Last week I talked about the importance of looking at the details and refining one’s trading game in Forex Trading, Ted Williams, & The Little Details Pt. 1 article. All highly skilled professionals realize paying attention to the details pays dividends, and often leads to the difference between being good and great. Today is the continuation of that article, where I will be sharing how making a small trading adjustment in my trading could lead to a six-figure change in profits per year.

But before I get into one small adjustment I need to make in my personal trading, I want to discuss a few amazing examples of how Ted Williams really paid attention to the details, and how these small things separated him from the rest.

Attention to Details

Ted was known to be obsessive about his hitting skills and had made several adjustments which allowed him to understand hitting better than most of his time. Here are some of the details below;

-He traditionally used a much lighter bat than most of the heavy hitters (sluggers) back in the day. To test how sensitive he was to the lightness of the bats, he was once presented with 4 bats, 3 weighing 34 ounces, and one weighing 33.5 ounces. Most people on the planet now could not tell the difference between 34 and 33.5 ounces, a .5 oz difference, or to put this in context, a 1.4% difference in the weight of the bat (.5oz / 34 = .014, or 1.4%).

Yet Ted was able to consistently tell the difference and identify the lighter bat each time.

-Ted used to warn his teammates to avoid leaving their bats on the ground. Since the bats were made of wood, this would cause them to absorb the moisture in the dirt or grass, and thus become heavier, which would slow their swing down. How would he have known this unless he was sensitive to all the details?

-After he retired, in a Sports Illustrated article, he was able to demonstrate how swinging at a pitch, just one baseball width outside the strike zone heavily affected his batting average, and he divided the strike zone into 77 baseballs, with each baseball being = to a particular batting average for each pitch in that location.

When reading the above examples of how Ted paid attention to the details, you can see why he was such a great hitter and baseball player. All of those small little details, while they may seem insignificant on their own, led to a huge difference between him and everyone else.

Paying Attention to Details in Trading

This is exactly the same for trading. Did you know using the risk of ruin tables, if you were 35% accurate, risking 2% per trade, and always taking profits at 2x your risk, you would have an 8.37% chance of blowing up your account?

But reduce your risk to 1% per trade, and the chance of you blowing up your account is only .7%, which is improving your chances of being profitable 119x?

That is quite a huge difference, all with one small detail.

SIDE NOTE: This is also the reason why we always measure risk in % terms, not in dollars terms. Professionals don’t measure risk in terms of dollars, they do it in terms of %’s, because this is where they can use the risk of ruin and math to guide them about trading performance as dollars are relative to you.

The One Details Which = A Six Figure Difference

I was reviewing my trading journal one day in March this year, and noticed a behavior continually repeating itself. I had been making sure to mark in my journal since 2012, every time I entered at market, but also noting if I was entering a bit early in relationship to the system entry. I marked it with the code EM (‘entered at market’) / HOP (‘hit original price’).

Several weeks ago, I noticed this happening several times in the same week, so I started to go back through my entire trading journal over the last 12 mos to see how many times this happened. The answer….

78% of all trades entered at market, would have executed at the original price the system gave the entry at. This occurred a total of 242x in the last 12 months.

3.6 Pips

I decided to compile a few more stats to really get into the details and see what kind of effect this was having on my trading.

The average entry was 3.6 pips less than my system entry price.

Now 3.6 pips may not seem like a lot, but it has a significant effect on your trading. To give an example, lets say you have the following trade setup with my system giving me the stop and take profit (limit) levels using the following data below;

Long EURUSD at 1.3003 (entered 3 pips early at market)

Target = 1.3103 (100 pips)

Stop = 1.2953 (50 pips)

Total reward to risk ratio is 2:1

But lets adjust this by just 3 pips, meaning I entered at 1.3000, still had the stop at the same level (1.2953) and target (1.3003) assuming they were my targets based on the original price action system numbers.

This translates into the stop being 47 pips, and the target being 103 pips, or a 6 pip difference. This also increases the reward to risk ratio from 2:1, to 2.2:1, or a 10% difference just in the R:R ratios.

This 3 pip earlier entry, was in reality a 6 pip difference, but for me, the number was 3.6 pips, so a total of 7.2 pips of difference in performance. Assuming a 50% win ratio, 7.2 pips x 242 EM/HOP (entered at market/hit original price) would result in a 1742.4 pips difference. Based on the average lot size, this would = ~200K USD. Even if we halve this performance, it would still be ~100K USD, which is a huge difference in performance, per year!

The Difference Between…

After getting over the initial shock of how much of a difference this small detail meant in my performance, I have come to a greater understanding of how important the small details are in trading and performance (in anything). Often times, these small details can be the difference between losing and winning, between breaking even and making money, between being just good or great.

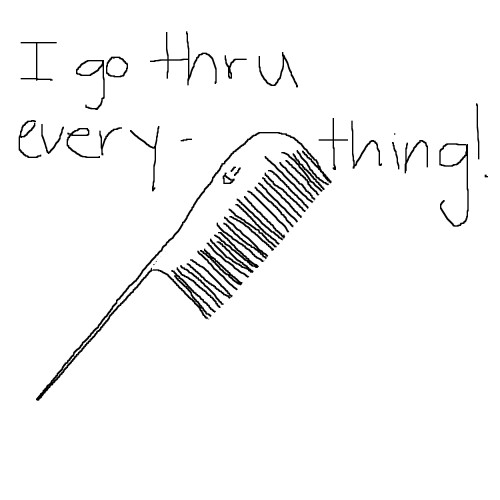

Thus, make sure to apply a fine comb to your trading account performance and journal, to mine the little details which could be separating you from losing and winning, or making a little money to a lot. You cannot underestimate the power and difference a few small pips, or one small bad habit can have on your trading.

All highly skilled professionals pay attention to these small details, as they can truly create a world of difference in performance. Jimmy Hendrix realized this when adjusting his guitars. Ted Williams also realized this when it came to baseball and batting.

The question then remains, will you take the time to find the little details which could be holding you back? How much is it worth to you, to take a few hours away from the screen time, the beach, or the bars drinking, so you can increase your performance by a huge amount? The benefits could last you a lifetime, and it’s possible this could be one of the best reward-to-risk plays you ever embark on.

8 thoughts on “Forex Trading, Ted Williams, & The Little Details Pt. 2”

Comments are closed.

Hi Chris

Its so true It reminds me of a leaking tap that I had although it only leaked a small amount over time it had a big effect on my bill

Hello Dave,

What a great analogy that captures the idea perfectly.

Kind Regards,

Chris Capre

Yes, you are right. How many trades do I have to look at to get a good idea of my ratio?

Hello Lola,

Min. sample set would be 30-50, and that is on the low end. The more the better and more statistically useful/accurate it will be.

Kind Regards,

Chris Capre

Hello Chris,

Good article, “attention to detail” something I am working on at the moment..

Thank You,

Hugo

Hello Hugo,

Something we can all work on consistently, but glad you liked the article.

Kind Regards,

Chris Capre

Hi there, how much data on the 4 hour and daily timeframes do I need to go through in order to calculate my % win rate? 6 months? 1 year? What sample of data will be sufficient and how often do I have to keep reassessing my win ratio?

Thankyou in advance.

Hello Lola,

Are you referring to how many trades you need to take before getting a good sample of data with your trading?

Kind Regards,

Chris Capre