This stock is not the flashiest. We can’t promise it will 2X or 10X your investment in the next year or even the next decade. But for value investors, Jazz Pharmaceuticals PLC (Nasdaq: JAZZ) is definitely worth giving a second look.

Source: Pietro Jeng

Jazz Pharmaceuticals is a researcher, developer, manufacturer, and seller of medicines for rare ailments. The company focuses on neuroscience and oncology niches. Some of the most popular drugs in the company’s inventory include Xyrem, Zepzelca, and Xywav.

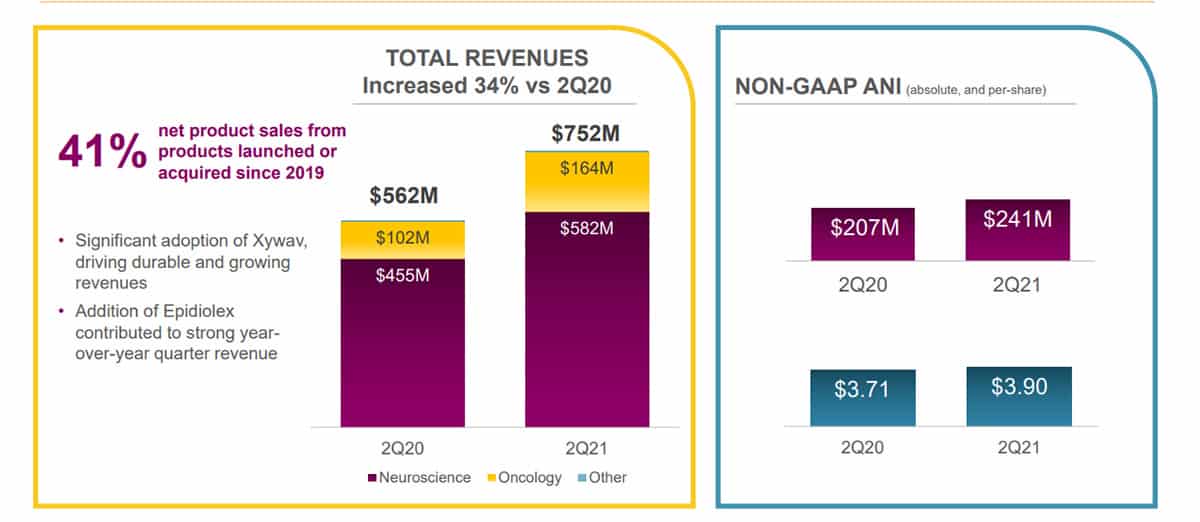

While Zepzelca raked in $55.9 million in net product sales in Q2 FY21, Oxybate (a combination of Xyrem and Xywav) only saw a 3% increase to $458.3 million at the same time from what it was the year before. JAZZ made $751.8 million at the end of Q2 FY, a 34% increase year on year.

Source: Jazz Pharmaceuticals

Perhaps, the brightest star in the galaxy of Jazz Pharmaceuticals Plc. is its acquisition of GW Pharmaceuticals, a CBD-based drug maker. With this acquisition, Jazz Pharma can claim the revenues coming from Epidiolex, a drug that treats seizures because of scarce forms of epilepsy. This drug helped JAZZ make up to $109.5 million in sales.

Europe and the US also gave Epidiolex regulatory approval to treat seizures induced from a rare tumor called tuberous sclerosis complex (TSC). This approval exposes the company to up to 50,000 patients in the US and about 2 million patients in the world.

This drug may be what drives the revenue growth for JAZZ in the coming years,

Technical Analysis

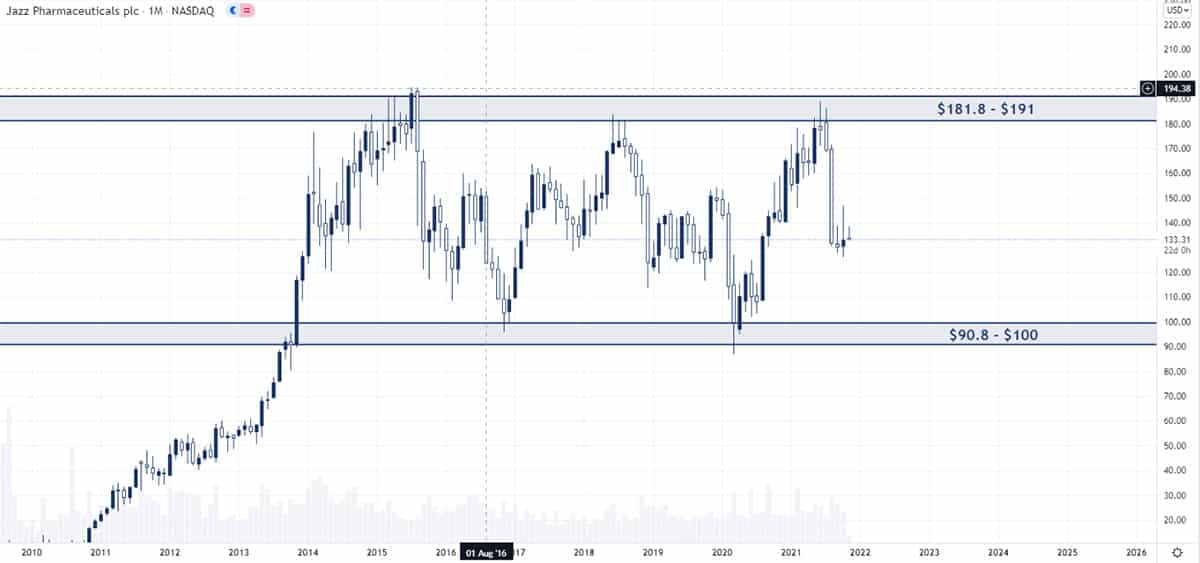

To help us understand what the JAZZ stock is telling us through the chart, we pulled up the stock on the monthly chart.

PS: If you’re a growth investor, look away, please.

On the monthly chart, we noticed that the stock has been in consolidation for the past eight years. And honestly, we don’t think it is breaking out of the range soon, as it is right in the middle of the range after bouncing off the longstanding $181.8 – $191 resistance level. In fact, the stock might very well dip some more before it sees its next bullish run.

For entry levels, we advise that investors err on the side of caution. The best entry point is to wait for the stock to bottom out at the $90.8 – $100 support level. From there, you may claim the potential 80%-plus ride to the resistance level.

However, if you’re not so patient, you may delve into the weekly chart to seek potential entry levels. Each of the following levels may be a good buy level:

- $155.8 – $159.5

- $142.5 – $145.7

- $127.5 – $130.8

- $114 – $117.5

Don’t forget, however, that you would be buying in the of a range, and the price could go either way from this position.

Option Positioning

There is not many options or open interest in JAZZ with only 12K call options and 9K puts, so nothing to write home to mama about and thus we take our option data with a large grain of red sea salt.

Be that as it may, there is strong open interest around $130 which lines up with the technical support level above.

FULL DISCLOSURE: Chris Capre currently has no orders in $JAZZ. If you’d like to learn more about Chris’s trades and positions, you can get access via the Trading Masterclass where he shares his live trades, further investment ideas and daily market analysis.

Or you can get access to Chris Capre’s entire trading portfolio by becoming a subscriber to Benji Factory.