When a company has a history of consistent increase in dividend yields for 25 consecutive years, it is called a Dividend Aristocrat. This is no easy feat and companies rarely make the list.

Then, there are Dividend Kings. These have a 50-year consecutive dividend yield increase. If being a Dividend Aristocrat was a hard feat, being a Dividend King is twice as hard. And our stock for today, 3M Company (Nasdaq: MMM), belongs to this proud category of stocks with over 60 long years of consecutive increase in dividend yield.

(Source: Photo by Lukas from Pexels)

3M Company has over 50,000 products in almost all industries. These companies fall into four major groups; safety & industrial, transportation & electronics, health care, and the consumer industry.

A major advantage of such a diversified product base is that the company can weather most economic storms and still come out on top. When revenues are not looking good in one industry, the company can always make up for it in other industries. That the company has raked in over 60 consecutive years of dividend yield increase is enough proof.

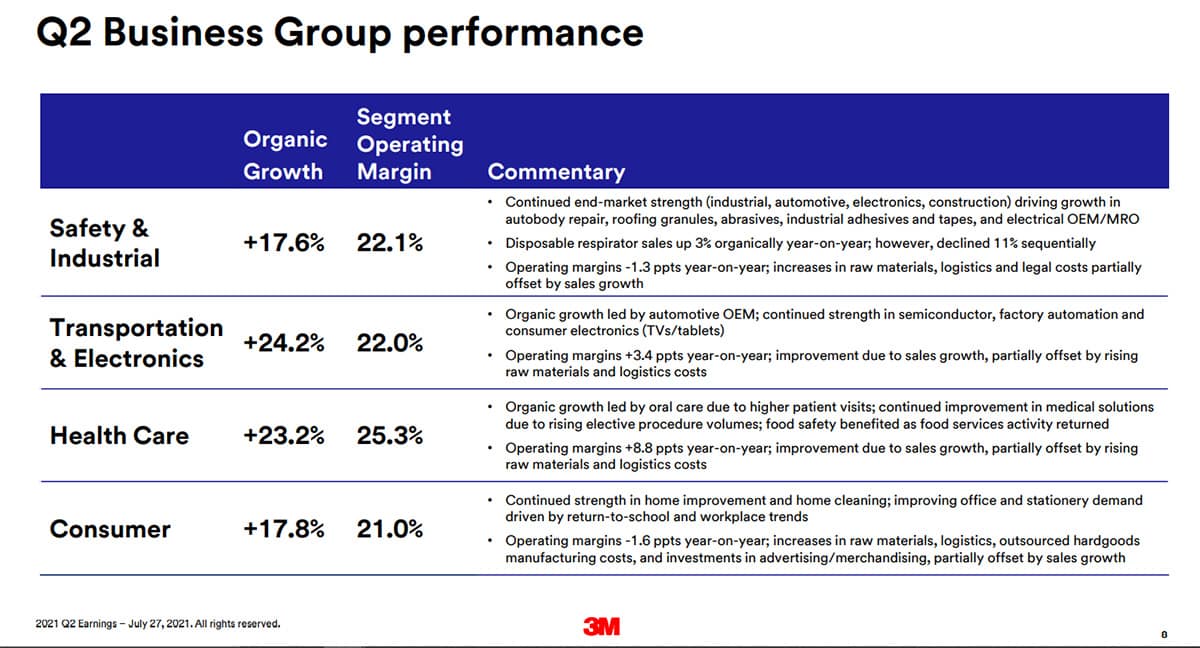

The revenue figures of 3M Company have also been impressive. When the company reported its Q2 FY2021 earnings, revenue had grown by 24.7% from the same period in FY2020. In the same report, the company recorded at least a 17.6% increase in organic growth in its four major industrial groups.

(Source: 3M)

You should note that it’s not all good news at 3M at the moment, though. The dividend yield for the stock as we speak (October 2021) is down to 3.3% after the company has faced some harsh times because of the Coronavirus and raw material inflation. But the 3M Company is known for always being able to weather the storm. Hopefully, this time wouldn’t be different.

Technical Analysis

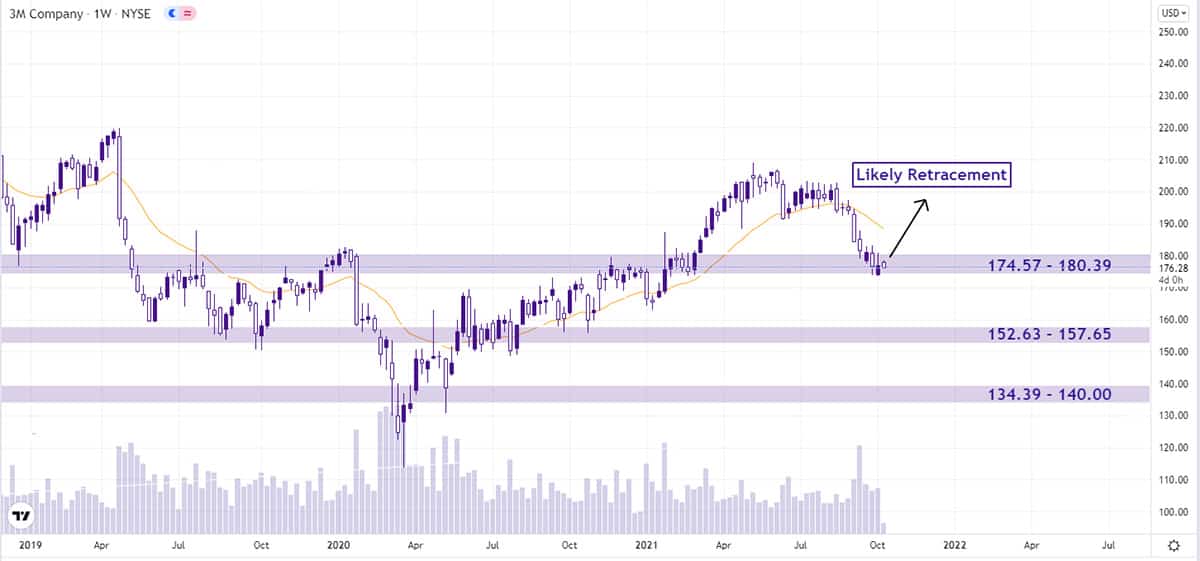

The 3M stock has pulled out of the consolidation it was in for a little over a year now. It broke out of the resistance level ($174.57 – $180.39) and now, it’s currently retesting the same level as a support level.

Once the retracement is complete and the price bounces off the retracement level, you may look to enter long positions on the stock. However, if this support level fails to hold, the next support levels are within $152.63 – $157.65 and $134.39 – $140.00. The price can gather enough strength to make a bullish challenge from any of these lower support levels.

Option Positioning

Currently there are about 90K calls and 100K puts, so a bit put heavy on the option positioning.

Short term there are about 55% of the options expiring this Friday, which may create a headwind for the stock into this Friday’s op-ex.

However after that, option support seems to be coming in between $168 and $175.

FULL DISCLOSURE: Chris Capre currently has no stock or option position in MMM. If you’d like to learn more about Chris’s trades and positions, you can get access via the Trading Masterclass where he shares his live trades, further investment ideas and daily market analysis.