I recently had a great opportunity to see a host of famous actors speak along with meeting several of them. They shared a lot of stories about their experiences throughout their career, including several of the roles they are famous for. One story in particular made me think of trading.

What most of us see when we witness actors is the success, fame and money they have made over the years. But many actually have a story to tell that is unique to them. This story, if you listen carefully, often highlights a wisdom which can be useful for our lives (even trading).

Although I cannot say he is my most followed actor, after hearing some of his personal stories, I was impressed and appreciate his ‘wisdom qualities‘.

William Shatner is most famous for his role as Captain Kirk in the popular Star Trek franchise. If you were to interview 10,000 people and say his name, probably the first words from 95+% of them would be ‘Captain Kirk‘ or ‘Star Trek’.

What most do not realize is he originally trained as a classical Shakespearean actor with his first minor roles in the early 50’s. Slowly working his way up to small TV/Broadway/film roles, it wasn’t until 1966 that his most famous role as Captain Kirk.

The original show ran from 66′-69′, but was then canceled after receiving moderate reviews. The year it ended was also the same year he went through a divorce. This is where it starts to get really interesting.

After being typecast as ‘Kirk’, he had a hard time finding roles. Never mind the fact he went through a divorce (difficult in itself), he had three kids to feed and lost his home. He lived out of a truck bed camper for a quite a while, where he had days without food in the fridge. He took whatever small roles he could to support his kids.

During the 1970’s, he got small roles which eventually led back him landing a film role in the first Star Trek film again as Captain Kirk. Six more Star Trek films, along with two TV series roles led to a new level of fame that would last him a lifetime.

To Recap

He worked for 15+ years before landing the Kirk role, to which he played for 3 years and then lost his job. He lived in a camper with no food for days on end, and did whatever it took to make it work. He never stopped working towards his goal, no matter how hard it got, even after two+ decades with no/little money for his hard work. Yet after 27+ years of this, he finally landed an opportunity which lasted him a lifetime.

He has demonstrated the mindset of success, a determination and willingness to keep going after his goal after incredible hardships and failures. Ironically, these are the same things required to be successful in forex trading.

One last note I’d like to share about Mr. Shatner before discussing another subject.

Through some really savvy business deals, he has become a deca-millionaire several times over. He is now 82 years of age, yet still works incredibly hard – traveling to conferences, TV projects, one man shows, competing in horseback riding and more – all at 82!

He doesn’t need the money at this point (hasn’t for decades) – yet works tenaciously hard. Why? Because he is passionate about what he does. He likes to create, produce and continually challenge himself.

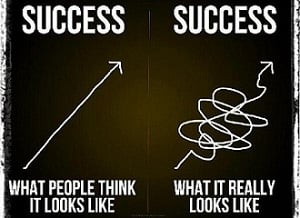

Underneath the unique history of his failures, work ethic, and successful mindset is another critical point. That is – most people think of success as a straight line, but in actuality it is nothing from it. It is beset with years of hard work, preparation, and overcoming challenges. It is wrought with failures, mistakes, and low points.

Most people go through these things, whether its acting, sports, or trading. The difference between successful and unsuccessful people is how they respond to those moments, particularly when things go wrong or become difficult. Successful mindsets keep moving forward and find solutions.

They are willing to work hard whether their fridge is empty or full – have a home or not. They are passionate about what they do, and meet each failure with more effort than before. What is required to be a success in forex trading is the same.

Your path as a trader and equity curve will in all probability not move in an upward 45 degree line. It will require you to work when you do not want to, and make decisions that feel incredibly uncomfortable (almost irrational). They will not be your preferences, nor will they be easy.

You will need to prepare day after day, and the work never ends. It will require you to maintain a high level of energy, and will demand you to get up from each failure. Your emotions will fight you at almost every step in the way – yet you need to be calm and clear.

This is what is required to be consistent and successful at forex trading. Whether you meet this challenge will be entirely up to you, your mindset and choices from this moment forward.

