What It Takes to Become A Master

Ever heard of the name Anders Ericsson? Perhaps not, but i’m guessing you heard of the name Malcolm Gladwell, author of the bestselling books Blink and Outliers. Gladwell in his last book Outliers was trying to figure out what separates highly successful people from the rest in any field. In it, he discussed the 10k hour rule, which was actually from the research of Anders Ericsson at Florida State University.

Anders conducted a critical research project whereby he found it normally takes 10,000 hours of practice at a skill to become an expert in any discipline. During this time, your central nervous system will string together new circuits and connections that eventually give you the tools and abilities to execute your skill with mastery. Ironically, he also found it was done without a conscious consideration of the action – the athlete or performer was just doing.

What he discovered in his research was a Zen-like intense concentration, whereby the experts completely focused on the activity. It was in these moments that the experts in their field were achieving peak performance by entering a state called ‘the flow‘, originally characterized by Csikszentmihalyi in the 1970’s.

10,000hrs to Become an Expert Trader?

I know, many of you are saying, ‘10,000 hours would take me years, perhaps a decade to get to that‘. In response to that, I have a few questions;

-What if you could accelerate your learning curve and learn how to enter that state before 10,000 hours?

-What if you could enter that state every day while trading?

-What do you think this would do to your trading?

-Would you put in the effort to develop this?

We are going to talk about what you can do to leap-frog the 10,000hr process in this article and take years of your learning curve.

Before we talk about what you need to do to enter the state of flow and effortless concentration, we are going to discuss the four key features that characterize the state of flow. They are;

1) An intense and focused absorption that makes you lose all sense of time

2) Autotelicity – a sense that the activity you are engaging in is rewarding for its own sake

3) The ‘Sweet Spot’ – this is where the task at hand in relationship to your skills are perfectly matched

4) Automaticity – the ability to do something automatically

Let’s get into each one and see how we can relate them to trading. Then we will talk about what you can do to shortcut this process and decrease the number of hours you need to be studying charts to become an expert in reading the charts.

#1 An Intense and Focused Absorption

One would almost think this would be enough to enter that flow, but all four are required to enter this zen-like state in trading. If you train in yoga and meditation consistently day in day out, then this will come a lot more naturally because you are already practicing the craft of focus and concentration. But if you are not, many things will come into play and affect your concentration.

For example;

-Did you have an argument with your partner, spouse or child lately?

-Did you completely process everything from yesterday and are totally present with what you are doing today?

-Did you wake up and properly stimulate your central nervous system to be prepared for your trading day?

-Are you still focused on a recent loss or mistake?

-Did you drink coffee earlier that morning, or alcohol the night before?

-Are you taking phone calls or talking with others while trading?

-Are you checking email or watching TV during the trading session?

If you answered yes to any of these, it’s highly likely your mind is not 100% absorbed in the markets as they will all inhibit your ability to concentrate.

But lets say you have not had any of these come up. Do you really think you are totally focused and absorbed in concentration? If so, then take a simple test:

Sit in a chair with your spine upright, in a very relaxed and quiet room, no music or tv or anything going on, just you sitting in a chair with your eyes gently focused forward, and try to concentrate solely on your breath. Just follow the inhales and exhales completely. Try and see if you can follow 20 breaths (one inhale and exhale = one breath) without having a single thought other than your breath. Try and see if you can follow them so perfectly you are never once taken off the focus of your breath, that you are so immersed in the experience of your breath, nothing diverts your attention.

Go ahead and try and let me know how far you got (take a moment here).

Finished? How did you do?

I would be willing to bet most of you did not get past 5 breaths. Yep, 5 breaths without;

a thought about your experience

without moving to scratch an itch

or have a question about whether you are doing it right

about whether you can do it or not

without hearing that song in your head

or thinking about the one thing that person said which bothered you

or that one thing you got to do later today

or that bill you have to pay

or the money you need

or whatever…

In fact, I’d be willing to bet many of you did not even make it to 20 without losing count, let alone make it to 5 breaths, perhaps even 2 or 3.

Remember, all you were asked to do is focus on your breath (inhales and exhales) solely for 20 breaths.

Now ask yourself the following questions;

-If you cannot focus on your breath while sitting in a quiet room by yourself with no noise or stimulation going on, how can you be absorbed or concentrated on the markets?

-How could you be totally focused and not let those emotions interfere with your trading?

-If you could not stop the radio of your mind and its constant stream of thinking while sitting still trying to do one task, how could you spot the subtleties in the price action communicating to you the market is going to turn or make a big move?

