As databases and the cloud are becoming more and more interwoven, some companies, such as MongoDB, Inc. (Nasdaq: MDB), are beginning to establish themselves in that sweet spot of intersection between these two technologies.

Source: Rawpixel.com

MongoDB is a peculiar database company that stands out with its innovative database management solutions.

Every website or online platform has a database where pieces of information are kept and organized in rows and columns. However, the kind of files we deal with in this tech age aren’t those that would naturally fit into rows and columns. This is where MongoDB shines.

MongoDB offers an efficient solution to the storing and management of such files in databases made of code rather than rows and columns. The result is a wide embrace from software developers and an eruption in stock values as well as revenue generation for Mongo DB.

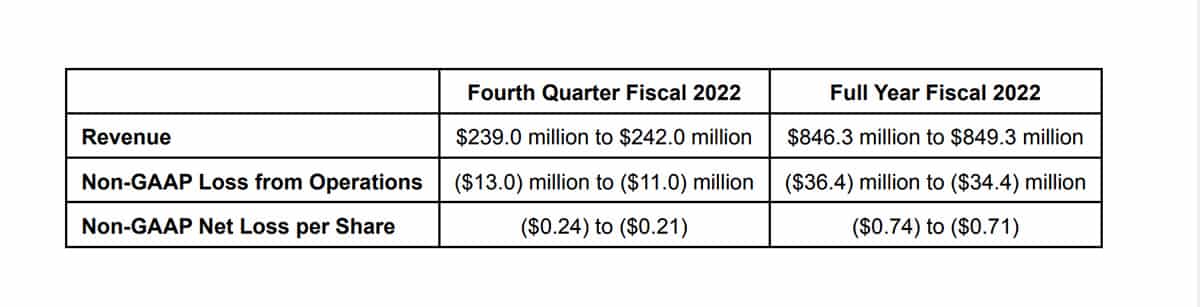

In the most recent quarterly report, Q3 FY 2022, MongoDB saw a 50% rise in revenue to $226.89 million year-on-year. The majority of this income came from subscriptions, which increased by 51% year-on-year to take up 96% of the total revenue at $217.87 million. This result means the company has gained more customers and/or has gotten its existing customers to spend more. The company estimates that Q4 FY 2022 is going to be even better with its guidance of $239 million – $242 million.

Source: MongoDB

MongoDB finds itself in a market that the IDC has estimated to be worth $121 billion by 2025. To add some context here, MongoDB is only a company that started in 2018, now has a market cap of $25 billion, and has fair growth potential.

The one thing that can’t be ignored is that MongoDB is in the same database management market as giants Microsoft and Oracle. Although the company has shown it can retain customers and even steal new ones from under the noses of the giants, it will be interesting to see how the company holds out long term.

Technical Analysis

MDB stock is headed down after tearing the $423 – $444 support level apart. But one could argue that the stock was long overdue for a correction, having steadily crept by almost 2000% to an all-time high of $592. It has now shed 37% off of that all-time high level and desperately seeks a support level on which to settle. The $247 – $270 support level might just provide that.

If the Heads and Shoulders pattern that appeared at the stock’s peak is anything to go by, then MDB still has another 37% dip to go. And as it would be, this level coincides with the $247 – $270 support level. If the price does make it to the support level, it would place the stock at a more attractive entry area for potential investors.