But I’d like to end with a hats off to Mr. Shatner for sharing some of his wisdom qualities and stories. He has earned his success, traversing difficulties where most would fold, while never stopping to move forward.

Once again a truly inspirational post Chris. Star Trek has always been one of my fav series and even in the recent 2 parts – they stand for personal leadership and decision making in complete uncertainty. It is great to hear WS story as a human which only makes him bigger in my eyes. I love your penchant for connecting the personal leadership stories to trading and they seem to always come at the right time to me. Thanks once again

I really appreciate the effort you put in writing this articles.I find them very inspirational especially after doing things as per what i have learned then i end up making loses,it makes it difficult to stay focused and get back on my feet.success doesn’t come easy as people think.Thank you for sharing and energizing me when i feel like giving up.be blessed

Hello Ishmael,

I am glad you are finding the articles useful and inspirational. We all experience losses or downturns in trading. It is what you do and how you react to them that defines your growth or lack thereof as a trader. They are opportunities to grow indeed, but glad you felt energized by this article.

Kind Regards,

Chris Capre

Great story Chris. Funnily enough I recently saw some lame commercial with him in it and thought, gosh, why does he bother? Perhaps he’s still scarred by his experiences with destitution and feels that if you get any opportunity to get paid for doing something that you enjoy you should take it no matter how much money you may have. I think another key takeaway here is to never retire and always look for new challenges. He’s definitely a great example to follow.

Very good example of survivorship bias

Hello Sebastian,

Hmm, there seems to be a confusion here. I am not overlooking people who did not ‘survive’ because of their lack of visibility, while only concentrating on the ones who did (which would be survivorship bias). I am talking about someone who went through a unique process to them specifically. There is no way you could compare logically what he went through in relationship to his ‘process’, as opposed to what others went through which was their unique process.

Nor am I excluding others which no longer exist, or studying specifically a ‘remaining population’ – because I am not comparing various actors here. I’m simply talking about one person, his unique events, and how he dealt with them individually (without regard to references to other actors).

Survivorship bias applied to this case would be ignoring all the others in his graduating class, that took all the same classes (or similar), and also went through the same programs and theatre schools as he did, yet failed to make a certain level of success like he did. Then isolating certain characteristics about his success story (perhaps stating because he was male, of x years and graduated with this level of grades, or something of the sort), and attributing those specific qualities as the reason why he succeeded – while ignoring the others who went through his classes, school, training programs.

Yet I am not doing this at all in any way shape or form, so there seems to be a confusion here about this being an example of ‘survivorship bias’ as this is nothing of the sort.

Kind Regards,

Chris Capre

I agree with Petra here. I too have learnt a lot about myself since I entered this path and your courses. I really appreciate your writing this type of articles as I find them very inspirational during hard times, when is difficult to stay focused and get back on your feet but stories like these is what helps me get to the end of the day.

I personally do not recall him playing Star Trek but I have seen Boston Legal and he is really amazing at it and really enjoyable to see. Great actor, great story, great man by not ever giving up on his dreams during harsh times. That’s what I most fight for every day for myself.

Kind regards,

Great inspiration. Bookmarking this page. thanks Chris.

Fantastic article Chris . You never know what the life of a successful man can hide…

Ive never seen Star Trek (shame on me:) but I really enjoy reading your articles about psychology and mind set. This part I actually enjoy the most from whole trading path. I have already learned a lot about myself. its amazing how trading itself and learning about trading open a new door to another world 🙂

Hello Petra,

Yes, definitely something here to learn about the trading path (and all paths for that matter).

But if you get a chance, I’d definitely recommend watching some of the movies and various series.

Kind Regards,

Chris Capre

Nice piece. Anybody who doubts the abilities of William Shatner should watch Boston Legal. I have all five series on DVD and he and James Spader are brilliant in their respective roles. I’d love to meet WS. His story is an inspiration.

Agreed, I don’t watch TV much anymore, but from what I had seen about that series, his acting and role was impressive.

Kind Regards,

Chris Capre