Cruise lines and travel stocks were two industries that took the largest hit when the pandemic landed in early 2020,with bookings and revenue drops up to 99%!

One company still feeling the effects, and trying to adapt to the pandemic challenges is Norwegian Cruise Line Holdings (NYSE: NCLH) which reported a $717 million loss in Q2 alone.

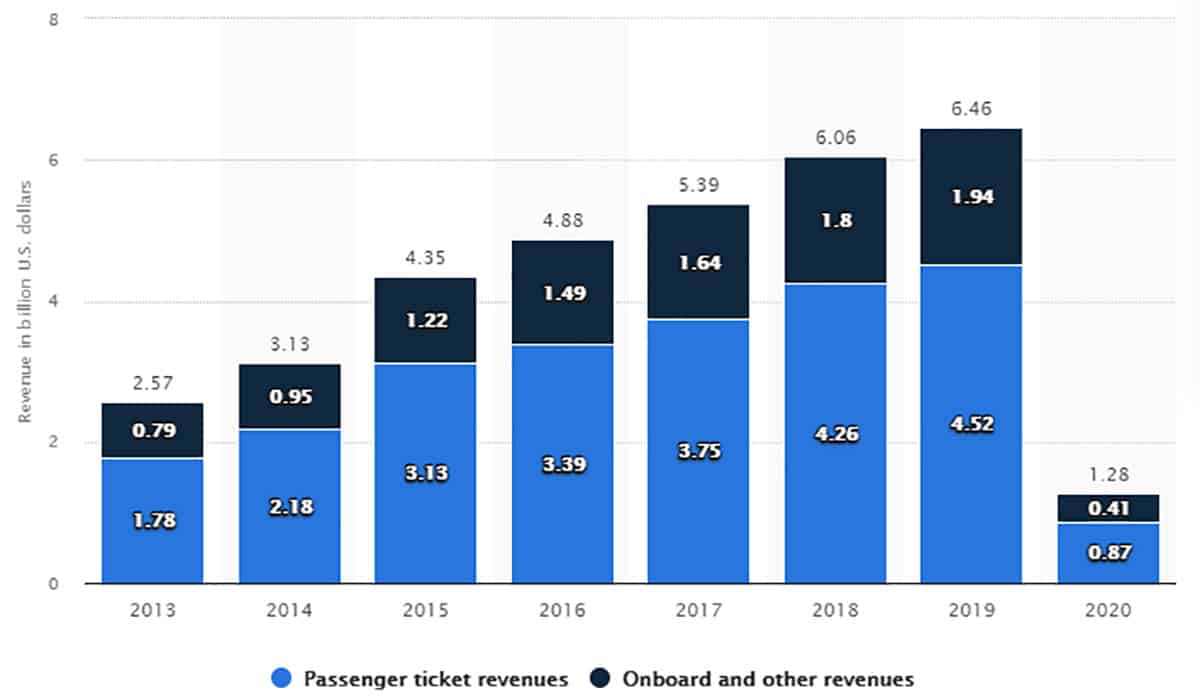

To give you a visualize representation of how bad things got, take a look at the 2013-2020 revenue diagram for Norwegian Cruise Line Holdings below.

(Source: Statista)

On the bright side, the CDC has now given the green light for cruises departing from US ports again which is a clear indication that the worst might be in past for cruise line operators at this point. Obviously the delta variant can delay this, but there is some light ahead.

Another ray of sunshine is that the company’s bookings for the 2022 are already surpassing the bookings of 2019, which was a record year. Add on top of this the fact that the company also has raised cruise prices by up to 20% on new bookings, hinting that the recovery in travel, once it fully manifests, likely will be strong.

In terms of risks, we see two major risk factors for the company with new covid-19 strains emerging being one of them. The delta variant has proven to be very transmissible and it’s very hard to foresee new potential outbreaks which can have renewed negative impacts on the company’s operation and income.

Secondly, the company has taken on major debt during the pandemic (highest debt-to-equity ratio in the sector) which needs to be repaid, and this can obviously only happen if the travel industry recovers in full.

Based on all this, our overall assessment of the company and stock is we think that the recovery process for the travel industry is far from over.

Also, as traders and investors we always want to be able to quantify the risk on every trade/investment. With Norwegian Cruise Line Holdings, we feel that there is too much of an ‘unknown’ factor when it comes to the whole pandemic situation. Thus, we do not think NCLH is a buy for now, especially at current price levels (more on that in the technical analysis below).

Technical Analysis

The stock has recently broken below a key support around $27 and price action suggest further potential downside to be around the corner.

Unless we see a strong reversal/transition from bearish to bullish, based on this price action, for now, we don’t think this stock is a buy unless we get down to the key support zone between $12.50 and $14.50 or some light exposure in the low 20’s.

Option Positioning

In terms of the option traders, we see about 700K calls and 450K puts out there in the market. The largest gamma expiry is September 17, so nothing immediately pushing/pulling this stock.

We see resistance up ahead in terms of option trades with the first layers of support coming in the low 20’s.

FULL DISCLOSURE: Chris Capre currently has no stock or option position in NCLH. If you’d like to learn more about Chris’s trades and positions, you can get access via the Trading Masterclass where he shares his live trades, further investment ideas and daily market analysis.