Splunk (Nasdaq: SPLK) is a cybersecurity and data analytics software company based in San Francisco trusted by 91 of the Fortune 100 companies.

The company has a usage-based pricing model that thrives with its customers, meaning that every time their customers increase the usage of a product or adopt a new one, prices go up and Splunk earns more money, creating a win-win situation for both parties.

On top of this, the company is in a 2-year transition period, moving away from a license-based model to a full SaaS subscription model which should help to ensure and stabilize future cash flow for the company.

Initially, the primary business of Splunk was focused on cybersecurity only, but over time, the company has evolved to become one of the biggest machine-data focused company out there with New Relic and Datadog being its closest publicly traded competitors.

Worth nothing is that Silver Lake Partners recently made a $1 billion convertible stock investment with a strike price $10 above current price which not only communicates long-term confidence in the company but also in the stock direction.

In conclusion, a high-flying SaaS company and growth stock like Splunk, operating with a price to sales ratio of under 10 is hard to find these days and a bargain in the world of tech stocks.

This, coupled with the fact that the stock still is trading 33% below its all-time-high from last year plus has put in a solid reversal structure makes us think that there’s a good amount of potential upside available in Splunk, both from a mid-term trading opportunity, but also from a long-term perspective.

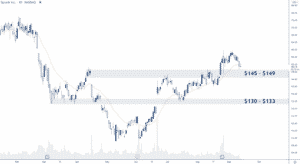

Technical Analysis

Starting 2021 by selling off -35%, in May/June the stock started to stabilize. After successfully building a base and double bottom around $112, the stock has staged a solid comeback and reversal structure.

In late August, buyers managed to clear the key resistance between $145-$149 which we think is a good first location for investors looking to acquire shares of Splunk. Should this area fail to hold as support, we see the next solid area of support coming in at around $130-$133.

Option Positioning

Currently there are 145K calls and 82K puts out there on SPLK, so not a big stock in terms of options volume. $145 is looking like a solid support short term and there are no short dated expiries to affect the price materially one way or another.

FULL DISCLOSURE: Chris Capre currently has no stock or option position in SPLK. If you’d like to learn more about Chris’s trades and positions, you can get access via the Trading Masterclass where he shares his live trades, further investment ideas and daily market analysis.