Want FREE Trading Charts For Forex, Stocks or any asset class? Check out our top charting provider Trading View.

Check out my latest video How To Day Trade Stocks Using Volume

Want my Price Action Course for FREE? Click here to find out how.

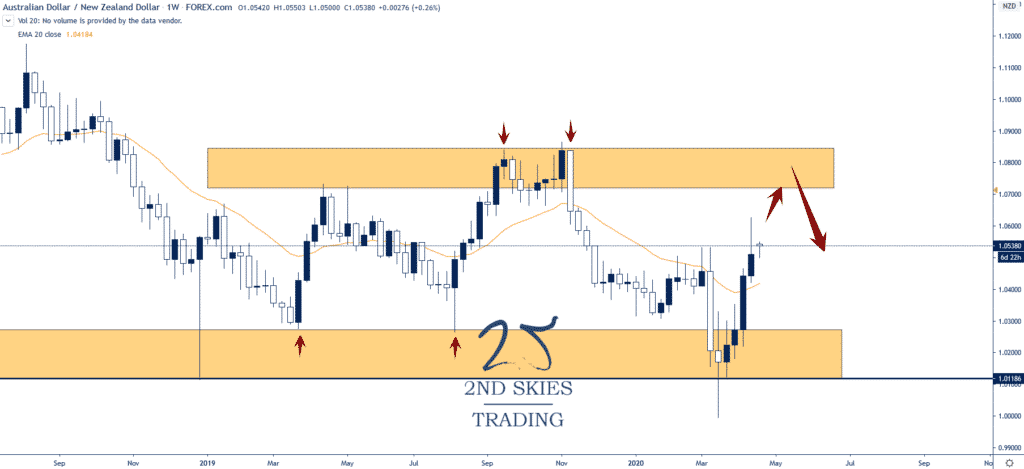

Forex Trade Setup: AUDNZD – Looking to Sell On Rallies (weekly chart)

Price Action Context

After probing the parity level in early March, the AUDNZD has rallied 4 of the last 5 weeks and is looking to retest the major resistance zone ahead between 1.07 and 1.0842.

I’m looking to sell this pair on rallies into the zone and am watching for trade setups to get short.

Trending Analysis

ST bullish but MT neutral while inside this larger range between 1.0842 and 1.0118

Key Support & Resistance Levels

R: 1.07, 1.0842

S: 1.0274, 1.0118

Stay tuned to our members market commentary for updates.

******

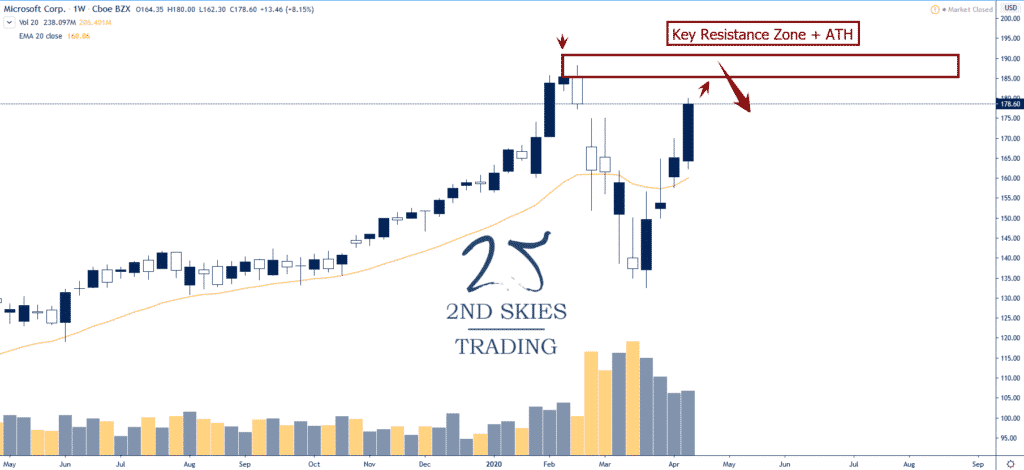

Stock Trade Idea: $MSFT (Microsoft) – Likely Profit Taking At ATH’s (weekly chart)

Price Action Context

One of the stocks we talked about buying in our is the stock market going to crash article was Microsoft ($MSFT).

Our feeling was the leaders before the crash are most likely going to exhibit strength when it returns, and Microsoft was looking strong before the stock market crash.

Fast forward about 1.5 months and Microsoft is one of the top performing stocks lately, bouncing 34% off its lows and almost back at the ATH (all time high).

What I’m suspecting is current longs are going to take some profit at the ATH’s near 190, thus creating a mild pullback, potentially leading to a decent sell off.

Hence I’m looking to get short at the ATH’s with a tight stop above should we get a weekly close above the ATH.

Trending Analysis

ST very bullish while MT neutral to slightly bullish while below 190.75 on a weekly closing basis.

Key Support & Resistance Levels

R: 183.50, 190.75

S: 151, 135

******

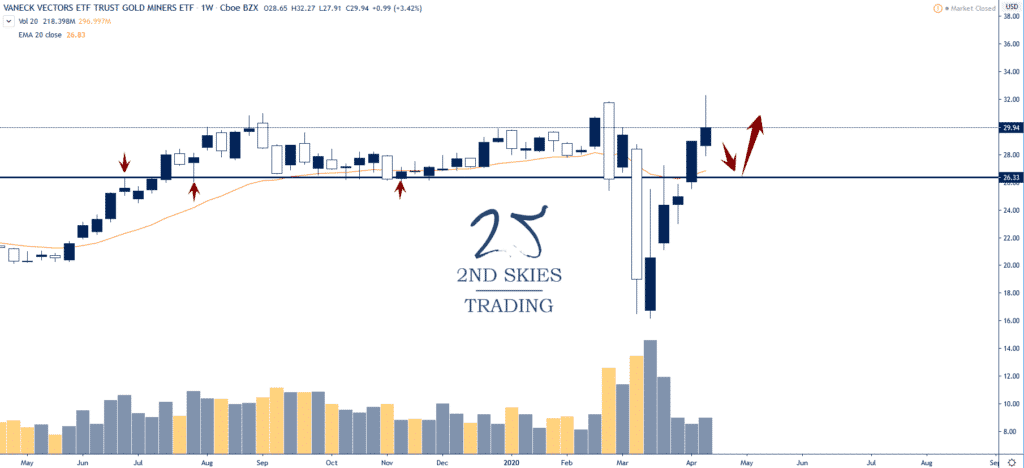

ETF Trade Idea: $GDX (Gold Miners Trust) – Looking to Buy Into Dynamic Support (weekly chart)

Price Action Context

Up 5 weeks in a row and poking at the recent range highs, the VanEck Vectors Gold Miners ETF ($GDX) is looking bullish on a MT perspective.

I’m thinking we’ll get a minor pullback here, but there is a large range of technical support meeting up with dynamic support around 25 which might be a good location to add longs.

Trending Analysis

ST & MT bullish while above 25 on a weekly closing basis.

Key Support & Resistance Levels

R: 32, 40

S: 26.42, 24.54