Many times, acquisitions are good for the acquiring companies, especially when they already have solid foundations in their industry. Will such be the story of Walker & Dunlop (NYSE: WD).

What Has Happened:

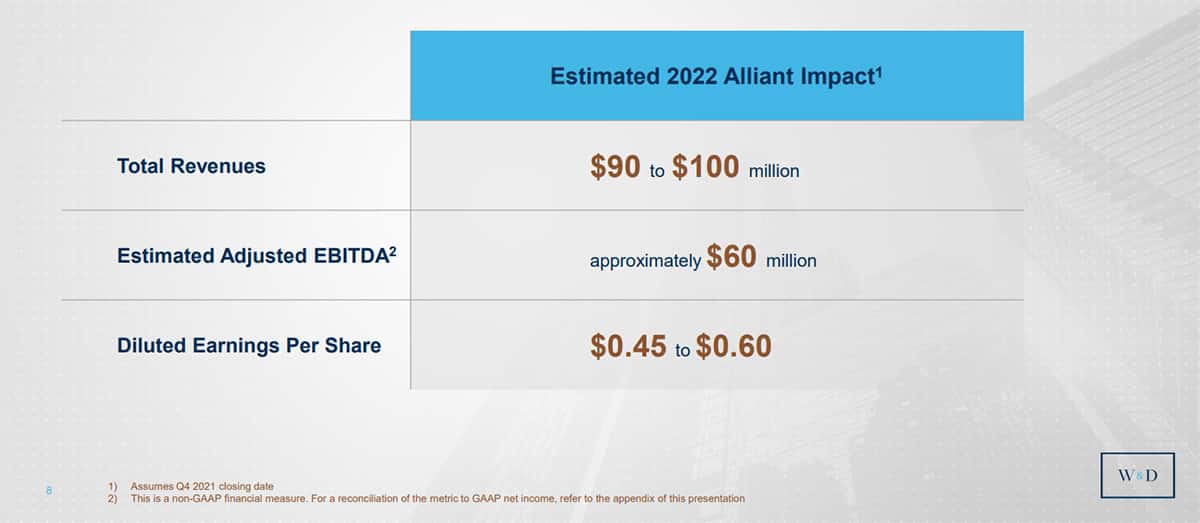

On the 16th of December, 2021, Walker & Dunlop announced the acquisition of Alliant Capital. This acquisition is set to help Walker & Dunlop better penetrate its market, and the company estimates the impact to be immediate.

Source: The Lazy Artist Gallery

Why This Matters:

Walker & Dunlop is a leading real estate lender in the United states — the biggest multifamily capital lender and the fifth largest lender on commercial real estate, such as offices, hospitality in the country. Alliant is the sixth largest low-income house tax credit (LIHTC) syndicator in the United States.

The absorption of Alliant into itself places Walker & Dunlop in a better position to influence housing on the U.S. “Combining the largest provider of capital,” Willy Walker, Chairman and CEO of Walker & Dunlop, said, “to the multifamily industry with the sixth largest low-income housing tax credit syndicator in the nation creates a focused affordable housing financing platform with few peers. Walker & Dunlop is now a big part of the solution to build and maintain affordable and workforce housing across America.”

Source: Walker & Dunlop

Walker & Dunlop estimates the acquisition would raise the total revenues by $100 million, while also driving the estimated adjusted EBITDA by $60 million.

What Now?

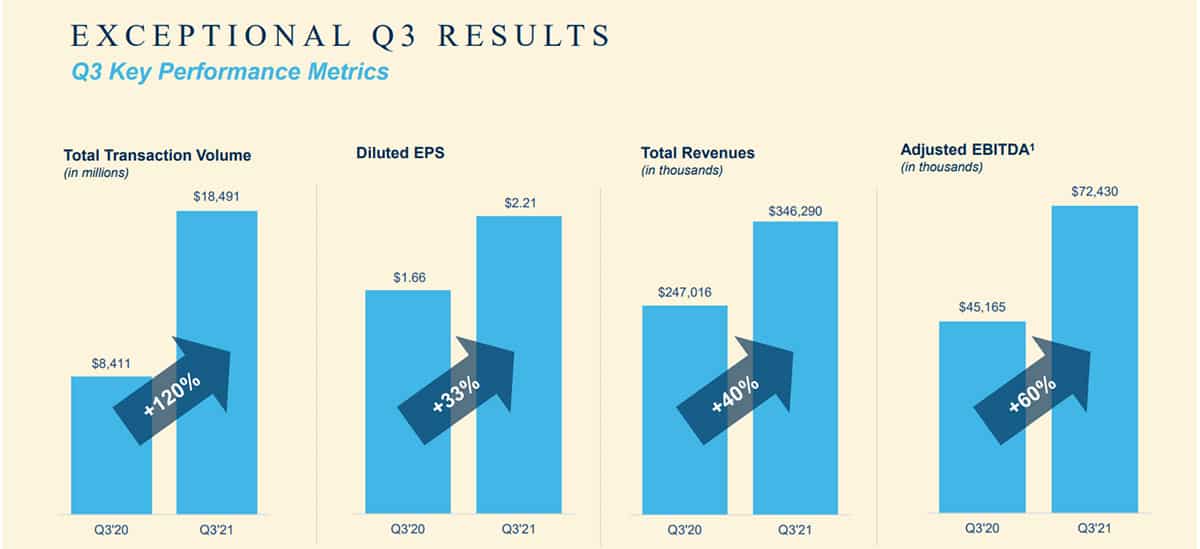

The Alliant acquisition is only going to boost the consistently outstanding performances Walker & Dunlop has already built. In the company’s latest quarter, Q3 FY 2021, total transaction volume rose by 120% to $18.5 billion, total revenues increased by 40% to $346 million, and earnings by 60% to $72 million year-on-year.

Source: Walker & Dunlop

The growth opportunity is also there for the real estate lender. According to Freddie Marc Forecast, the total multifamily loan originations are expected to grow to $476 billion by 2022. MBA estimated it to be about $421 billion this year.

With such impressive results, the next thing on your mind may be to get in on the stock. For that, we’ll do a little technical analysis on the stock.

Technical Analysis

The $152 – $157 resistance level proved to be a too strong resistance level for WD, as it was immediately repelled at contact, effectively preventing any new all-time highs.

WD has a support at the $113 – $117 price range to which the price may make further correction before continuing on its bullish journey. If this support level fails to hold, the next support level is at the $80 – $84 price range. But we expect the price to hit the dynamic support level in the form of the bullish trendline that originated in April 2020 before it hits this lower support level.

Although price targets are higher than the current price, only a further correction to lower prices could provide a palatable entry level for the stock.