The timing of the Coinbase (Nasdaq: COIN) IPO couldn’t have been worse, as that period marked the turning point for most cryptos, which ‘topped out’ and sold off heavily, dragging the stock of the leading crypto-trading exchange with it. In some sense, the IPO was more a direct listing, which is really just a way for executives to cash out.

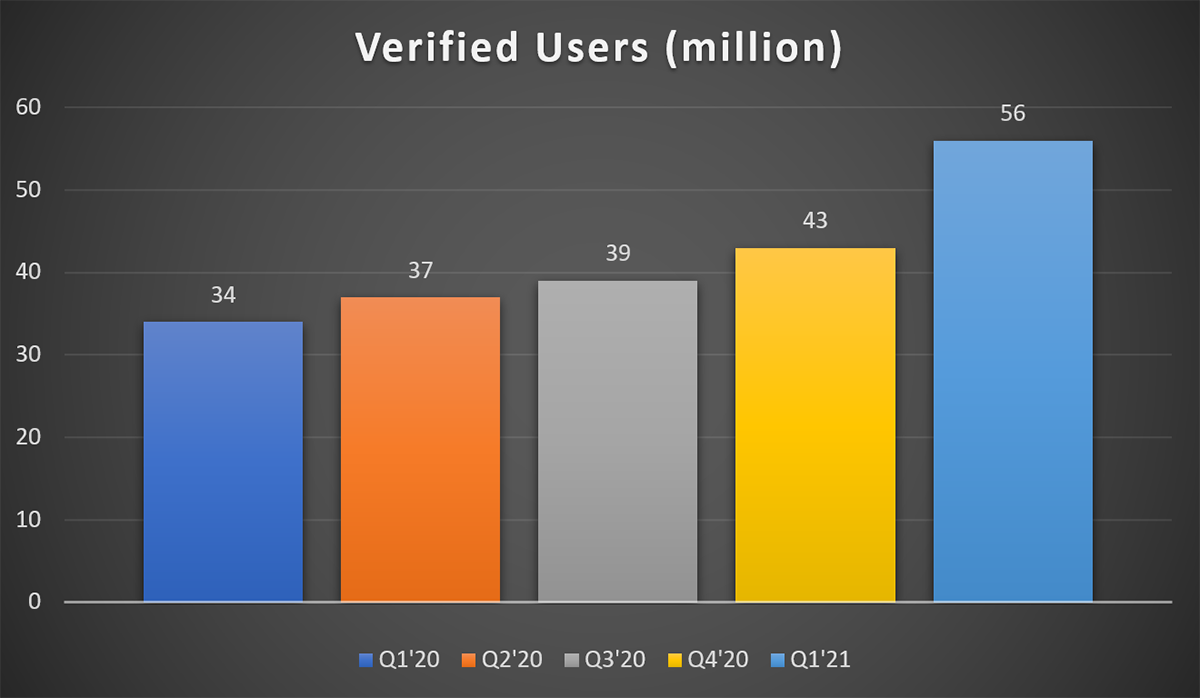

However, the position that Coinbase holds should not be underestimated. The market leading exchange for crypto currencies now has 56 million verified users, and is operating in more than 100 countries with a quarterly volume traded of $335 billion.

It’s no surprise that the stock price will be affected by strong trends in the pricing of crypto currencies. But it’s important to remember that the company’s revenue comes from trading fees and crypto traders which tend to be very active.

Thus, high volatility in the crypto market, which it is well-know for, translates into increased trading activity and fees paid by traders adjusting their positions.

