Software automation of all sorts has been at the forefront of digital technology for a long time, and it will continue to be that way. And one sector that has enjoyed this automation is the accounting sector, thanks to companies like Blackline, Inc. (Nasdaq: BL)

Source: Mikhail Nilov

Blackline creates a space for itself in the accounting industry by helping accountants handle smaller tasks, while the accountants themselves focus on more important tasks. The company offers software solutions that can handle control assurance, intercompany accounting, account reconciliations, transaction matching, journal entry, and others.

The solutions Blackline offers can be used across various industries, as long as accounting exists there. The customers it has in its books are some of the world’s biggest companies, including Spotify, Domino’s, Mastercard, and IBM. But the more interesting thing is that these big companies seem to be loyal to Blackline. The business runs on a subscription model and the renewal rate has never dropped below 97% since 2017.

(Source: Blackline)

The growth opportunities for Blackline are massive. The accounting automation company estimates that it has a Total Addressable Market (TAM) of over $28 billion from 165,000 target customers. Of the TAM, Blackline has only claimed $387 million from about 3600 customers. Blackline intends to reach this market by gaining more customers, providing better solutions for existing customers, and through business expansion.

(Source: Blackline)

Blackline also has solid financials to propel it towards these growth opportunities, with the company recording a 23% year-on-year growth in revenues in Q2 FY 2021.

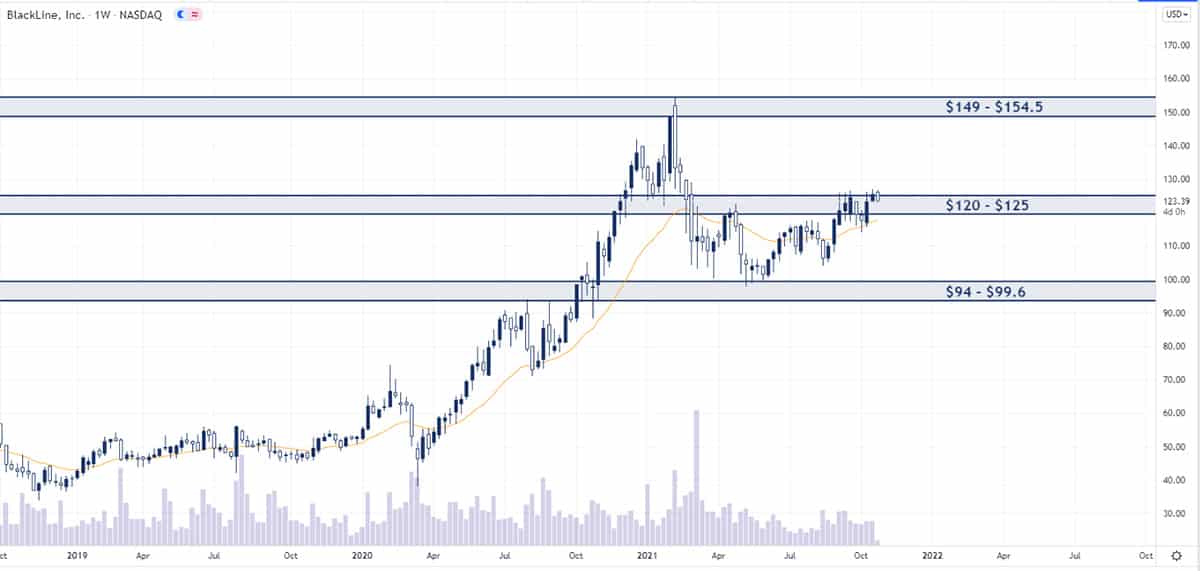

Technical Analysis

BL is once again nearing its all-time high, having fallen short of it by about 35%. It found support on the $94 – $99.6 level, from where it is currently pushing against the $120 – $125 resistance level. If the stock breaks through this resistance level, it only has its all-time high to challenge. And we believe it can easily achieve this if all goes to plan.

However, if the stock makes a U-turn from this resistance level, it could be stuck in the consolidation zone between the $94 – $99.6 and $120 – $125 levels.

Ultimately, we believe the stock has strong fundamentals to drive its growth and we hold a long-term bullish sentiment towards this stock.

Option Positioning

There are very few options out there in the universe for us to really comment on the option flows since they are less than 6K including both calls and puts.

FULL DISCLOSURE: Chris Capre currently has no stock or options trades in $BL If you’d like to learn more about Chris’s trades and positions, you can get access via the Trading Masterclass where he shares his live trades, further investment ideas and daily market analysis.

Or you can get access to Chris Capre’s entire trading portfolio by becoming a subscriber to Benji Factory.