The year is all but over. If you’re like many other investors, you’re preparing for the new year by making investment plans for the year. Now more than ever, you are looking for beaten-down stocks with substantial upside potentials in the coming years. If we just described you, Amyris, Inc. (Nasdaq: AMRS) might be worth your attention.

Source: Tima Miroshnichenko

What Happened?

November and December have not been good for holders of AMRS stock in their portfolios so far. Amyris is a synthetic biology establishment that produces bio-based sustainable products. After the company released an underwhelming 30% year-on-year dip in ingredient production revenues, the bears pounced. A 65% dip has since ravaged the stock.

Amyris’ CEO, John Melo, had supply chain disruptions to blame for the unexciting report, and he expects the company to suffer into the fourth quarter. It also cited the late quarter launches of new brands as another reason for the challenging conditions the company found itself in.

What Now?

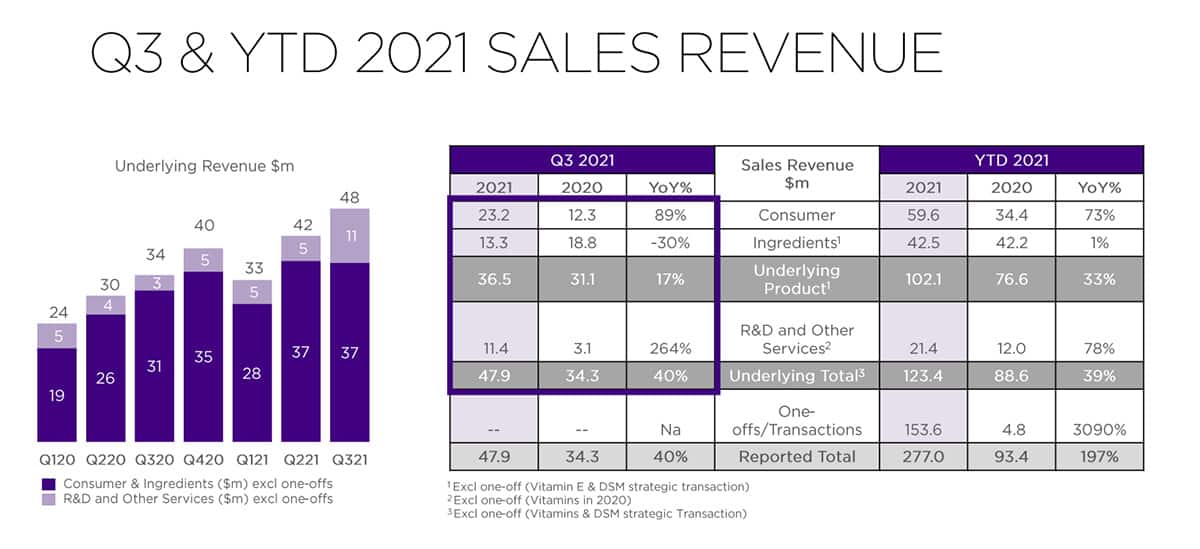

The ingredient production revenue was only one of the few things that didn’t go well for Amyris in the third quarter. Apart from those, the consumer product sales revenue gained by 87%, underlying products increased by 17%, and the company’s R&D and other services soared by 264% over what they were the previous FY year. In addition, the company reduced debt by 43% while increasing cash by over 300%.

Source: Amyris

Already, Amyris is working hard to fight the supply chain headwinds it faced this year. It plans to begin operations at a new ingredients plant with four production lines in Brazil early in 2022. It also plans to start up a 150,000 ft sq. consumer production facility in Nevada in 2022. The CEO believes these two are going to directly ease the supply chain headwinds.

Going into the new year, Amyris will hope to turn the tide and end the year stronger than where it’s ending this one. And this is what investors are hopeful about.

Technical Analysis

If the $5 – $6 support level is not enough to hold the plunging price, we may see a continued bearish charge to the lower $1 – $2 support level. So at the moment, our short-term sentiment towards AMRS is bearish.

However, if the price bounces back up from the support level, our sentiment may change. But that all depends on what happens between that support level and the $9 – $10 resistance level. A breakout from the resistance level would be a powerful statement of intent from the bulls.

Based on the fundamentals and the other things the company has in the works, though, we hold a bullish sentiment for the stock long-term.