Did Branson ground his stock?

What Happened?

After a successful first flight into space, Branson’s Virgin Galactic (Nasdaq: SPCE) is down almost 15% on Monday as of 2:00 p.m. EDT.

On July 11th, the space tourism company helped push forward the commercial space industry taking a full crew up to space, including the well know business magnate Richard Branson.

One would think stock traders and investors would be bullish on the news, so why did $SPCE fall almost 15% today?

Buy the News, Sell the Fact?

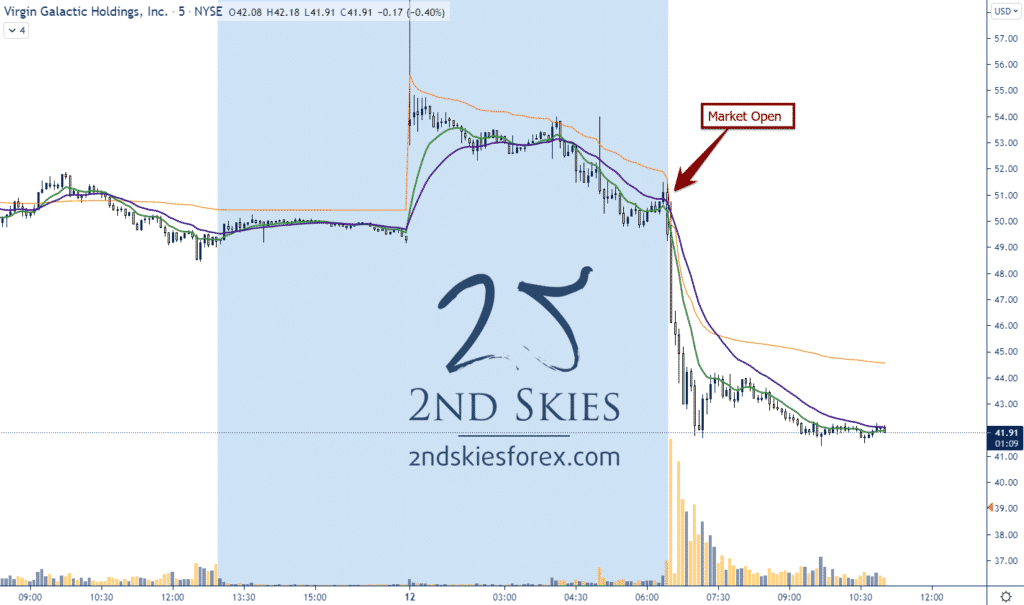

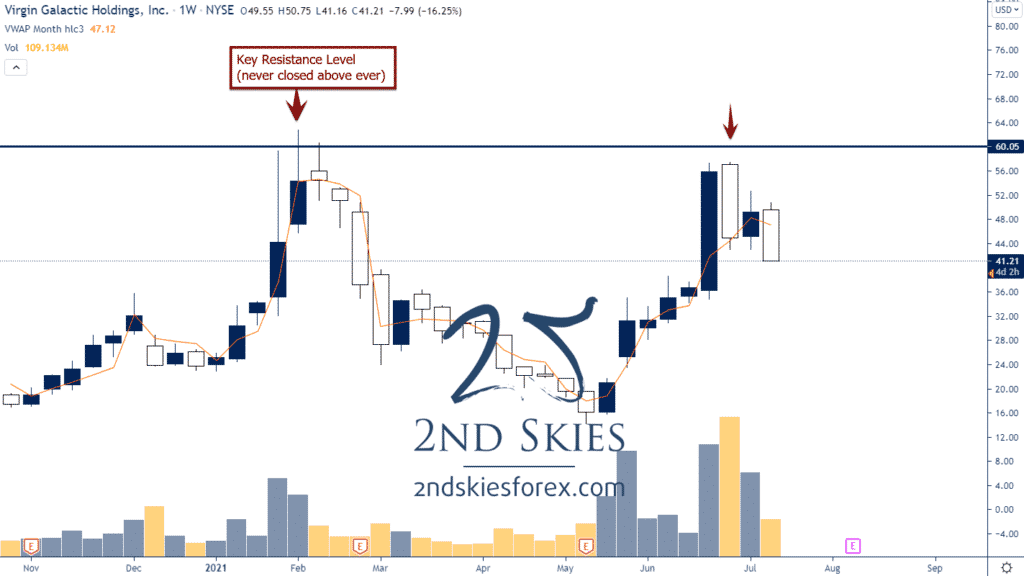

Space was initially up over 10% pre-market, but quickly fell after tagging the key resistance at $60. Today’s volume of 107+ million shares shows the stock was heavily traded today with a lot of selling on the open. It’s average 10 day volume is at 76 million, hence we have a 40% increase in trading volume.

