This week I wanted to share several trades over the last few weeks from my students, and one of my personal live trades. Our members have adapted quite well to the changing volatility levels, playing ranges, trends, breakouts, pullbacks, intra-day and swing trading on the daily and 4hr charts.

I’ll share several live price action trading setups, giving both commentary on the trades themselves, along with pointing out any adjustments I would suggest.

The goal of this article is to show you what kind of trading you could be doing with the right training and skill set. If you have been waiting around for 1-2 bar patterns the entire time, you would have missed most of these trade signals sitting on the sidelines. Hence hopefully this will give you a different perspective on trading.

I’ll conclude the article by sharing some insights about my own trading, along with discussing the topic of ‘over-trading‘. There have been many ideas put out there as ‘truth‘ about over-trading, which are really just confusion and mis-understanding. When you are done with today’s article, you should have a new perspective on what over-trading really is (and what it is not).

For now, let’s get into these live trade setups from myself and members of my price action course.

Trade Setup #1: EURUSD Setup for +3R

Here the student recognizes a corrective pullback offering a good opportunity to trade with the trend. He astutely enters at a short term role reversal level that holds and sends the pair lower continuing the with trend move.

What I like about this trade is how he didn’t wait for a pin bar, engulfing bar or any 1-2 bar pattern to get into the trade. He had the confidence to purely trade the resistance level and sell there.

Hence no ‘confirmation‘ via a signal, and thus giving himself the best risk to reward scenario. He placed his stop 10 pips above his entry and captured +30 pips in less than an hour.

Now you may be thinking, ‘big deal…this is just 30 pips. He missed the big move in the market‘. Sure, you could say that. But in terms of catching big moves in the market, how many pips or points you take home is irrelevant.

If you make 600 pips on a trade, but had to have a 300 pip stop, you only captured +2R. So although you caught the ‘big move’ in the market, your return was the same as someone who made 100 pips of profit with a 50 pip stop. There is absolutely no difference.

So make sure not to make the freshman mistake of thinking you need to capture ‘big moves in the market‘ to profit because the same 100 pip winner can make the same profit in your account as a 600 pip winner, all by having the same +R gain. Food for thought.

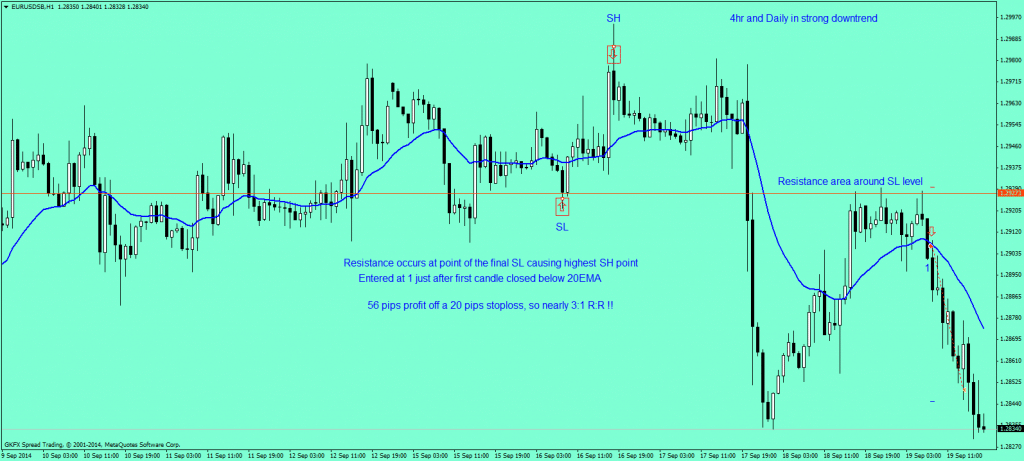

Trade Setup #2: +2.6R on EURUSD 1hr Chart

In this trade, while the EURUSD was in a consolidation the last few days, it formed a false break on Sept 17th and pulling back into the consolidation. In our members commentary on this day, we anticipated a pullback into the consolidation before it pushed lower.

Working with my price action analysis in the private members area, he looked for a short trading with the trend. His overall result was +56 pips with a 20 pip SL, so a +2.R in about 8 hours.

What I like about this trade is ability to spot the key level the market would stop at before sellers absorbed the bids, and sent the pair for another leg lower. I think his target was pretty well placed just shy of the former support level and swing low, thus being safe if buyers stepped back in there.

The one thing I’d change was his entry. I’d prefer getting in near the resistance level near 1.2927. This would improve the risk to reward on the trade, along with give him greater protection in terms of trade location.

However, I understand his theory, which was he wasn’t sure it would reverse there, and wanted to see a close below the 20 EMA before getting short. He used the 20 EMA pullback to get short, and was still able to have a small stop and solid profit. So overall, a good trade here.

Trade Setup #3: Trading the Range for +5R

Here we’ll start with the two trades from the middle to the left of the chart. As you can see, this member deftly outlined the range, and felt comfortable after the false break just before, that the range would hold and thus give him a good range play.

