Chris Capre’s current live open price action & ichimoku trades: USDMXN, EURRUB, EURMXN, BIG, DIS, AC, ISD

New to Forex? Then check out my FREE Learn Forex Trading Course with videos, quizzes and downloadable resources

Top Trade Review: Check out our latest Top Forex Trade Review with my student banking +428 Pips on the GBPAUD (MASSIVE PROFIT!)

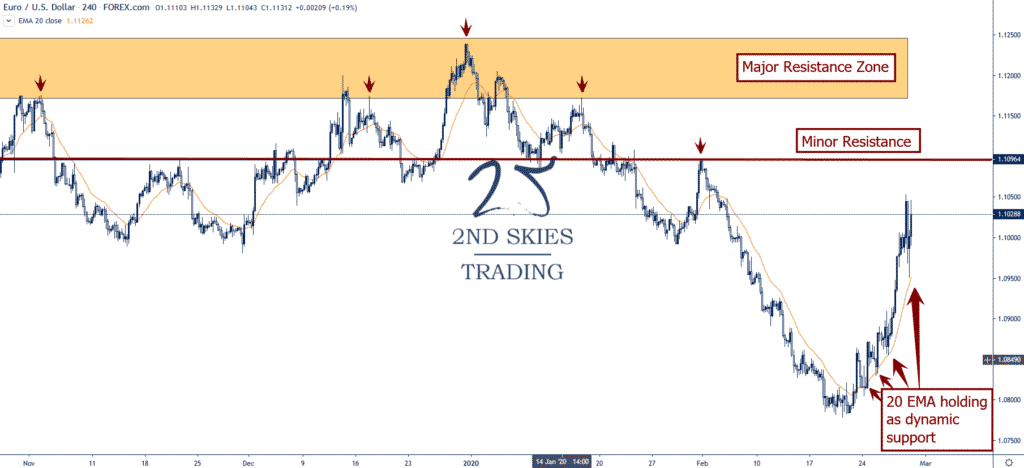

Forex Trade Idea: EURUSD – Staying Long Till Momentum Change (4hr chart)

Price Action Context

A week ago on our youtube channel we commented on the momentum change in the EURUSD captured by the change in the price action and the 20 EMA.

This is what it means to understand dynamic support & resistance.

The EURUSD call was pretty prescient as the Euro staged an impressive reversal climbing another 200 pips from when we posted that.

Looking at the 4hr chart below, you’ll see how the 20 EMA Held on 4 separate pullbacks suggesting the market is now treating it as support, thus a bullish sign for now.

I’m looking to stay long while we’re above 1.10 and the 4hr 20 EMA on a closing basis.

Trending Analysis

ST bullish while above the 4hr 20 EMA and 1.10. Looking to stay long under these conditions towards 1.1175 resistance zone.

Key Support & Resistance Levels

R: 1.1096, 1.1175

S: 1.10, 1.0775

Get EURUSD updates with our members market commentary 4x per week.

******

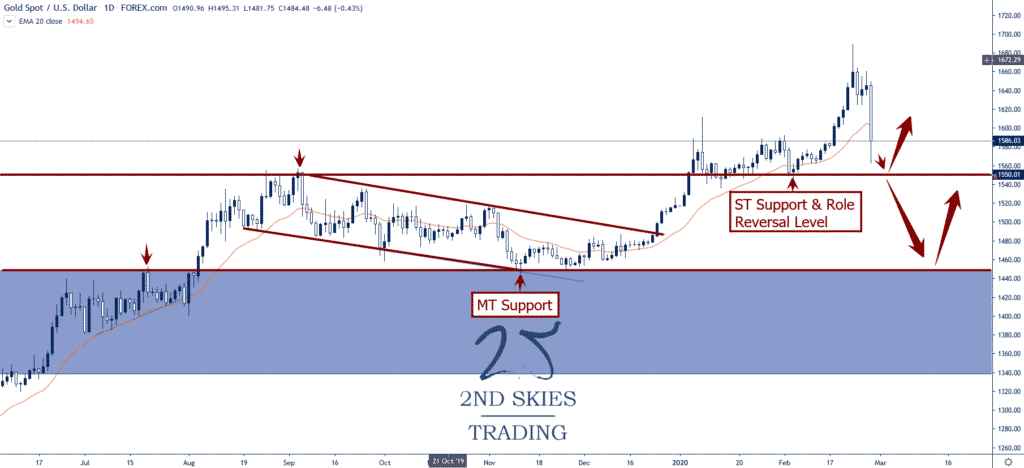

Commodity Trade Idea: GOLD (XAUUSD) ST Bearish But MT Bull Trend In Play (daily chart)

Price Action Context

While having an impressive bull run for 2020, Gold puked to end last week with billions being sold and wiping out most of the yearly gains within a matter of days.

My sense is there was a lot of profit taking in gold to subsidize losses from stock holdings (which also took a beating last week).

Regardless, ST gold isn’t my cup of tea, but I think the MT bull trend is still in place with two major support zones in play for potential longs.

Trending Analysis

ST bearish but looking to get long at key role reversal levels.

Key Support & Resistance Levels

R: 1660, 1770

S: 1550, 1450

******

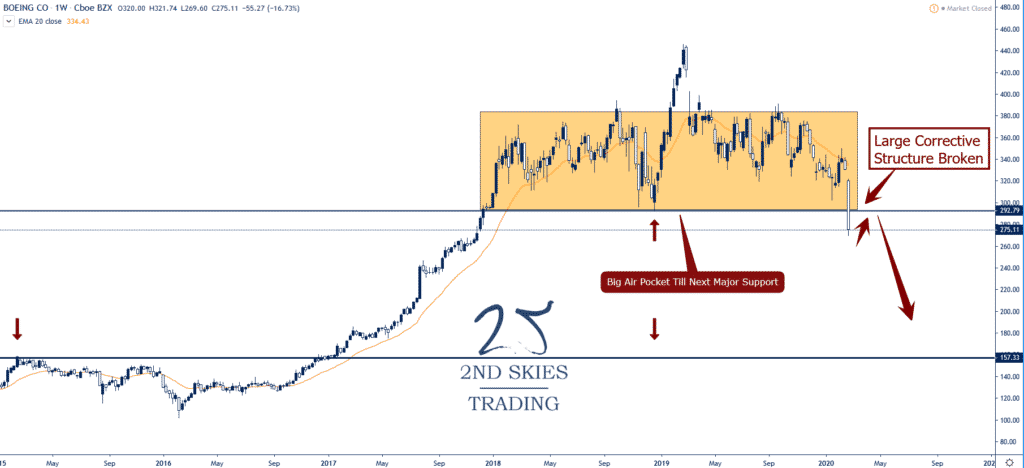

Stock Trade Idea: Boeing (BA) – Collapses Below Large Corrective Structure, Bearish (weekly chart)

Price Action Context

For the last two years, Boeing has had a base of support between 292 and 318 which has supported the stock well and created a lot of good short to medium term trade setups.

However, last week Boeing got hammered closing below the 292 base of the large corrective structure for the first time ever.

NOTE: We called a bearish setup way back at 369 which profited massively for our stock trading members.

IMO, the break below this structure is a very bearish technical event with many MT and LT stops being tripped.

Also of importance is now there is a large air pocket with only thin layers of support for the company, and nothing major till 157, so this could turn really ugly fast for this stock.

Trending Analysis

ST I’m looking to get short and stay short till we get a close above 292 on a weekly basis. Downside there could be a lot of room to run if none of the minor levels hold along the way.

Key Support & Resistance Levels

R: 292, 318

S: 242, 157

******