Nvidia Corporation (Nasdaq: NVDA) already has over $600 billion in market cap. It’s a massive company by all reasonable definitions. But we have compelling reasons to believe it could become even bigger.

Source: Athena

Since its invention of GPU, Nvidia has found its way into just about any computational device needed for heavy computations.

Like its huge strides in the development, manufacture, and sales of GPU is not enough, the company dipped its toes in the networking hardware and software industry, artificial intelligence, and data analytics. Each field is massive, and customers abound for companies the standard of Nvidia. In fact, the company estimates its data center market to be up to $100 billion three years from now.

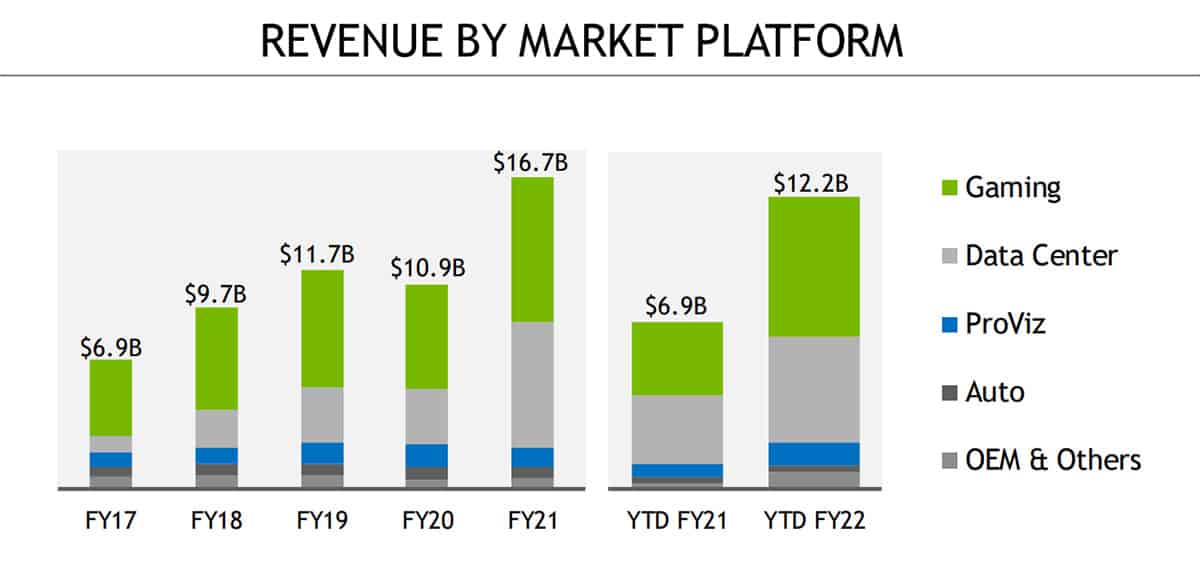

We could go on and on about the strong fundamentals Nvidia has. But we’ll use the company’s figures to summarize what we think about the stock.

Nvidia’s revenue grew by 66.7% to $6.5 billion year/year according to the company’s Q3 FY ‘22 report. About half of this growth was driven by the sales of gaming GPUs, with this department raking in $3 billion. Not far behind is the company’s data center market, which saw a 35% year/year growth to $2.4 billion. These two market platforms, including 3D design, AI, and self-driving cars, make up the company’s growth drivers.

Source: Nvidia

Enough about the fundamentals. Nvidia looks even more attractive on the stock charts.

Technical Analysis

All-time highs almost mean nothing to the NVDA stock, as it has broken its most recent all-time high for the 5th time this year alone. And it doesn’t look to be out of gas yet. On the weekly chart, the stock creates a new trendline and then redefines it, and then redefines it again.

Zooming into the stock on the daily chart, we see how the stock orchestrates a breakout from the $228 – $235 resistance level after a strong push from the bulls, as denoted by the strong spike in volume on the breakout candle.

For traders who intend to trade the stock short term, we recommend you wait for a retest of the $228 – $235 support level and buy around $239 – $241. However, if you’re holding on to the stock for your dear life, you can go bullish immediately. We believe the potential gains from awaiting the retest will be negligible 10 years from now.

Option Positioning

There are currently 1.05M calls and 1.1M put options with about 20% of those options rolling off this Friday. We’re seeing option support coming in around $230 which matches up to the first layer of support in the price action above.

FULL DISCLOSURE: Chris Capre currently has pending orders in $NVDA. If you’d like to learn more about Chris’s trades and positions, you can get access via the Trading Masterclass where he shares his live trades, further investment ideas and daily market analysis.

Or you can get access to Chris Capre’s entire trading portfolio by becoming a subscriber to Benji Factory.