In an industry where behemoths rule, Snowflake Inc (NYSE: SNOW) has managed to gain customers, retain them, and produce immense growth statistics. This one is a proper growth stock, but for investors with behemoth risk appetites.

Source: Egor Kamelev

Snowflake harnesses the power of the public cloud to allow organizations to save, share, unite, scale and manipulate their data. It also offers innovative AI solutions with which these organizations can analyze their stored data to produce growth-driving results.

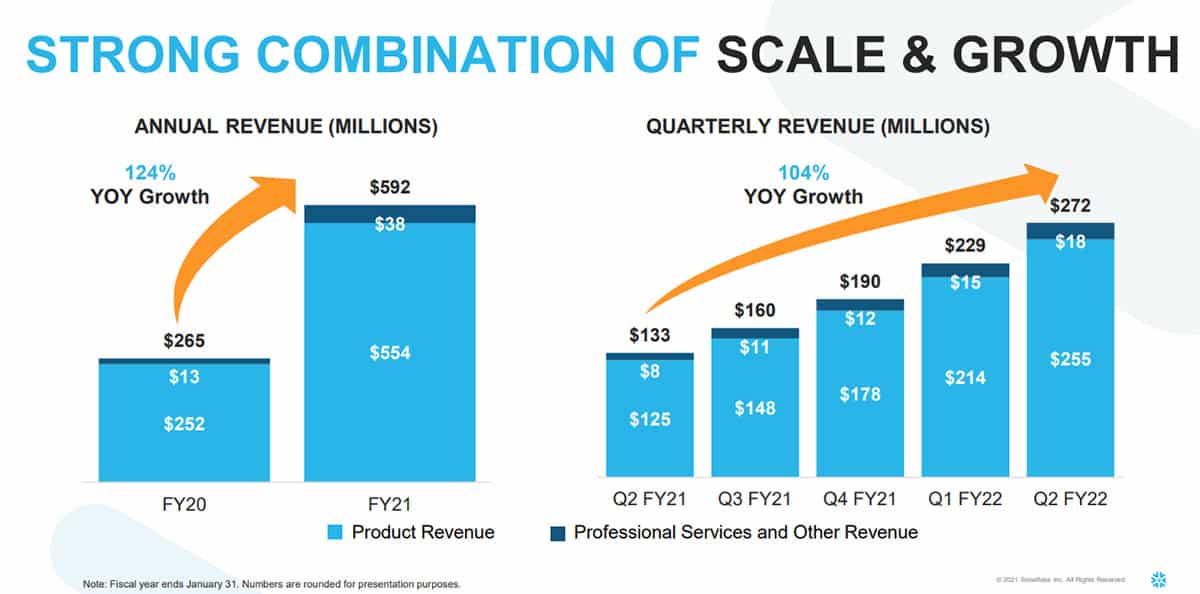

One of the first things you look for in a growth stock is its growth potential, and Snowflake is not short of this. The cloud-based company estimates about a $90 billion market opportunity for its cloud data platform and its financial growth backs up this possibility. FY ‘21 saw Snowflake make a 124% year-on-year growth on its annual revenue from $265 million. Its Q2 FY ‘22 result also trumped its year-on-year result by 104% from $133 million.

This growth is massive by all standards and two things are going to be crucial if the company aims to keep it up. The first is the customer recruitment rate, and the other is the customer retention rate. Snowflake seems to be doing well in both crucial areas. The company has continued to gain more customers, with total customers growing by 60% year-on-year from Q2 ‘21, and Fortune500 customers growing by 34% in the same time. The retention rate is also massive at over 150% for 5 consecutive quarters.

Source: Snowflake

If Snowflake manages to sustain even a half of this level of growth, it would at least double your investment within a decade. But the company may not go far if it cannot outsmart its giant competitors, Microsoft’s (Nasdaq: MSFT) Azure and Amazon (Nasdaq: AMZN) Web Services (AWS). Already, Snowflake has its platform based on these two bigger rivals. And unless the leadership of the company has something magical up its sleeves, Snowflake may never grow into maturity.

Another potential downside is that the stock is overvalued at the moment, and any bad news can send it falling like a snowflake to the ground. However, the stock remains a growth stock, and it still has the capacity to do what growth stocks do; grow.

Technical Analysis

The Snowflake stock just broke through a crucial resistance level ($323 – $332) and currently sits on it as a support level. We expect the price to continue its upward momentum from this level and maybe even challenge its ATH level of $430.

However, if the stock breaks the support level once again to the downside, the next support level is at $255 – $265.

Option Positioning

There are about 100K calls and 105K puts out there on SNOW, so quite balanced. The next major expiration for the option traders out there is the Nov op-ex (19th), so no short term issues.

I’m seeing option support around $320 which lines up with our first support zone.

If you’d like to learn how we use options to generate monthly income, then check out our option trading course here.

FULL DISCLOSURE: Chris Capre currently owns $SNOW. If you’d like to learn more about Chris’s trades and positions, you can get access via the Trading Masterclass where he shares his live trades, further investment ideas and daily market analysis.