Our most recent analysis mentioned a stock with solid dividend ratings and worth buying. Today, we have something similar; another dividend stock to boost your portfolio, regardless of the market condition.

Source: Pixabay

But it’s not all rosy for the stock, though, as there are some red flags. So, should you now buy Williams Companies, Inc (NYSE: WMB)?

The Wiliams Companies is an energy midstream establishment that delivers natural gas to its end-users. WMB is so successful that it manages about 30% of the natural gas in the United States.

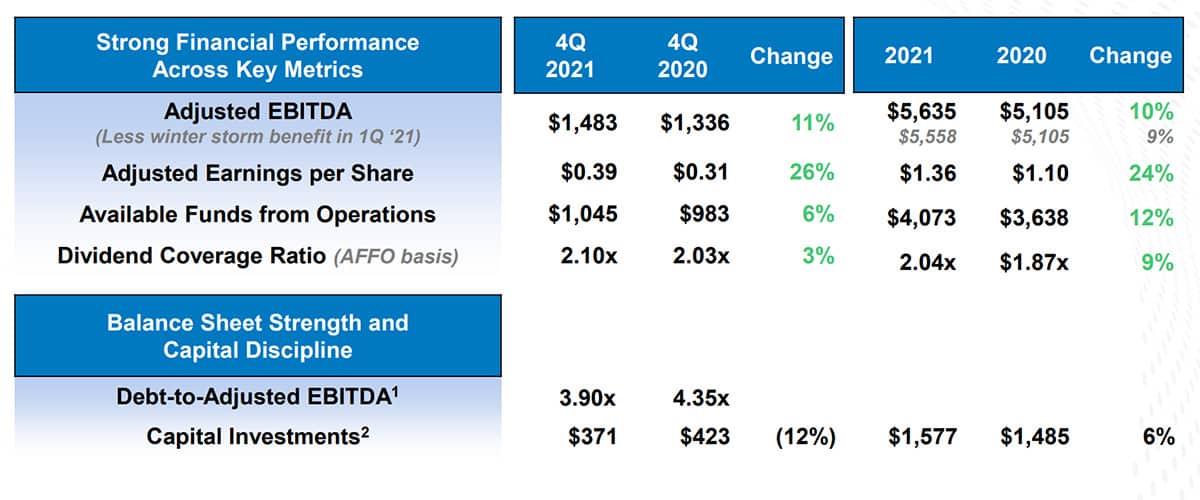

Another thing WMB has going for it is a rock-solid balance sheet. The adjusted EBITDA of the final quarter of FY 2021 increased by 11% year on year to $1.4 billion. Adjusted earnings-per-share increased by 26% to $0.39, And the available funds from operations also topped what it was in FY 2020 by 6% to $1billion.

Source: Williams Companies

These figures are not a one-time thing. WMB has recorded successively solid results in the past. So, it’s not a surprise that the natural gas midstream company has a dividend yield of 5.4%.

Williams Companies might not have the most exciting prospects, but it has put plans in motion to help it remain relevant and even grow. An instance is the company’s agreement to acquire gathering and processing assets at the Haynesville basin. That, and expansion projects in Pennsylvania and Alabama, would increase the company’s capacity going forward.

The valuation, however, is a reason investors could pause before buying the stock. WMB is overvalued at a price-to-earnings ratio of 24.9 in the US oil and gas industry with a PE ratio of 15.8. For this reason, we suggest you hold the stock for now and await a lower valuation.

Technical Analysis

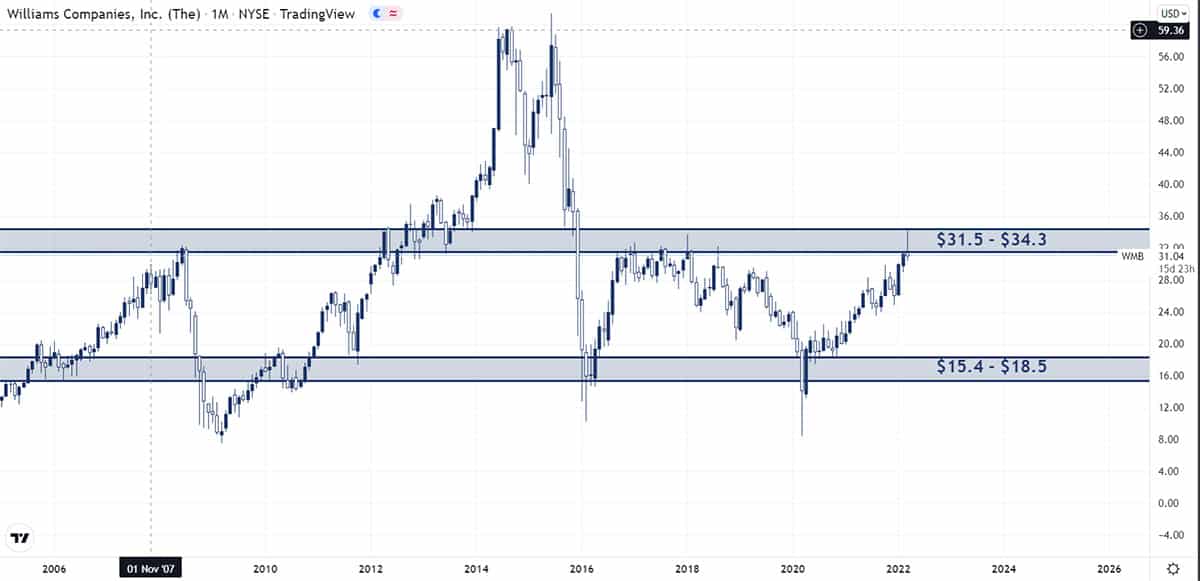

WMB stock has done a great job recovering from the coronavirus-induced dip in March 2020. Over 200% rise since then is no fluke.

There was a resistance level at the $25 price, but the price seems to have gotten past that. However, it is anyone’s guess what the price does at the $31.5 – $34.3 resistance level.

Based on the technical analysis, we recommend you hold the WMB stock until a clear price action pattern appears based on the technical analysis. This pattern could come from the price breaking out of and retesting the $31.5 – $34.3 resistance level or falling back to the $15.4 – $18.5 support level.