A Sector Looking For Disruption

The company we’re going to talk about is highly disruptive in a sector that for years has been governed by massively slow, expensive and bureaucratic companies.

But this is about to change as new technology finally has been introduced into the fray. The industry we’re talking about is the insurance industry and the company providing this disruptive force is Lemonade (NYSE: LMND).

If you have not heard about Lemonade before, it’s an insurance company utilizing a mobile-first platform with artificial intelligence to do the selling and administration for them.

Not only does this allow them to keep costs low, but the big amounts of data they are able to collect allows them to make better predictions, specifically about risk/fraud which helps to keep unnecessary claim payments to a minimum, and this lowers the prices for the end customer.

Looking at the growth of the company compared to its competitors, it’s nothing short of amazing. In 4 years, LMND was able to grow its customer base from zero to 1 million, whereas it took State Farm, which is the leader in the industry 22 years to reach the same number of customers. This goes to show the power of new technology when applied correctly.

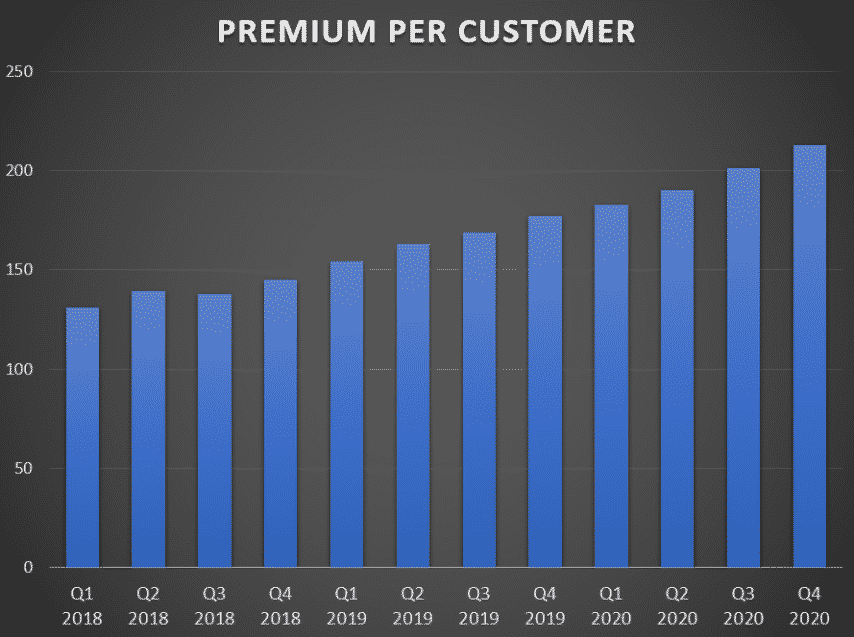

In terms of recent numbers, the company is growing at an impressive rate with a 56% increase in customers in Q4 2020 alone whilst premium per customer also increased 20%.

(source: Lemonade)

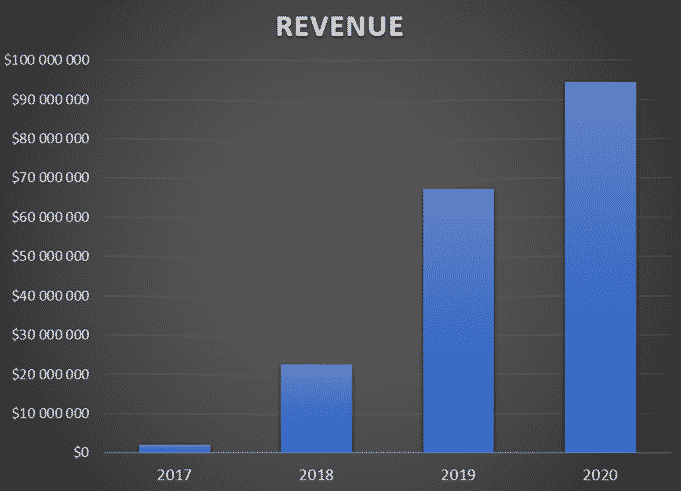

This growth is also reflected in the company’s year-on-year revenue increase. In 2020 Lemonade generated $94.4 million in revenue, an impressive increase of 40.27% compared to 2019.

