As more companies move their services online, there is the need to also move their worker profiles online, manage authentication and authorization services for these workers, and provide identity security. This relatively sparsely populated niche is where Okta, Inc. (Nasdaq: OKTA) reigns.

Source: fauxels

Okta offers an identity management platform through which businesses migrate their process and people to the digital space while also providing the necessary security to prevent identity theft.

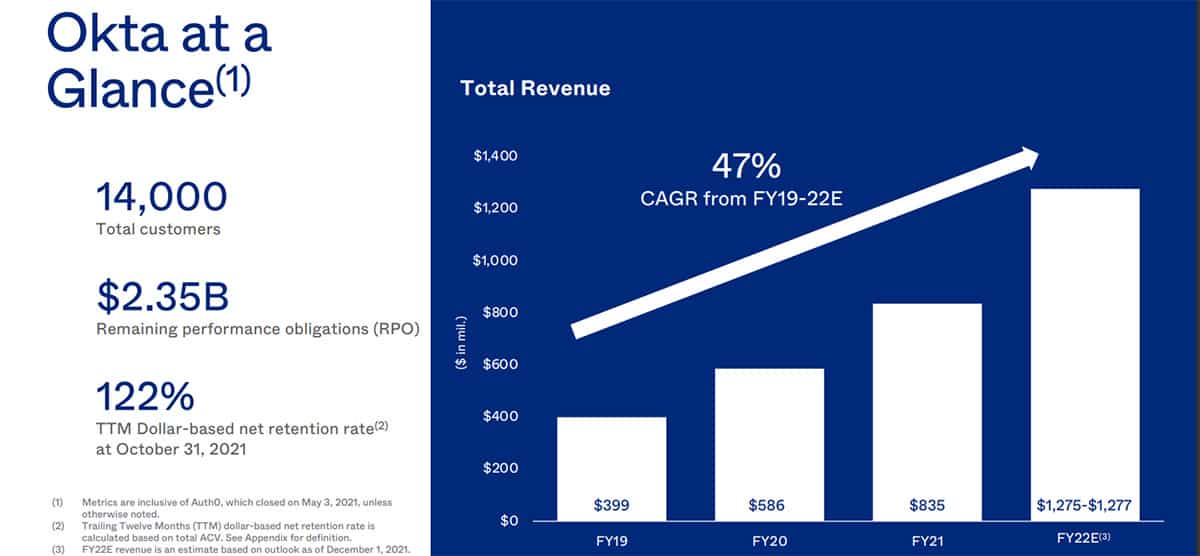

Q3 FY 2022 was not a great quarter for Okta. The company reported a total revenue of $351 million, a 61% increase from what it was in Q3 FY21. In this same quarter, the company reported a TTM- dollar-based net retention rate of 122%. This metric is used to determine how well the company is doing with gaining new customers and retaining them. And with a value of 122%, it means Okta is not only retaining customers, but it is also getting them to spend more.

Source: Okta

Thanks to these impressive Q3 figures, Okta raised its revenue guidance and estimated the company would end the year with total revenue of $1.26 billion, over 50% year on year.

The growth opportunity is also there for Okta. The company, in its Q3 FY 22 report, estimated its Total Addressable Market (TAM) at $80 billion. To achieve this, the company intends to strike more partnerships going forward, expand internationally, and develop its recent pretty penny acquisition, Auth0.

Technical Analysis

If you were asked to point at a stock that has not had a good 2021, you wouldn’t be wrong if your pick was Okta. The stock rode on a momentum that drove it for years into the first couple of months in 2021. Since then, the price has only gone sideways.

Despite this sideways formation, one chart pattern that immediately becomes obvious is the pennant chart pattern. Two bullish trends sandwich a triangular-looking sideways price movement.

When you bring the good ol’ support and resistance level into perspective, you notice that the price recently touched the $190 – $199 support level and is likely headed in a temporary bullish direction. But there’s no way to know for sure where the price goes from here.

While investors may not mind this short-term uncertainty, some traders will enter a long position on the stock and close at the next support level. The more conservative traders, on the other hand, would love to see the price drop some more before they even begin to consider a trade entry.