So why did it fall?

I think there are two culprits here:

Reason #1: Heavy Option Positioning At Resistance

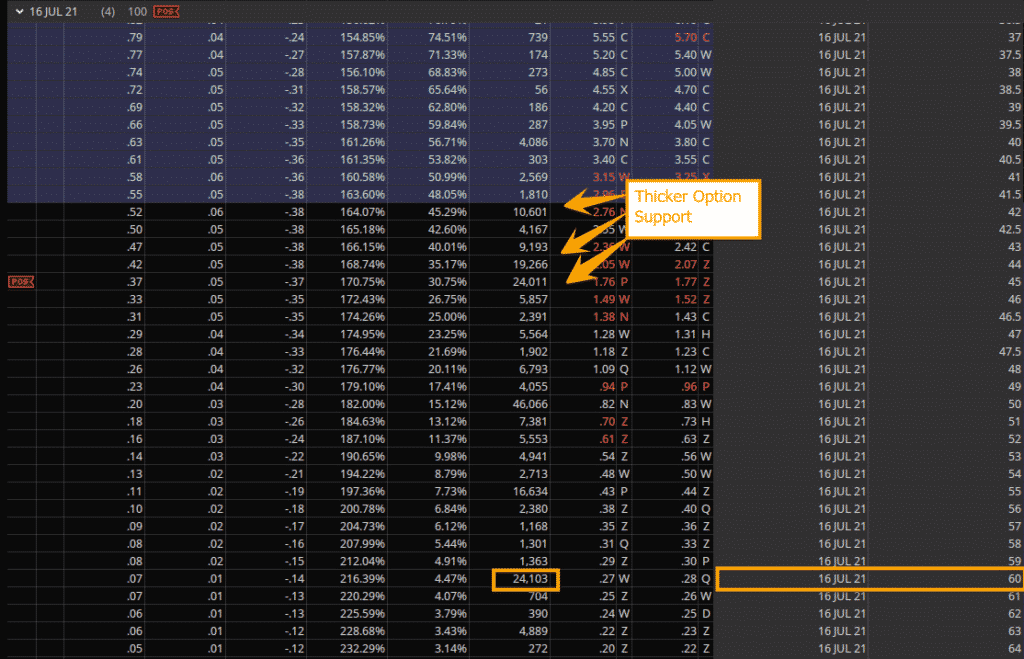

$SPCE has over 60% of its options expiring this Friday. And with the option market having a total of roughly 650K calls and 475K puts, not only is the market more long calls than puts, but you have a lot of calls that are going to be monetized at the July op-ex (July 16th).

As you can see from the option chain below, SPACE only had 24K calls at the $60 strike, but not much below it till the $55 and $50 strikes. Meanwhile if you look at the strikes between $42-45, you’ll see a lot more option traders willing to buy at these prices.

I think a fair amount of those $60 calls were sold to collect on the high implied volatility (215%) and thus take the premium. If you also look at the price action on the weekly chart, $SPCE has never closed above $60 in its history. So it was a tall order to get and stay above $60.

Hence I am not surprised to see SPACE sell off today. Profit taking + heavy option positioning made it hard to maintain a $60 share price.

Reason #2: Sell the Fact

$SPCE had let everyone know weeks in advance it was going to run its test flight on July 11th. I think traders built up long positions leading into the event, then sold to take profit once the news was no longer news, but a fact (the flight was successful).

Combine these two, and it makes complete sense why $SPCE fell heavy today.

Now What?

The $40 strike is a major level for the stock to hold. The current impulsive and corrective structure on the 5 minute charts suggest more downside in the short term. How it closes today (above or below $40) will have an impact on whether value investors want to buy the dip, or wait for lower prices.

If SPACE closes below the $40 strike this week, that will put pressure on the next support between $35 and $30.

FULL DISCLOSURE: Chris Capre currently has a long stock position in $SPCE, along with open option positions as well. If you’d like to learn more about Chris’s live trades, you can get access via the Trading Masterclass where he shares his live trades and daily market analysis.