The company we’re talking about is Boeing (NYSE: BA) and unless you’ve been living under a rock, you should already be aware of the bad-news-storm that started out in 2018/2019 when two of Boeing’s new flagship aircrafts, the Boeing 737 Max, were involved in fatal crashes.

If those crashes weren’t bad enough by themselves, investigations revealed that the management of Boeing had been pushing the internal organization hard, bypassing critical safety barriers in the production of the aircraft.

Initially, Boeing had also told airlines that their pilots only needed a brief refresher training despite the aircraft having a completely new system installed, called MCAS which was the root cause of the two fatal crashes. The pilots involved in the crashes had not received any training on the MCAS system, nor were they aware that this system even existed.

With the 737 model being Boeing’s best selling aircraft type of all time, the combination of bad management decisions and results that followed, couldn’t have been worse.

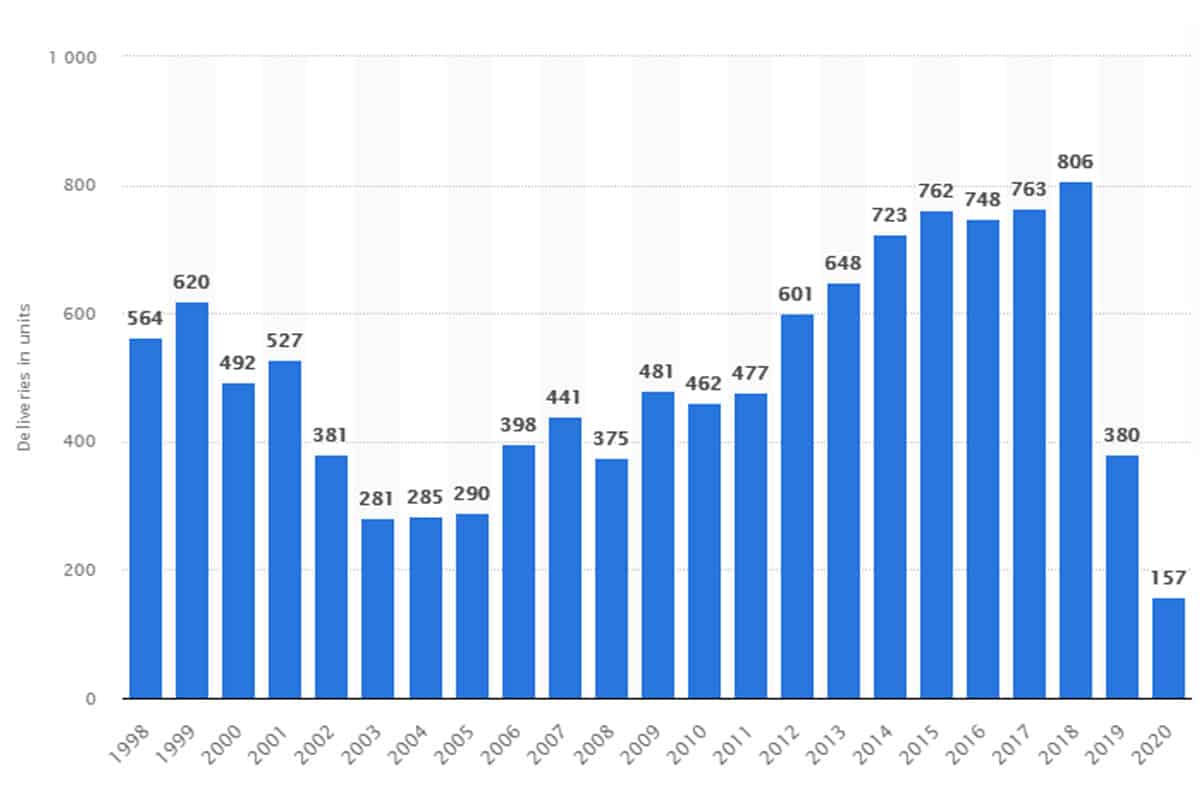

As a result, aircraft deliveries crashed from 806 aircrafts delivered in 2018 to only 157 (!) in 2020.

Revenue dropped from $101 billion in 2018 to $58 billion in 2020, and net income dropped from $10.45 billion in 2018 to -$11.87 billion in 2020!

(Source: Statista)

These are horrendous numbers for the Chicago-based manufacturer and a financial crisis for the company that even had an impact on key economic indicators in the US, slowing down the economic growth by 0.3%-0.4% due to the sheer size of the company.

If the 737 Max problems were not enough, shortly after, the pandemic hit the aviation industry with a baseball bat, reducing international travel at most airports by 90-99%, naturally leading to a slowdown in aircraft sales.

The list of bad news for Boeing can be made long, but in short, below are a few of them:

- Boeing’s Starliner spacecraft capsule has faced major setbacks

- The 787 Dreamliner and 777X aircraft models are facing engineering/certification issues

- The military tanker KC-46 program has faced major delays and setbacks

And whilst Boeing is stuck in its self-inflicted battles, their main competitor Airbus keeps on stealing both market shares and customers in front of their eyes.

What is keeping the stock and company alive at this point is a backlog of more than 4000 commercial aircraft orders and billions in defense orders. But one things is for sure, Boeing must start getting things right from here on out for the company and stock being able to recover to its former glory.

In conclusion, based on all the above, we do not like Boeing at current price levels and think there is more downside to come before the stock is able to stage a strong recovery.

If you’re thinking about buying stocks in Boeing, we think it’s likely best to wait for bigger dips in the stock and/or for the fundamental headwinds of the company to turn into tailwinds.

Technical Analysis

The stock topped out right after the second fatal aviation incident involving a Boeing 737 Max, producing a strong long-term counter-trend false break. After a brief consolidation, the stock then entered a free-fall towards the long-term support zone between $88-$120, a 80% (!) drop in a 12-month period.

Since then, the stock has recovered, but the recovery still looks weak compared to the price action preceding it. Unless we see a clear change in price action or strong positive news coming out, we do not think Boeing is a buy at any other location than the long-term support zone shown above.

Option Positioning

Currently there are about 1.4M calls and 1.15M puts with only 10% of those options rolling off this Sep op-ex. We’re not seeing solid option support till at least $195, and potentially $150.

FULL DISCLOSURE: Chris Capre currently has no stock or option position in BA. If you’d like to learn more about Chris’s trades and positions, you can get access via the Trading Masterclass where he shares his live trades, further investment ideas and daily market analysis.