(source: Lemonade)

On top of the already impressive numbers the company delivers, Lemonade recently announced their next product which is car insurance. This will add another $300 billion market to the company’s opportunity in the United States alone.

In conclusion, we feel that Lemonade with its tech, to cut off a slice of the cake in the insurance industry and that now is a good time to invest before the next growth cycle kicks in.

Technical Analysis

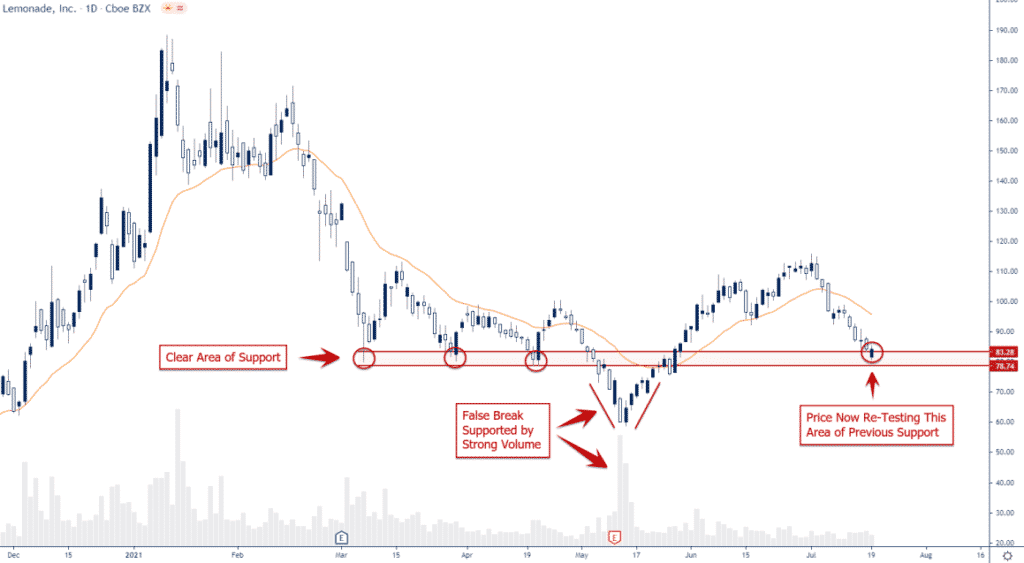

Between Lemonade’s IPO on the 2nd of July 2020 and mid-January this year, the stock price surged an impressive 278% to $188. Apparently, the market didn’t fully agree with this valuation as sellers started to step in, pushing the price of the stock all the way down to $59 on May 12th which is a -68% decline from the stock’s all-time-high. One contributing factor likely also was an equity offering from the company in January.

After this massive sell-off, the stock impulsively snapped back above $80 (on strong volume), an area of clear support with multiple touches/bounces in the past, producing a false break at this key support zone.

After rallying back to $110, the price of the stock has now pulled back for a first real test of this key support zone following the false break. Overall, we think that this pullback into a key support zone offers a good zone for long-term bulls to look for potential entry locations.

Option Positioning

Currently there are about 65K calls and 70K puts, so slightly heavy on the put side. However, most of the options aren’t expiring till September, so August shouldn’t see massive swings or changes in terms of option positioning.

Currently we look for $85 to hold as resistance, but that buyers should start to step in between $75-70 with $60 being a very strong value point.

FULL DISCLOSURE: Chris Capre currently has no stock or option position in LMND. If you’d like to learn more about Chris’s trades and positions, you can get access via the Trading Masterclass where he shares his live trades, further investment ideas and daily market analysis.