In my prior article on the New York Daily Close Charts, I exposed the forex myth demonstrating how the New York Close Charts are not superior to the UK GMT 00.00 charts.

For my price action course members, I just updated our stats on the inside bar strategy, and compared the NY 5pm Close vs. the UK GMT 00.00 Close. For the second time, the results showed no superiority in performance.

Keep in mind, this is just a price action strategy I built, with no server time in mind. We tested it using identical parameters, and here are the results below;

FXCM UK GMT 00.00 Close

-9 Pairs Total Made the Cut

-13 Possible Trade Combinations (via pair/time frame)

-All 4 time frames had profitable setups (Daily, 4hr, 1hr, 30m)

-60% Hit Rate

NY Daily 5pm EST Close

-9 Pairs Made the Cut

-13 Possible Trade Combinations

-All 4 time frames had profitable setups

-61.5% Hit Rate

Now, if the NY Daily Close Charts are so superior, how come they only account for a 1.5% edge in hit rate, yet in the other system they had a 4% lower hit rate?

Does this sound like massive superiority to you? I didn’t think so.

Although you hear it all the time they are superior, who is backing it up with actual statistics? Nobody……save here.

What was also interesting is many of the pairs others are purporting to be profitable using the inside bar strategy are not – not by a long shot.

What the data simply translates into is that neither one is significantly more profitable than the other. However, it is important to know which pair and time frame is, as many did not match up across the different server times for continued profitability.

Now I did promise to discuss an alternative platform besides MT4 for those that want to stick with the NY Daily Close. First, before I share the platform, I should state why I do not like MT4 for trading;

1) Execution on Market Orders is Slow – so slow that FXCM spent a ton of money and time just to remove the 3rd party bridge and no auto account syncs so that it would execute faster

2) Bulky – not user friendly or flexible unless you can program an EA

3) Have to do more clicks for simple trading operations (i.e. closing multiple positions at once, etc.)

There are many other reasons, but if you do any sort of intra-day trading (1hr charts and below), or market orders, you will find other platforms to be far faster with their execution. Even the MT4 demo platforms can have slower execution then a live order on another platform.

What MT4 is Good For

The only use I have for MT4 is to run my algos which inform me of setups (that I execute on other platforms). For programming EAs, it can definitely be cheaper and simpler, but beyond this, for trading purposes, MT4 is slower and bulkier.

A More Intuitive Platform

For those that want a more user friendly and intuitive platform, I suggest the FXCM TS2 (Trading Station 2) platform. The execution for market orders or any sort of intra-day trading will be far superior and faster than almost any MT4 platform. But even more important, you will have to do less clicks to execute orders.

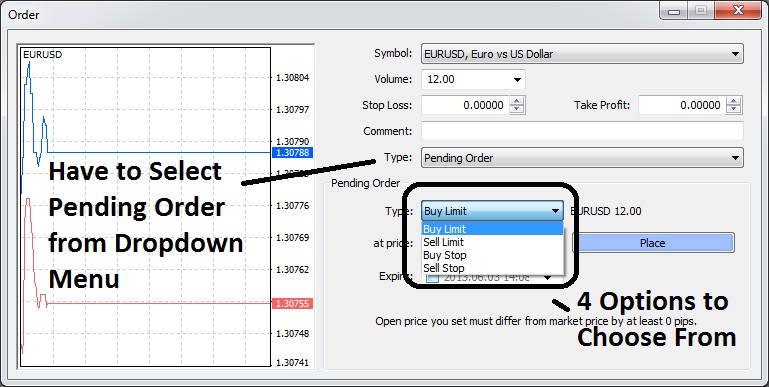

Case in point, open up a new order tab in MT4 to execute a pending order. Here is the window below;

Now notice, just to execute a pending order, you have to 1) click on the ‘New Order’ button, 2) select ‘pending order’ from the drop down menu, 3) then choose from 4 types of orders.