He bought off the bottom of the range, took first profit halfway through the range, and final profit at the top of the range. Notice how his entry on the range bottom was not a price action signal, meaning he wasn’t waiting for a 1-2 bar price action pattern. He simply played the range lows without needing ‘confirmation’.

On this trade alone he walked with +4R in less than a few hours.

His second trade on the top right of the chart was playing a breakout pullback setup to the top of the range. Reading the price action in real time, he correctly suspected a breakout setup was available. So he bought at the range support (again, with no signal), and was able to profit +1R in another few hours, thus profiting +5R on the day across two trades.

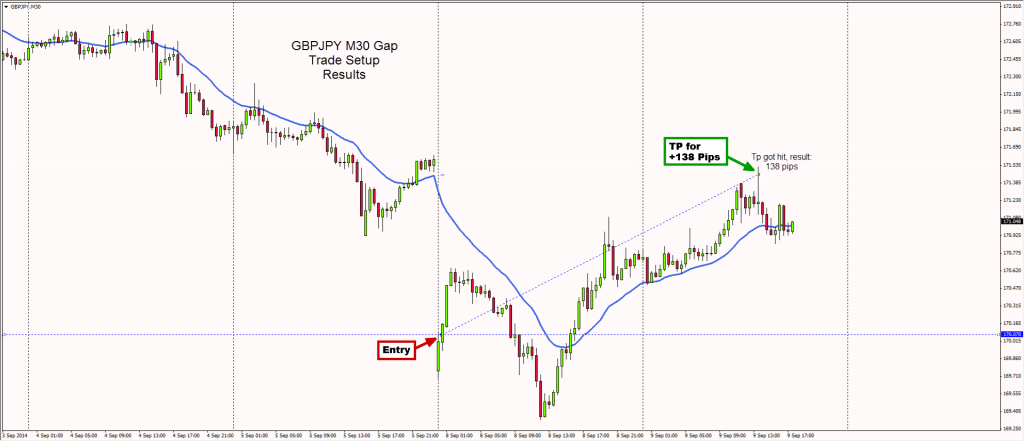

Trade Setup #4: +138 Pips on GBPJPY M30 Chart for +2R

Here the trader was playing a setup shortly after the market open, taking advantage of the gap and the market eventually filling it. His stop was well placed as the market got close to it, but shortly after the trade went towards his take profit for +138 pips and +2R.

I think what most impresses me about this trade is the student holding through it, after being nicely in profit, then watching the trade go negative, only to come back and hit his profit target. Shows maturity, patience and discipline and thus a successful trading mindset.

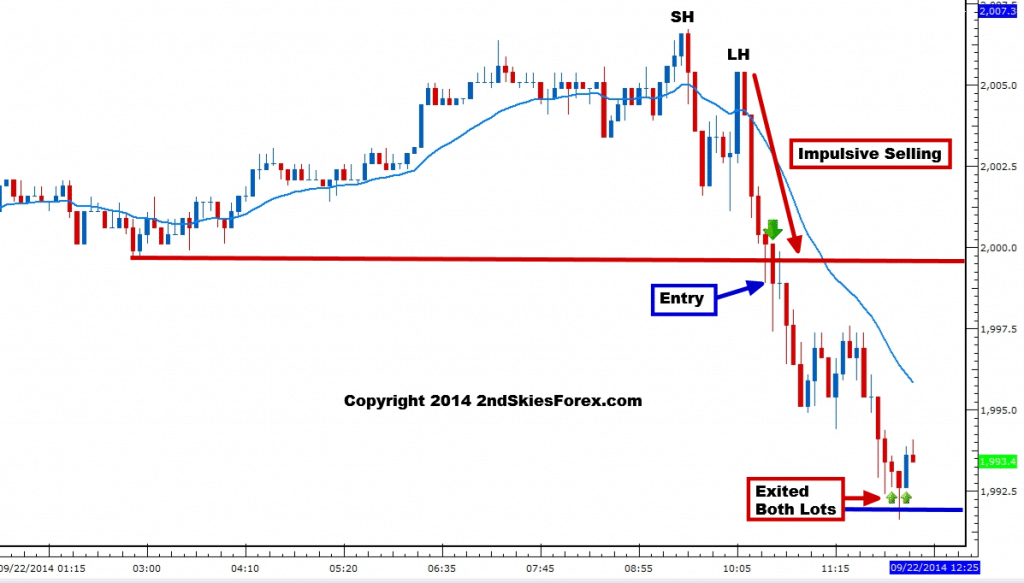

Trade Setup #5: S&P 500 Intra-day Trade for +2R

This is one of my personal live trade setups using the same strategies from my price action course. What I was reading in real time was how the S&P 500 formed a swing high, then an LH (lower high). Notice after the swing high was made, there was some impulsive selling.

After attempting to make a set of new highs, the US index failed, forming a lower high, and then selling off aggressively. This second failure, along with sellers coming in more aggressively the second time, suggested some new lows were going to be made on the day.