Of all the 4 characteristics, the first one is the hardest. The most common misconception of the whole 10,000hr rule is not just to absorb enough information so you become a master. It’s to develop the concentration needed, along with the repetition of a task that leads to confidence and allows one to relax their mind. All of this is to develop that zen-like absorption and penetrating concentration to achieve peak performance.

But what if you practiced something which solely focused on developing that concentration? What if you practiced yoga, meditation, or any activity which developed this skill set? Wouldn’t that cut down the time you needed since your concentration and awareness would be sharper?

Someone recently shared a great Abraham Lincoln quote where he said, ‘If I have 8hrs to chop down a tree, I’m spending 6hrs sharpening my axe‘.

If the markets are a tree, your mind is the axe, so sharpening this tool will help you reach your goal faster than anything else. In fact, awareness, focus and concentration are the three things which will accelerate any skill, task or endeavor you engage in. They will reveal information faster to you, help you take in more, focus on the key things and yield insight more naturally. To learn a few techniques which can help you with this, click on my article Building A Successful Trading Mentality.

#2 Autotelicity

This refers to doing something for its intrinsic value, and not so much for the external rewards it may provide. For example, do you play football so you can become a multi-millionaire, or do you play the game because you love it so much, you’d play it for free if you had all you needed to make a living? Simply put, if one pursues an action for intrinsic reasons, then one’s actions are intrinsically valuable because one is motivated to pursue the action as its own means to an end, or for its own enjoyment – not for what it brings.

To put this in a question – do you trade because you absolutely love it, that you really want to learn it inside and out? Or do you trade to become financially abundant and independent – who doesn’t? Therefore, the latter is an inferior motivation since it is something you’d want naturally (financial independence). Are you really wanting to be a professional trader, or are you trying to escape your financial situation and state of existence? The former is ideal, the later is less helpful, but still can be used.

Doing it for the latter reasons will translate into the experience, that when you run into obstacles or excuses why you did (or did not do something), you will accept those excuses as reality instead of doing something to change them.

It will mean your motivation for doing something is not the love of it, but hating (or disliking) something in your life you want to change, avoid or make sure doesn’t happen.

Ask yourself which of these two is why you are wanting to trade. Are you doing it because you really believe deep down inside you can do this, that you have to do this, regardless if you are successful or not? Think about which of the two you will put more focus, effort and attention to? Then ask yourself which of the two you are. Nothing will be more important than being honest with yourself here. If you find in all honesty the latter is your answer, you can still become successful, but either a) you will have to trade with that intention in your mind (via aversion to your current financial state) or b) your motivation will have to evolve into an more subtle appreciation for trading.

#3 The ‘Sweet Spot’

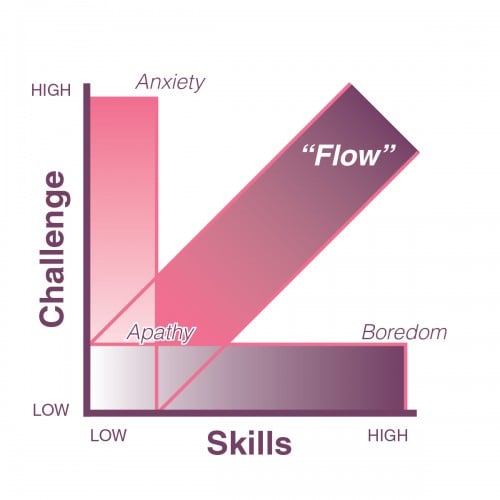

This comes out of the work by Csikszentmihalyi where he discovered a person was most likely to enter this state of ‘flow’ and masterful play if the task at hand was challenging enough in direct relation to their abilities. So, if the task is too hard for your current level, then it will be mentally frustrating and you will get emotional during the experience. If it is too easy, you will get bored and not stimulate your brain and potential fully.

This is actually critical in terms of your trading. If you are an absolute beginner, I do not recommend live trading, nor trading ultra short time frames (less than 15mins). Why? Because you will need to read subtle price action clues with very little time, make decisions really fast, have precision in your execution, while having little or no room for error. Sound like something a beginner should start with in any field or craft? I didn’t think so. Do you start learning how to be a professional archer by shooting at 18meters, 70meters, or 3? With that being said, I recommend starting at the 1hr, 4hr and daily time frames to hone your skill-set.

First things first – build your skillset, learn how to read price action, get hundreds of trades under your belt, then decide what type of trading you want to do. If you challenge yourself too hard in the beginning beyond your abilities, you will likely incur some big losses, or many in a row, then get frustrated, and be unable to enter any ‘sweet spot’. You want to be able to stretch yourself, but only in a controlled growth fashion. This will allow you to enter that flow as your concentration will be challenged, yet you will have the ability to do the task successfully.