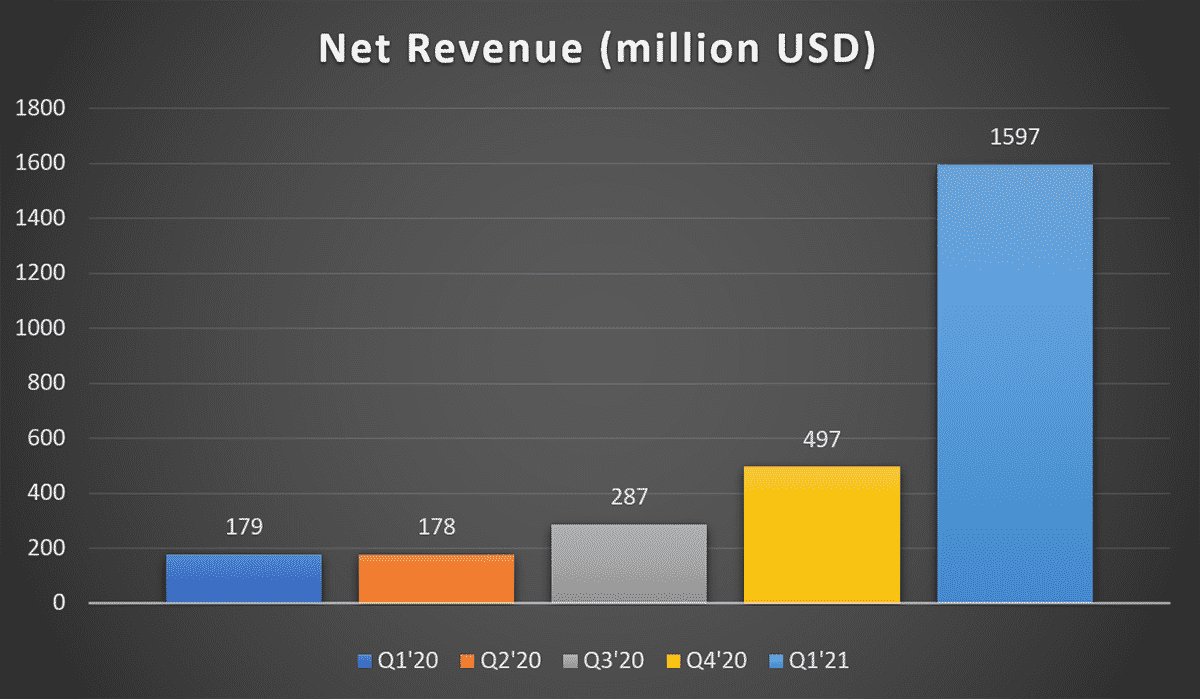

Just looking at the growth of verified users and growth of net revenue alone should spark your interest in this stock.

The company saw verified users increase by 64% in Q1 on a YoY basis and net revenue exploded by a massive 792.18% in Q1 compared to Q1 2020!

(Source: Coinbase)

It’s no wonder that most analysts remain heavily bullish on Coinbase with 15 buy recommendations, 4 hold and only 1 sell, with an average price target of $360 (source: WSJ Markets).

Whilst it is true that the company is and will be heavily affected by the future of the crypto market itself, which has proven to be a very volatile journey, we think that the recent financial report speaks for itself, making Coinbase an attractive growth stock for investors looking for above-average returns.

Technical Analysis

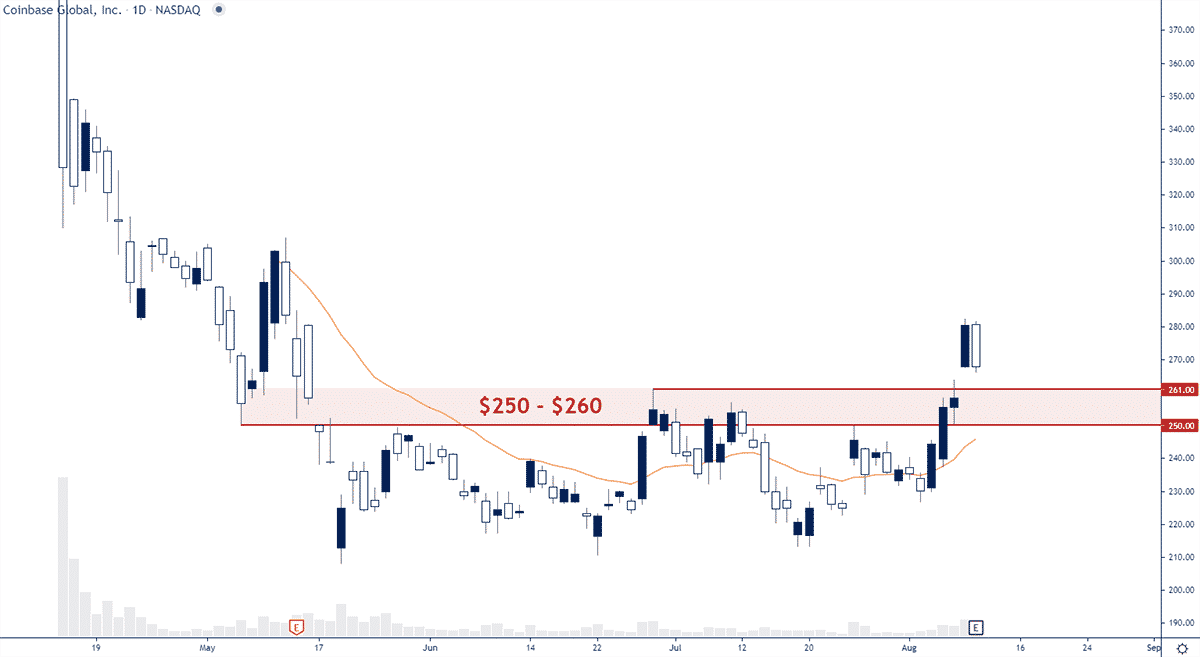

After dropping by 50% post-IPO, the stock stabilized in a range between $208-$260, a range which price now has broken out of to the upside following the recent bullish order flow in the crypto space.

We think that the broken resistance zone and top of this previous range between $250-$260 provides an attractive area for bulls looking to long this stock, whilst the all-time-lows between $208-$216 undeniably would be an even more attractive location.

Option Positioning

Currently there are about 200K calls and 150K puts with 15% of the options rolling off this August op-ex. There is a fair amount of options positioned around 250 with it being one of the top gamma strikes out there. Hence this aligns with the recent zone the stock broke out of for at least a partial long and having more size below in our lower price range.

FULL DISCLOSURE: Chris Capre currently has no stock or option position in COIN. If you’d like to learn more about Chris’s trades and positions, you can get access via the Trading Masterclass where he shares his live trades, further investment ideas and daily market analysis.