Effective Trailing Stops

One of the most common questions I get from traders is how to trail a trade.There are several solutions and one of them is to have two targets whereby the 1st one gets easily hit and then you move the stop to BE (breakeven) to reduce the risk.However, trades can often go for a run so there has to be a way to systematically measure and trail the position.

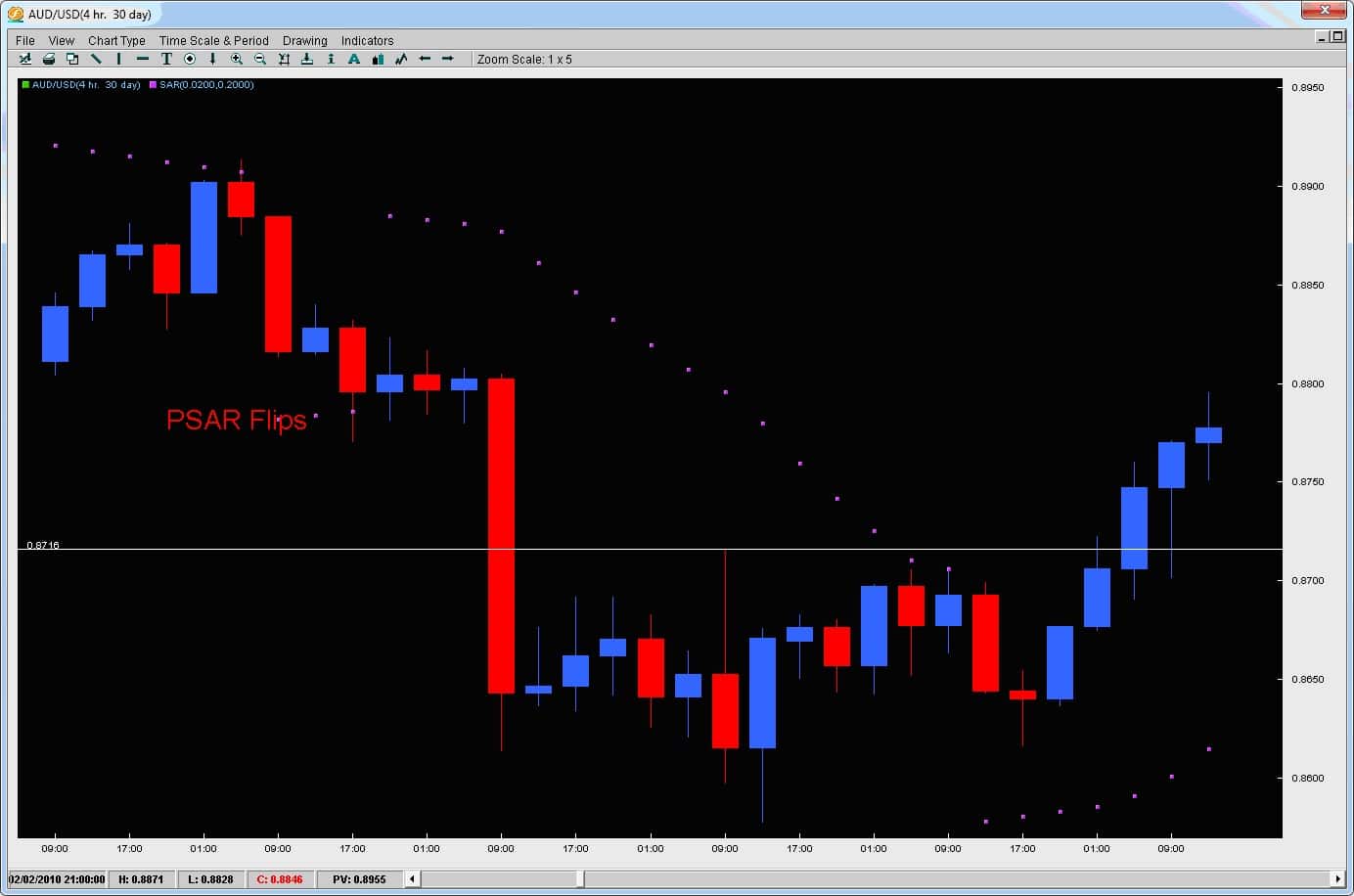

One effective trailing stop forex method or indicator is the Parabolic SAR which stands for ‘Stop and Reverse’. In many ways, this indicator was built for this and is ideal but the typical method of using it may not work so we are going to offer a solution. Take a look at the chart below on the AUDUSD 4hr time compression.Notice how its falling steadily in the beginning but then later gets more impulsive.Trends do not always move the way we want them to which is a straight line like Carl Lewis in the 100M sprint.Trends can oscillate back and forth like inhaling and exhaling but the bottom line is they are still in tact. One way to use the Parabolic SAR is to trail behind each dot say by 15pips on time frames 1-4hrs and 9pips less than the 1hr time frame.You only have to adjust the stop at the close of each candle.If it gets tagged, fine your out but if its still active, adjust it after each candle.In the chart below, we could have gotten short on the break of .9000 and by trailing behind the PSAR dots we would have stayed in this position for a while.

Using the traditional method for the PSAR you would exit the position.We offer and alternative which is to keep the last stop you had on the last dot that was on the side of the trend.By doing this, if the pair flipped for a small corrective move, then when the trend continues you will still be in the trade.If you get stopped out, you still locked in profit.We feel this is much more advantageous as is still gives you an opportunity to be in the market.In this case, it would have turned into much greater profits staying in the trend banking another 110pips.

Then at the bottom when the pair is really ready to reverse, your PSAR trailing stop gets hit and you lock in your profits as you no longer want to be in the position.

We actually have two very popular forex trailing stop strategy (Shadow Swing Trading) which use proprietary trailing stops that are great at keeping you in trending moves capturing the lions share of the move while neutralizing risk as quickly as possible on intraday time frames.

If you would like to learn more about our systems, check out our courses.