#4 Automaticity

This is the ability to do something automatically, to the point where it requires none of your mental resources (or so little) that you can use the rest of your mind for finding the best trading opportunities. Your brain is like a computer processor, and if you are using resources for one or two other tasks, then you will have less processing speed for the task at hand. That is why multi-tasking is the worst thing you can do when trading as it actually reduces your overall IQ.

So shut off the email, turn off the cell-phone, unplug the landline, close your email program, and just focus on the markets when trading. Give all your energy and focus to that so you can have your full natural intelligence dedicated to trading. This will help you spot the best trading opportunities and make the best trading decisions.

What Else Can I Do?

If you have all four of these characteristics present, then you can more naturally enter the ‘zone’ or zen-like concentration. But there are some additional things which will help you get there.

While studying experts, Csikszentmihalyi found something unique in their brain activity. First, he noticed less activity in their pre-frontal cortex. This is the part of the brain typically associated with higher cognitive processes such as working memory and verbalization.

Although that may seem like something you want highly active, what it really pointed out was during their states of zen-like concentration, the experts across all fields were able to silence their self-critical thoughts which allowed automaticity to take hold and thus have more resources dedicated to their craft.

As traders, we have actually had this direct experience. Ever had the experience of ‘analysis paralysis‘? This is your pre-frontal cortex working overtime – criticizing every idea and thought to the point it paralyzes you. Ever had a perfect trade come up, but your mind came up with all kinds of ‘reasons‘ and ‘excuses‘ or ‘ideas from other experts‘ about how the market was going the other way? This is exactly that kind of pre-frontal activity which actually inhibits your trading.

Complimentary to this, Chris Berka looked at the brain-waves of olympic archers and professional golfers. What they noticed was a few seconds before the archer released the arrow, or the golfer hit the ball, they observed a small spike in the ‘Alpha Band‘ = 8-12hz frequencies, and ‘Theta Band‘ = 3-7hz frequencies.

Alpha band frequencies are linked to a lower heart rate and a greater sense of calmness and relaxation, while Theta band frequencies are associated with deeper levels of concentration, meditative absorption, a heightened awareness of the sensory field, and a shift in the relationship to thoughts, feelings and the experience of self.

As Berka noticed in her studies, the spike in the alpha waves represented more focused attention on the activity, while other sensory inputs are suppressed, accompanied by a slower breathing and lower pulse rate, all leading to greater concentration.

To compliment this, Gabriele Wulf (a kinesiologist at UNLV) examined the way athletes move. She noticed that if swimmers focused on an external stimuli, like how the water moves around them, instead of how their limbs are moving, their performance, speed and technique increased because the conscious thought of the pre-frontal cortex was turned down or off, and thus didn’t interfere with the process.

It allowed the automaticity to take over what it could so one could have more resources to doing the task with grace, effortlessness and creativity. It should be noted, that it takes time to produce consistent alpha waves in the brain. How much time? A lot less than the 10,000hours needed to achieve a sense of mastery and flow of your craft.

In fact, if you can learn how to develop consistently stable alpha waves, you simply short-circuit the need to have 10,000hrs of chart time. This is because your focus, concentration and awareness will all be sharper than usual. You will spot more details in the price action, find better opportunities out there, and be less inhibited by emotions and critical thoughts.

In other words, you are removing all the obstacles for having the same mindset as an expert in any field does, thus shortening your learning curve to successful, effortless and masterful trading. It is spending the first 6hrs sharpening your axe to chop down the tree in two hours, instead of hacking away at the tree for all eight. Which path do you think requires more effort? Which path helps you cut down the obstacles to your success faster and will lead to more successful trading?

I look forward to hearing your comments and reflections on this.

Kind Regards,

Chris Capre

If you enjoyed this article or what we do, please make sure to share/like/tweet this article, and click the ‘Like’ button for 2ndSkiesForex at the top of this article.

Related Articles;

Building a Successful Trading Mentality

Awareness, Negative Habits and Concentration

Poker, Concentration and Trading

Hi Chris, I’m slowly going through your articles and really enjoyed this one. This is an area that I absolutely MUST improve upon to obtain the desired level of success I have in store for myself. I acknowledge that I MUST learn this skill as part of the strategy for this journey I am on. I would like to learn more. Regards.

Hello BP,

Yes, mindset is a very particular skill you’ll need to succeed in trading (and life). Focus directs your mind so super important to improve and expand.

Kind Regards,

Chris

Love it! 🙂 Thanks Chris!

:-)))

Cool article, this gives a different perspective to trading.

thanks

Hello Haro – glad you liked it and that it offered a different perspective on trading.

