New to Forex? Then check out my FREE Learn Forex Trading Course with videos, quizzes and downloadable resources

Top Trade Review: Check out this Top Forex Trade Review with my student banking +377 Pips on the EURUSD (HUGE REVERSAL!)

Want FREE Forex Charts? Check out our top charting provider Trading View.

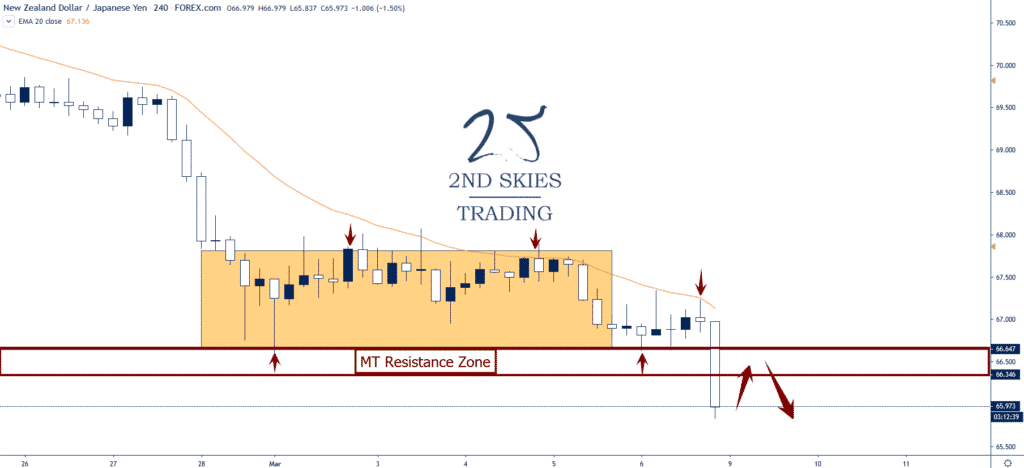

Forex Trade Idea: NZDJPY – Breaks Key Support Zone, Looking to Sell (4hr chart)

Price Action Context

On our youtube channel last week we talked about the NZDJPY forex pair and how we were bearish looking to sell.

To open the market this week, the NZDJPY forex pair sold off aggressively opening below the major support zone between 66.33 – 66.63 printing below the 66 handle.

I’m looking to sell on a pullback into resistance.

Trending Analysis

ST & MT bearish while below 67.75 on a weekly closing basis.

Key Support & Resistance Levels

R: 66.63, 67.99

S: 63.45, 60.45

Stay tuned on this with our members market commentary for updates.

******

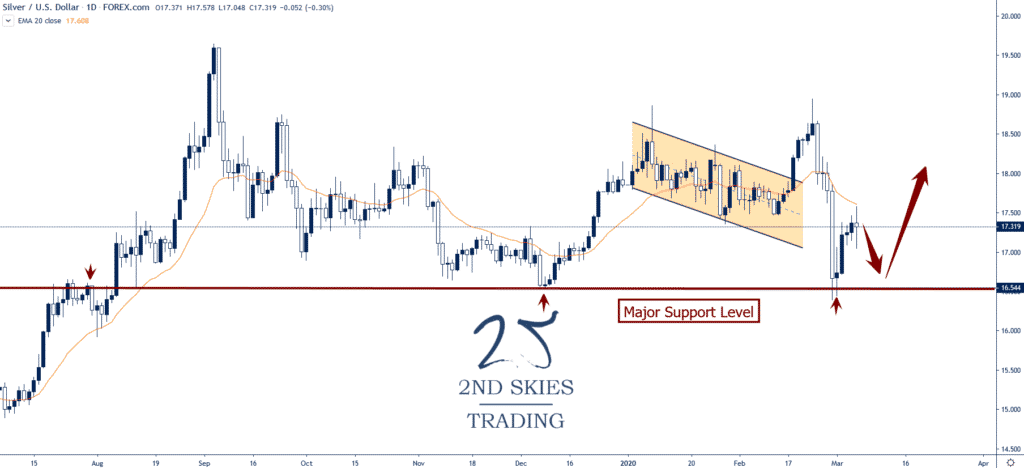

Commodity Trade Idea: Silver – Weaker Than Gold, But Holding Key Support Level (daily chart)

Price Action Context

Since August of last year, Silver has been holding steady above a key support level at 16.54.

This level was tested last week after a brutal 4 day sell off in the precious metal from just under 19 to 16.54 in 4 days.

The PM held and has bounced decently, showing through the price action and order flow the bulls are able to hold (for now).

I’m looking to stay long MT till we get a close below this level on a weekly closing basis.

Trending Analysis

ST bullish and MT neutral while stuck between 19.50 and 16.54.

Key Support & Resistance Levels

R: 18.63, 19.59

S: 16.54, 15.75

******

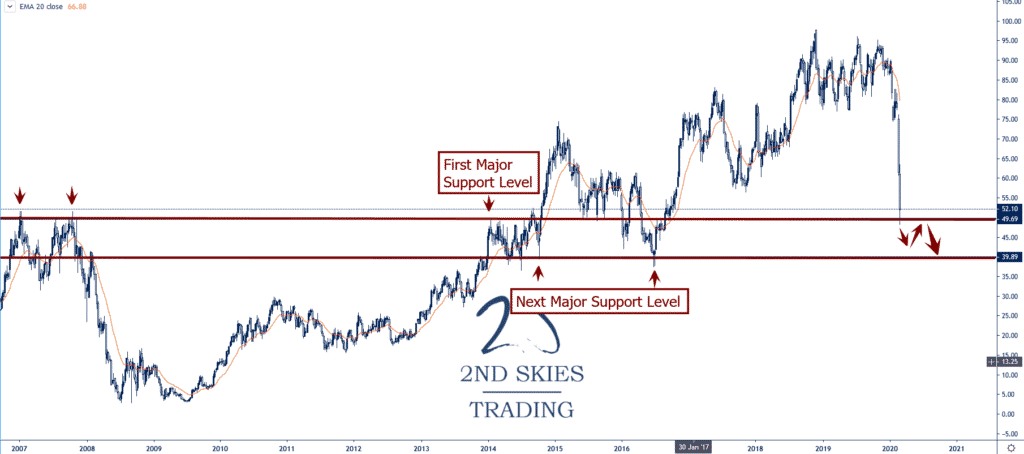

Stock Trade Idea: United Airlines ($UAL) – Looking to Sell Below Key Support (weekly chart)

Price Action Context

As we talked about in our latest article “Is the stock market going to crash“, we suggested selling airlines due to the coronavirus spreading and that travel/entertainment companies would get hammered.

If you had shorted any of the travel/entertainment companies like we suggested, you would have profited heavily from this.

Nothing has abated with the coronavirus and naturally, less people are flying and travelling.

This bodes really bad for airline companies, including United Airlines ($UAL).

Right now we’re just barely above a major support level around 49.69, but if this breaks, then there isn’t much below till 40 so a potential stock trade setting up.

Trending Analysis

ST & MT bearish. Weekly close below 49.75 will increase the bearish pressure and a potential move towards 40.

Key Support & Resistance Levels

R:57.9, 80

S: 49.69, 39.9

******