This is likely to be an industry of the future

If you do not have long-term investments in this industry yet, you might want to take a closer look. The industry I’m talking about is the plant-based food sector which according to Credit Suisse is expected to increase by 100% by 2050, becoming a $1.4 trillion market.

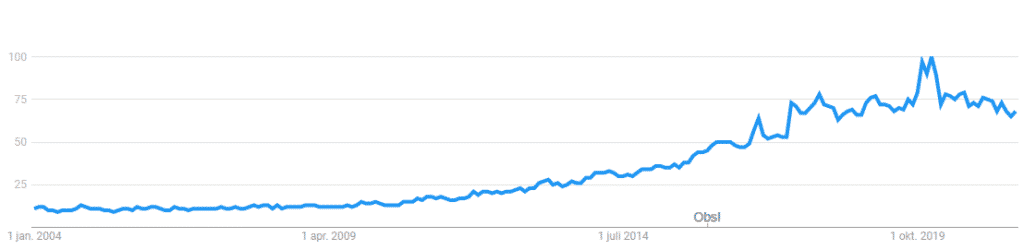

A simple search on Google Trends also confirms this trend with searches for the topic “Veganism” have sky-rocketed in the last 10 years, peaking right before the start of the pandemic. This peek is to be expected as the pandemic forced people to re-focus on essentials short-term, but one could expect that as soon as things stabilize, this industry will continue its impressive growth.

Ideally, as an investor, you’d want to be positioned well-ahead before the next strong bull move happens in this industry.

There are factors fueling the past and anticipated growth of this industry, but two of the primary driving factors are sustainability and health benefits.

Just looking at the sustainability aspect, today’s food production and consumption contribute to 90% of the world’s freshwater consumption and 20% of the global greenhouse emissions.

According to the research by Credit Suisse, a global change towards a more plant-based diet is inevitable if the world’s food production is to become more sustainable.

One company on the forefront of this movement is Beyond Meat, founded in 2009, that focuses on producing realistic meat-like products using only plant-based ingredients.

A bump in the road

Despite the positive long-term outlook for the industry, it’s not all roses. Catering and restaurant businesses took a massive hit during the pandemic due to the imposed lockdowns which naturally leaves a strong footprint in the sales for companies like Beyond Meat (Nasdaq: BYND).

The company did start to report net profits in some quarters in 2020, but despite continuously launching new products such as vegan breakfast sausages, ground beef and meatballs, the company is now back to reporting quarterly net losses again, most likely due to the impact of the pandemic.

Despite this ‘bump in the road’, we do think that the stock and price action of the company currently is trading at attractive levels for potential long-term investments.

Technical Analysis

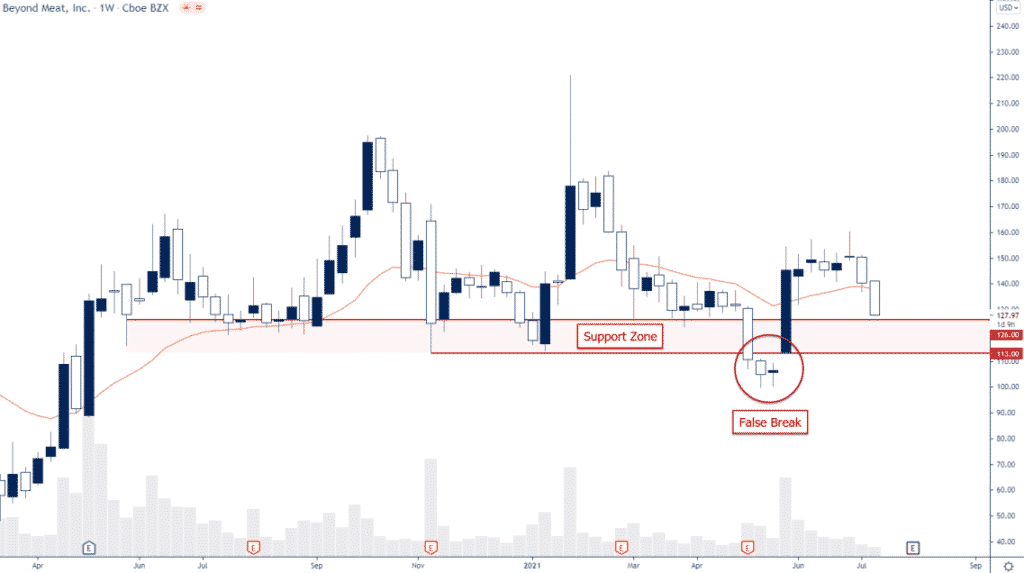

In early May the stock dropped more than 20% breaking below a technical key support zone only to sharply reverse towards the end of the same month creating a false break. This false break is a clear sign that the market thinks that the price of the stock was too cheap sub $110.

In the 7 weeks following the strong bullish impulsive move that took price all the way back above $150, sellers have only been able to push back roughly 50% of the move which clearly indicates a imbalance to the buy side in the order flow.

We therefore think there’s a good chance that buyers might step in and defend the key support zone ones more, making it a good location to look for potentially entry locations in our opinion.

Option Positioning

In terms of the options market and how the option traders are positioned, there are about 180K calls and over 260K puts, so the market is put heavy. About 28% of the options are rolling off this Friday, so am expecting a pullback in the stock price which could provide a solid buying opportunity around the support zone mentioned above.

Long term the option structure is supportive for bulls to step in at prices just below, thus making this a long term investment to consider.

FULL DISCLOSURE: Chris Capre currently has no stock or option position in BYND, but he does have pending buy limit orders on ETSY. If you’d like to learn more about Chris’s trades/positions, you can get access via the Trading Masterclass where he shares his live trades, further investment ideas and daily market analysis.