New to Forex? Then check out my FREE Learn Forex Trading Course with videos, quizzes and downloadable resources

Top Trade Review: Check out this Top Forex Trade Review with Itayi profiting +1100 Pips on the NZDJPY (AMAZING PROFIT!)

Want FREE Forex Charts? Check out our top charting provider Trading View.

Did you see my video “Is It Time To Buy Stocks” and whether you should be buying stocks long term?

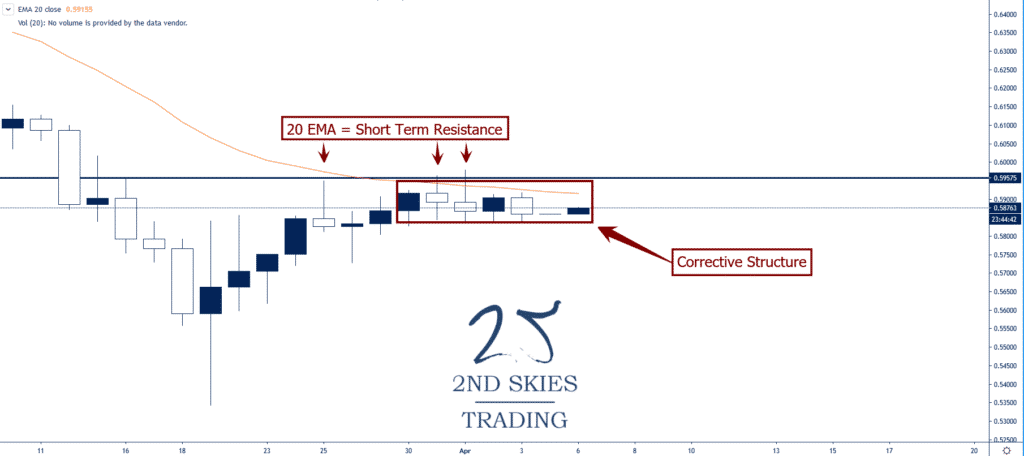

Forex Trade Idea: AUDCHF – Corrective Structure At Dynamic Resistance (daily chart)

Price Action Context

After the V-bottom bounce mid-March, the AUDCHF forex pair has been inside a corrective structure for the last 6 days near the top of this V-bottom bounce and bear market rally.

Interestingly enough the pair has also been held by the dynamic resistance and 20 EMA touching it several times but being unable to close above it.

A weakening in this structure points to a potential attack on 5600 and maybe the recent lows.

However an impulsive break and close above points at a ST recovery.

Trending Analysis

ST bullish while inside the corrective structure with strength gaining on a close above and weakness on a close below.

Key Support & Resistance Levels

R: 5957, 6221

S: 5642, 5400

Stay tuned with our members market commentary for updates.

******

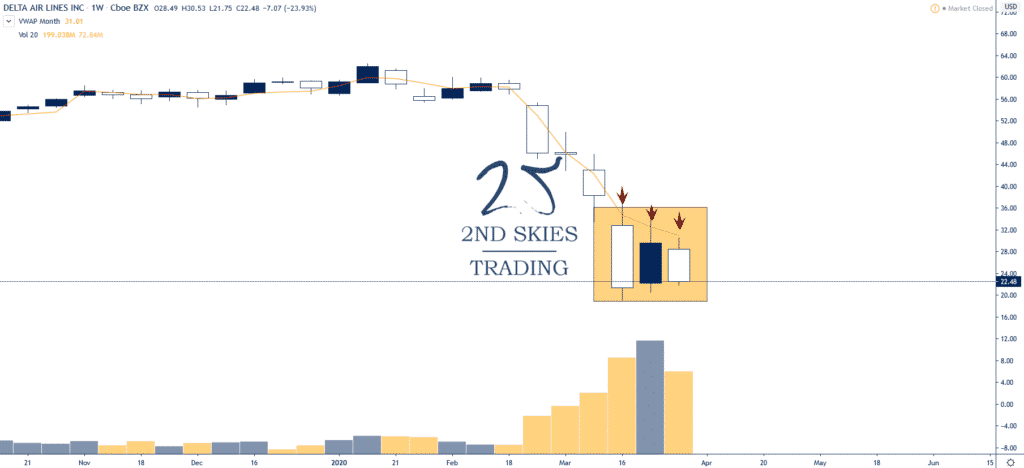

Stock Trade Idea: Delta Air Lines ($DAL) – Watching For Potential Break to Sell (weekly chart)

Price Action Context

Selling off 6 of the last 7 weeks, Delta Air Lines ($DAL) was already under pressure, being held below the anchored vwap over the last 3 weeks, and is pressuring the yearly lows again after last weeks sell off.

But pouring gasoline onto a fire, reports that Warren Buffet has sold 12.9 million shares of Delta should only put more pressure onto the stock.

I’m watching for a break below the yearly lows, or a weak pullback into the anchored vwap for a potential trade setup to get short.

Trending Analysis

ST & MT bearish while below 36 on a weekly closing basis.

Key Support & Resistance Levels

R: 30.75, 36

S: 19, 15

******

Commodity Trade Idea: Gold (XAUUSD) Showing Resilience In Bull Trend (1hr chart)

Price Action Context

Showing resilience in the bull trend, Gold started off the week selling off towards the 1450 key support level before correcting and then bouncing impulsively, making up the losses faster than it sold off.

This tells us the bulls still have the majority of control and are looking to break higher this week.

Trending Analysis

ST & MT bullish while above 1450 on a weekly closing basis. Am looking to get long on a break above 1640.

Key Support & Resistance Levels

R: 1640, 1690

S: 1567, 1450

******