actually see now there was no pattern at all.

This is from a biological reaction to the stress you experienced. In some traders, without the proper tools, it becomes so damaging, that it affects them for weeks, months, perhaps even years. Some traders may never even recover from this. Even though that huge loss was ions ago, you still remember it vividly and often recall it when trading. Has this ever happened to you before?

If so, do not worry, as most have had this experience.

Can You Change This?

The good thing is you can re-wire your brain, almost like re-writing your hard drive on a computer. Neural connections can be rebuilt and tuned for success. You can also build new connections which overpower this experience, to regain your confidence and make great trades.

One Way to Change Your Brain for Success

One of the best ways to re-wire your brain for success, and erase these negative trading experiences is to enter a ‘Whole-Brain State‘. This is where your brain operates in an integrated balance. Your left and right hemispheres are working well together. You are not pumping unnecessary stress hormones into your system. You avoid entering a ‘fight or flight‘ response, or being overly emotional, or too intellectual.

In essence, your brain operates in a balance which the Whole Brain State induces. When you think about it, which state would you want to be in for trading? A fight or flight state? Being too intellectual or emotional? Having massive amounts of stress hormones pumping through your brain? Or be in a balanced whole brain state?

Yoga and meditation are notorious for helping to put you into a whole brain state, while tuning your central nervous system.

Another powerful method is ERT Training, which we’ve specifically built for traders. If you’ve had similar experiences to the ones I listed above, and still keep recalling negative trading experiences even today, then you’re likely not in a whole brain state. But if you want to learn how to be in a whole brain state while trading, then you definitely have a tool to build a successful trading mindset.

Some truly prime content on this web site , saved to fav.

My biggest demon is not getting my break even stop moved and it can wipe out half of my profit for the day easily. It’s nice to read this article and feel like you are being spoken directly to, because it gives you a glimpse of how to curb your reactions based on our own physiology. Great article Chris!!!

Chris, I struggled with this constantly until I worked out money management issues. Slowly, I was able to figure out what an optimal amount of risk is for me, and now I have no fear of entering trades because I know what my risk is. Has transformed my trading. Much credit to your posts. Thank you.

Hello Vikasrao,

Yes, control risk and money management is critical, and will reduce the emotional/psychological stressors that can affect trading heavily.

So glad to hear you have benefited from this in our courses.

Kind Regards,

Chris Capre

I am finding other ways to relieve my stress being more active-

I find when i am stress i make unwisely errors and over look some of the basic things in trading.

Hello Sam,

Yes, being more active and finding ways to transform stress is highly useful, and definitely can reduce trading errors.

Kind Regards,

Chris Capre

Great article, Chris. I particularly enjoyed this part – “But take a huge loss, and now your brain is likely re-wired for more losses – minimally in a poor state for trading..” Ain’t that the truth?

It’s also important to change the self talk between your ears. This can be done (and you’ve mentioned this in the past) through mindfulness. Being aware doesn’t change the underlying behaviour, but it’s definitely a start.

Boris

Hello Boris,

Yes, the self-talk can definitely have a huge impact on ones state, mindset and wiring over time. So good point.

Kind Regards,

Chris Capre

“You’ve just had your largest loss ever (or big one), and you are feeling incredibly risk averse, almost to the point where nothing looks good to trade. With each new setup that comes, you find yourself still recalling that big loss and hesitate, or fail to pull the trigger.”

Nooooo… This is just happened to me yesterday.. ! a 20% loss is kinda hit me even though it’s not very BIG. Maybe I’ll need few days to relax and stay out off forex for a while…

Hello Juni,

A 20% loss is quite a large loss, and likely requires some adjustments in risk management. But I’d definitely suggest taking some time off to let the experience wash away from your brain. Definitely don’t think about it for a while, especially if your thoughts about it are negative.

Hope this helps.

Kind Regards,

Chris Capre