Kind Regards,

Chris Capre

Hi Chris,

Amazing article, a real eye opener, I know it will show all of us, the right path towards successful concentration on the Trading business. Cheers and thanks a lot.

Regards,

Sannjay

Great article Chris.

I have the passion but need to continue to work on the skills & proper mindset. Reading this made me aware of some of my lack of focus while trading. Too much multi-tasking & distractions. I’ll continue the journey with more concentration.

Thanks!

I might be able to achieve a C+ or B- in my understanding of technical analysis, but in the characteristic areas mentioned above, a D- at best. So recognizing this, maybe there ‘is’ hope. Going to get to work and sharpen that axe more and swing less. Thx

Hello John,

I always believe that if the person has the passion, then they can learn the skills necessary to trade. This is the foundational energy needed. Learning to read charts and price action can be learned, and will be with the right effort, so regardless of where you are grading now, the skills needed can be learned and improved.

Kind Regards,

Chris Capre

Hi Chris

How much sense this makes.

In a former life every day, every breath, every nuance of my craft was pure joy for the love of it. There was no effort involved even for complex time critical tasks. It was like everything crystallized out of thin air.

Aiming for the same zone in my trading.

Enjoying your articles immensely especially the ones about fear and feeling like a deer caught in the headlights.

Hello Greg,

Yes, when we really are passionate about what we do, it almost seems effortless and the time is not a burden but just a path we are on to our work and goal.

This can be achieved in trading with the right training as well, as it just takes a little re-programming, perhaps via ERT training.

If you are interested for more details, email me via the Contact Page

Until then – good luck trading!

Kind Regards,

Chris

I get, hard work

Chris, thank a lot for sharing. These are brilliant articles and it helps me in more than just my trading, also in my everyday life.

Chris, do you have a list of suggested books to read?

Thanks,

Nazaar

Hi Chris

thanks for this wonderful article, the best ive ever read.

i am going through this similar problem and ive lost my way, this article has helped me a lot. I will try to sharpen my skills more.

thanks a million.

rocky1980

Hello Rocky,

Am glad you liked it. I am really passionate about bringing material around this (trading psychology, mind, learning process, etc.) out there

so am appreciative of the kind words and that you are finding benefit from it.

If your ever open minded enough to go down the rabbit hole regarding improving your mindset, email me via the Contact Page and i’ll talk about some of the methods

i’ve used to build a successful mindset.

Kind Regards,

Chris

Regarding the above comment, I had a good chuckle the other day when it was late and for some reason I was watching a re-run of the movie “Hamburger Hill” that was shot in the early 70’s about the Vietnam war. One of the young soldiers says to the other one who is sitting cross-legged with his eye’s closed, “what are you doing?”…”I’m meditating, it’s where you try to think of nothing”….the other soldier says…”Then how do you know if it’s working?”……….A typical misunderstanding from people that have never heard of the benefits of it or tried it. Like many things. Most of the time it takes at least a few sessions for it to work…although I must admit that the first time when I was taught it the benefits were immediate. I was around 15 years old at the time. My wife has tried many times but cannot seem to meditate….we think it is because she just can’t calm her mind…..Anyway, again, great article Chris. Cheers!

I suppose the most common thought that arises when people try to take their attention to their breath, their inner body, to hearing without labeling et cetera is “this is boring, I have important things to think about”.

If someone is ‘thinking’ that meditation is boring and they have important things to talk about, then;

a) they are getting caught up in the conditional mindstream

b) have no idea what the fruits of meditation are

c) aren’t really paying attention as meditation done well is incredibly poignant

just my experience

kind regards,

cc

I am lucky to come by this article. I remember the times I was better than the professionals in my career at very small age. All the grace is lost with lack of concentration. It is a come back now. Great Wisdom Chris. Weldone.

Hello Thiruchenduran,

Am glad you liked this article. Yes, with a lack of concentration, our natural skills and intelligence will not be applied to the moment, nor released for their expression which is a critical feedback from our experience.

I hope your comeback is a fruitful one.

Kind Regards,

Chris

Great article Chris! As someone who has practiced meditation almost every day for the past 38 years, I can attest that you have hit the nail on it’s head with your suggestions in this article. Getting to the stage of blocking out, or releasing, all other thoughts takes practice. It is not easy to work at, just like any endevour or challenge, but once accomplished the day seems to easily flow from one positive to another, particularly if you JUST LET IT. Once a person has reached that stage it then takes just a little practice to keep the “radio” part of your brain quiet at key times and let your “quietness” determine your path. Here the answer to my next step up in trading has been right before me and I failed to notice it. I tend to multi-task while I’m trying to concentrate on my trading. Two wrongs. By multi-tasking I’m FORCING my brain to concentrate…. and not just “flow” to the correct path / reaction. Some of my best trades have been when I’m NOT concentrating, just reacting or “flowing”. Many thanks for the lesson Chris.