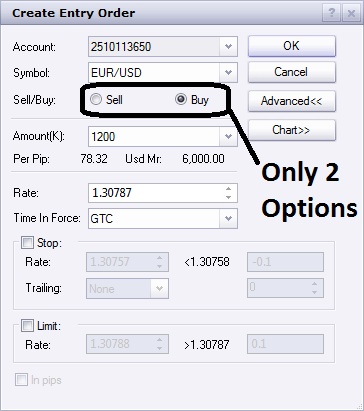

Let’s contrast that with the FXCM TS2 process with the window below;

To execute a pending order you simply 1) hit the ‘entry’ order button, and 2) select the ‘buy’ or ‘sell’ button.

Notice the difference?

We are talking 2 steps instead of 3, which when you are trading intra-day, could mean a big difference in execution and getting your price. But also notice which one is more confusing. With MT4, you have 4 order types to choose from, while with FXCM’s TS2, it’s a much simpler ‘buy’ or ‘sell’, regardless of whether its a buy stop or buy limit order – the platform and technology does the work for you.

But for those trading any significant size, or any intra-day price action strategies, execution is critical, and seconds can mean getting your price or missing it.

Trade History On the Charts

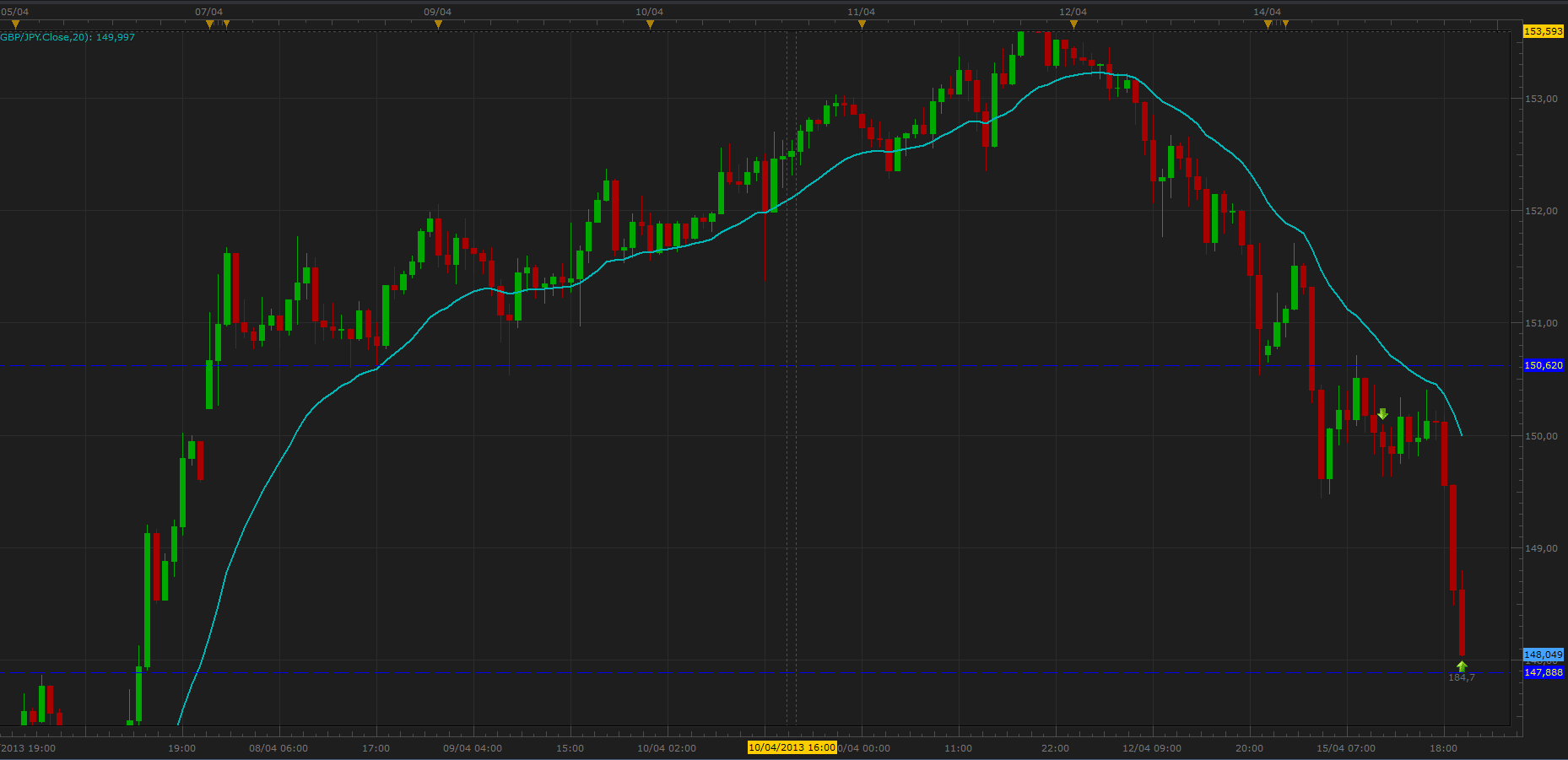

One other feature I really enjoy about the TS2 platform is it shows the trades (or trade history) you made in the last 24hrs on the chart, particularly your entry and exit levels. I find this particularly useful for when I’m doing intra-day trades, sometimes I cannot take screenshots of my trade as I’m in several trades at once. When I close the trade, the TS2 charts (Marketscope), will actually show me the entry and exit level on the charts. A good example is below;

The benefit of this feature allows to me to take screenshots of trades I missed, then store them for analysis at the end of the trading week so I can isolate patterns behind my winners and losers. But with MT4, these are not available. Once the trade is closed, the entry and exit levels on the chart are gone, which makes for more work.

Although this is a small feature, it’s all these little features that add up to a big result. When it comes to a trading platform, user friendliness is critical, and the more work you have to do to execute a trade, the more time and profits can be wasted.