My line in the sand for the bulls today was the support level drawn just under 2000. Notice how the index formed a pin bar signal here, then broke lower. A pure pattern trader would have bought this and lost money quickly. This is why you have to read price action context in real time.

I entered on the break of the pin bar lows, which is where the stops of anyone buying on that pin bar would have been likely placed. Within 10 minutes, the trade was in profit and never went negative again.

I spotted ahead of time the 1992 level, which had been strong support before over the last several weeks. If bears were going to take profit heading into a level, or bids around wanting to step in, I suspected they would do this here.

You’ll notice the downside wicks heading into the support level on the bottom right near 1992 for 4 candles in a row. This was the price action communicating to me buyers were in this area and would attempt to push back on the price. After the last rejection off the level, I exited for +105 points on a 51 points of risk, so a total profit of +2R in about 1.5 hours.

After this, the index consolidated for the next 6 hours at this level, not making any new major lows, so I was able to catch the lows of the move for the day being an intra-day trade.

A Brief Comment on Over-trading

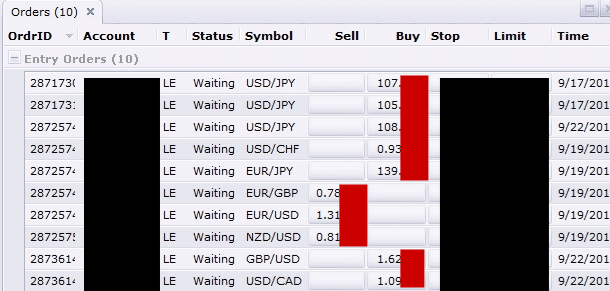

For the day, I have a total of 3 closed trades and 1 live trade running at the moment. In my pending orders list, I have 9 trades waiting. Here they are below;

All of these trades (live and pending) are a mix of intra-day and swing trades using daily and 4hr strategies. I do not just trade one style (intra-day or higher time frames). I trade all time frames. When you have the skill and training to read price action in real time, you can trade any and all time frames.

That does not mean you will make money on all of them, or that you won’t be better at one vs. the other, but with the right skill set, you can as it all comes down to training.

Now according to those who espouse only trading higher time frames, trading as much as I have today (including pending orders waiting) would be ‘over-trading’. The theory is over-trading occurs when you trade on lower time frames. Please tell that theory to every bank and prop trader, and let me know what response you get.

After you’re done humiliating yourself with such a question, you’ll realize what you’ve been told about ‘over-trading‘ is a confusion.

There is no set number of trades whereby once you cross such a maginot line, you are over-trading.

You are only ‘over-trading’ when you’ve violated any of these two conditions below;

1) You are trading a strategy not in your trading plan

2) You are trading outside (i.e. above) your risk parameters for the day

That is it!

That is the only definition of over-trading you’ll ever need. So let go of the idea that over-trading has to do with the time frame, or number of trades you make.

If you are trading 1x or 10x on the day, as long as you are trading setups only in your trading plan, and staying within your risk parameters for daily risk and overall risk, you are NOT over-trading. That is simply taking advantage of market opportunities which is your job sitting in that chair every day.

So the next time you hear someone writing how trading on lower time frames causes over-trading, just realize they do not know what they are talking about and do not understand trading.

I did only 3 intra-day trades today. Every trade was within my trading plan and risk parameters, so there was no over-trading.

The time frame you trade on has absolutely nothing to do with you over-trading. Only when you a) trade outside your trading plan and b) trade outside your risk parameters are you over-trading. And keep in mind, that can happen on any time frame!

Key Closing Points

- Catching big moves by themselves are over-rated if you have a large stop and make the same R profit as someone with 1/2 the pips and 1/2 the stop.

- Trading profitably can happen on any time frame from the 5m up to the daily.

- You don’t have to wait for a price action signal to catch a good trade. And you will often miss good trades waiting for 1-2 bar price action patterns

- Trading the level can offer you a great risk to reward ratio on a trade and give you a great trade location

- Over-trading has nothing to do with the time frame. It has to do with trading outside your plan and risk parameters. Nothing more.

- Your job sitting in that chair is to pull the trigger according to your plan while properly managing your risk. If you are not doing this, you are not trading.

So ask yourself how many opportunities you spotted today. How many trades did you miss because you were waiting for ‘confirmation‘ or a pattern to emerge? And do you pull the trigger when trade setups arise?

With proper training, you can do all of the above and learn to trade the market consistently.

These are impressive trades, yet all make a ton of sense. Thank you for sharing. Do you delete the pending orders before major news events (rate decisions, FOMC, NFP etc.) and go into these events with a clean slate?

been reading you for a while Chris ,you are simply awesome . Thankyou .

Hello Brady,

Thanks for the positive comments. Hope you can join our trading community soon.

Kind Regards,

Chris Capre

Yes a great article, especially on over-trading mindset.

Hello Mukhriz,

Glad you liked it and also noticed the key part on over-trading.

Kind Regards,

Chris Capre