Hello Murray,

Yes, learning how to deal with the conditional thinking patterns and distracting thoughts takes practice and learning to be able to sit with one’s mind.

It is good you recognized multi-tasking can limit or affect your concentration. It actually reduces one’s IQ and is really dividing or splitting your attention between two tasks. But also you noticed by multi-tasking, you are forcing your brain to actually be more engaged, instead of having more expansive awareness.

Thank you for sharing this and am glad you enjoyed this article.

All the best.

Chris

Another gem of an article Chris!

Personally, I know I have so much work to do in all 4 areas, however #2 Autotelicity, really holds the key to tying it all together for me.

Slowly but surely, I’m finding that the more I just enjoy my fascination with:

* how price ebbs and flows on the charts

* the various patterns price creates

* dutifully following rules for entries and exits that you have taught me

INSTEAD of just focussing on my trading account balance and the money (flowing in or out)

RESULTS IN me feeling that my understanding of price action is becoming deeper and that each trading day is becoming more enjoyable.

P.S. Big thanks for the tip on “Lumosity” a few articles back. Brain is loving it.

Tony

Quote: “Don’t judge each day by the harvest you reap but by the seeds that you plant” Robert Louis Stevenson

Hello Tony,

Tis ok that you have work to do, the process starts by first becoming aware of what you need to work on, then getting to work on those key areas.

Yes, price does ebb and flow, almost like an inhale and exhale. There are various patterns, some repeat, some are unique, but following the rules from the course will definitely help you in this process.

Balance checking is one of the most destructive and distracting habits – it can activate all kinds of thoughts, emotions and really keeps you focused on the wrong thing when you should be focused on the markets.

Good to hear you are enjoying the Lumosity – tis a great place to develop those key connections in the brain.

Kind Regards,

Chris

Hi Chris,

Great article! After reading your article it awakened something inside of me that has been buried for quite sometime. Probably everyone has a story similar to this and hopefully others can relate. I used to swim competitively on the US Masters swim team. Many of the swimmers were former college or Olympic athletes. Myself, I never swam in college and definitely not in the Olympics, but I had something. What it was I wasn’t sure, but I had a love for swimming and the willingness to go through anything to excel. I had no fear, just focusing on endless practices, etc…Anything I could do I did to achieve peak performance. I can relate to entering into a zone. There were times swimming where I forgot about everything. It was just the water and myself…nothing else…just the efficiency of sliding through the water focusing on every stroke. It’s interesting, but my learning curve decreased, and I became very successful in a shorter time frame, and before long I was swimming in the fast lane with the big dogs… and winning.

Now the interesting thing is this. I did this after having a benign brain tumor at 30 years old, which almost put me 6 feet under.

So I think this….when a persons vision is clear, the possibilities are endless!

I have a question. Trading is unlike anything I have experienced. My biggest hindrance in trading is the fear of losing. Suggestions?

Thanks again for the great article…..

Cal

Hello Cal,

If you’ve had the experience before of doing whatever was needed to achieve and stabilize in peak performance, then that information is still available to you today – just have to come in contact with it.

In regards to trading is experiencing fear, specifically the fear of losing, there are a couple of possibilities, a couple things that come to mind are;

1) risking too much in terms of $$$

2) not accepting the amount you are risking

3) or, it maybe something deeper, perhaps and unconscious or limiting belief which may be coming up during these moments

The first two can be easily dealt with, but the latter is something I’d suggest doing some ERT with (emotional re-polarization technique).

If you are interested in learning more about ERT, let me know, as I know someone who does this, and we are building a specific program just for traders in this area.

Kind Regards,

Chris

Actually, I never thought about something like this but have read it and when I think about it I may have the same problem. Fear and limiting belief. I tend to go into the “can I really do this?” zone too frequently. One other thing with me is impatience, where if I cant do it in a week, its too late, sort of thing.

One thing I “think” I have in me is to be able to follow rules and keep following them without wearing off course.

Hello Agni,

Having the ability to follow rules is critical in trading and will help a great deal. But definitely sounds like there are some limiting beliefs

which will continue to cause setbacks and you to repeat certain patterns in trading.

Luckily these things are workable and can be remedied with the right training, discipline and practice.

Kind Regards,

Chris

What a great article Chris, thankyou.

Am glad you liked it Colin – was a fun one to write.

Chris….Fantastic Article….

Thanks Chris!