I hope this article now has conveyed to you 1) the New York Daily Forex Close Charts being superior is a myth, and 2) there is a far superior alternative platform for trading then MT4 which also uses the NY 5pm Close should you wish.

For those wanting to learn which pairs and price action systems are profitable in your server time, then make sure to check out my Price Action Course where you will learn which pairs, time frames, and systems are profitable across specific server times.

Hello Alin,

Yes, you can take advantage of both statistics in the course. Just make sure not to have competing trades running at the same time.

Hope this helps.

Kind Regards,

Chris Capre

Hi Chris,

I have FXCM UK-MT4 platform,that is set for 00.00 gmt close and TS2, that it looks like is set for NY close(22.00gmt).

Does that mean that i can take advantage of your statistics on both server times?

kind regards

Hi Chris,

A trick on MT4: after a trade is closed you can “right click” on the closed trade in Account History and drag it to your chart. This will place a entry marker and a closed marker on the chart with a line connecting them. MT4 is still clunky to place the order but at least you can see your previous trade.

Thanks for sharing your research!

Russ

Hello Russ,

Neat trick – thanks for sharing. Although even then, its still clunkier than FXCM’s TS2 – as with TS2, its just on the chart there for you, while with MT4, you still have to do more steps. It all comes down to user-friendliness, and intuitiveness, which I find MT4 to be lacking, and TS2 to have more of.

Kind Regards,

Chris Capre

v informative as ever. Ty Chris

Hello Dekk,

Glad you found it informative.

Kind Regards,

Chris Capre

Hi Chris,

Does the TS2 platform run on Mac OSX?

Hello Isaac,

Yes, I think you can run it via parallels, but they also have a web based platform, so definitely options.

Kind Regards,

Chris Capre

Hello Gary – am glad you found the article useful and insightful. Make sure if you can to share it on any forums you are on so others can benefit.

Kind Regards,

Chris Capre

Thks Chris for the insightful n interesting article!