By definition, value stocks are those that are believed to be trading below their supposed value. In other words, you believe they’re undervalued. For a while now, Metlife, Inc (NYSE: MET) has been regarded as a strong value stock. But with the stock at its highest price ever, is it still a value stock?

Source: Andrea Piacquadio

Metlife is a financial service company that provides services, such as insurance, employee benefits, annuities, and more. Although the company has a presence in over 40 markets, most its revenue comes from its insurance market in the U.S.

If you would judge by the technical analysis alone, you could argue that Metlife is not undervalued. It currently trades at $68.37, which is its highest price ever. More on that below.

But if we’re factoring other things, such as price to earnings ratio, into the equation, the story becomes different. Metlife has a price-to-earnings ratio of 10.88, which is below that of its industry (11.4) and that of the general US market (17.4). This is a positive for value investors.

Earnings, though, may drop in FY 2022. The company puts a majority of the blame on the effects of the pandemic.

So, which is it? Value or not?

Irrespective of if Metlife is a good value stock or not, something you might not really be considering is that Metlife may makes a reasonably good dividend stock with a dividend yield of 2.81%, 0.8% above the current market average.

The company has also recorded a consistently above 3% dividend yield for about seven years now. But long term, this value could go back above 3% going forward.

Technical Analysis

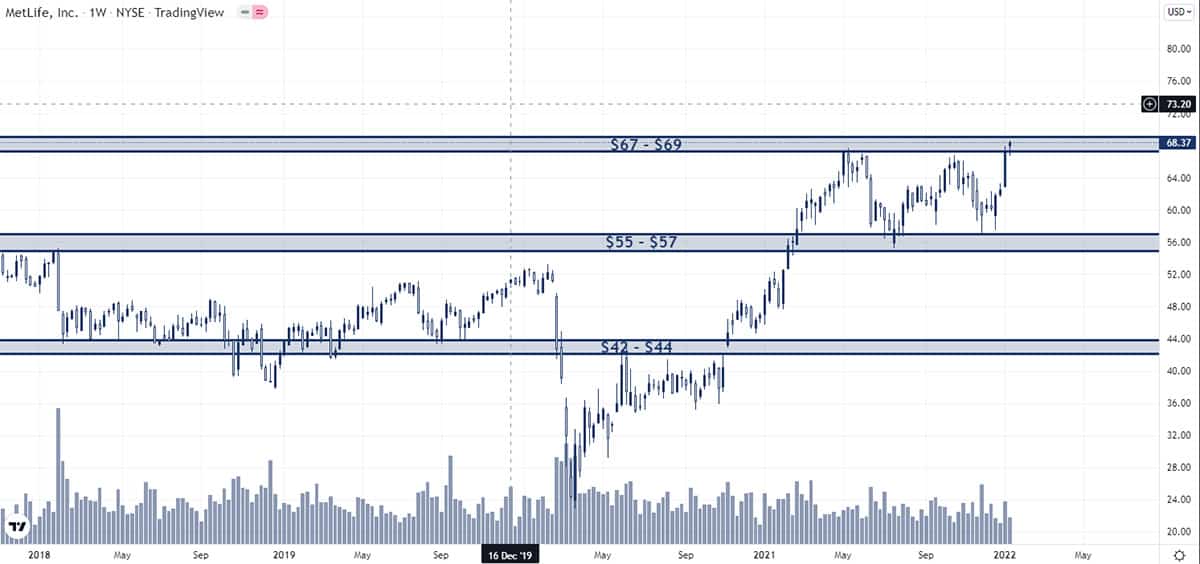

While trading at its all-time high, MET is still within the resistance zone of $67 – $69, and what it does from here could help us determine if the stock can be a value stock once again.

Should the resistance level be strong enough to repel MET, the price could find itself at the next level, which is the $55 – $57 support level. However, the price may well breakout of the resistance level and coast in uncharted territory (as long as it isn’t a false breakout).

While you could argue about the value stock status of Metlife, we believe the dividend status of the stock is surer. And we can’t completely shake off the potential for the future growth of one of the biggest financial services providers in the world, no matter how slow.