With many stocks trading at all-time highs at massive valuations, it can be hard to find stocks that are trading at decent values with promising fundamentals. But Splunk (Nasdaq: SPLK) is such a stock which is trading at <8x next year’s revenue.

In the early days, Splunk’s primary focus was on data analytics & machine data, collecting data within organizations, giving enterprises added insight into security and operations which they primarily used to flag security anomalies within corporate systems.

However, the company is now increasingly focused on moving towards cloud-computing. With the demand for cyber security demand increasing exponentially globally, there’s a lot of market shares for the company to grab going forward.

The recent earnings report already shows that Splunk’s transition is working well for them, with their cloud ARR revenue in Q4 being up 83% year-over-year.

Also, Splunk has a usage-based pricing model which means that the price increases proportionally to the customer’s usage of their products. As data globally continues to explode with more and more companies realizing the power and insight data can yield, Splunk is very well positioned to take advantage of this in the upcoming years.

It also seems investors feel confident about the company’s direction with Silver Lake recently announcing a $1 billion investment in the company via convertible notes. Based on all this, if you are looking for long-term investment opportunities, we think Splunk is worth keeping on your radar.

Technical Analysis

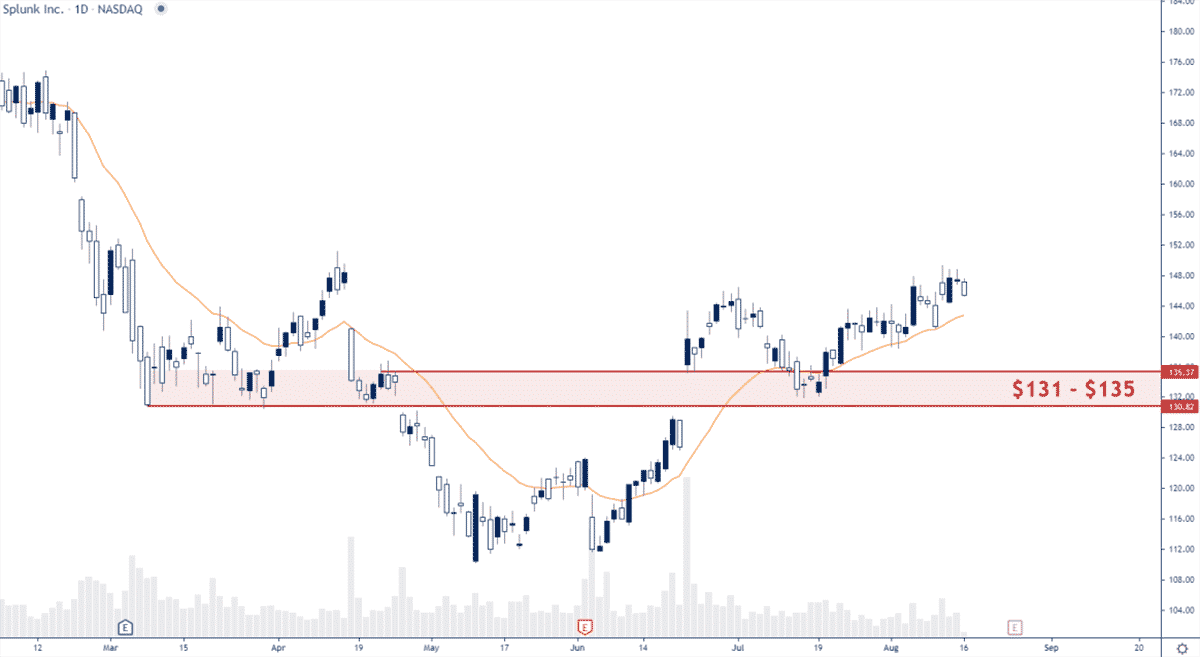

The stock underperformed last year and even this year it’s down -14.8%. But recent price action is suggesting that the tide might be turning as the order flow clearly has shifted from bearish to bullish mid-term with price currently trading correctively above a key support zone.

Based on this price action, we think that weak pullbacks towards $131-$135 can offer good opportunities to initialize bullish positions in Splunk.

Option Positioning

Currently there are about 175K calls and 92K puts, so the market is call heavy with a put:call ratio of .52. There are a fair number of options expiring this Friday (~38%) so we expect a little bit of a pullback this week. Option positioning supports looking for long opportunities around the $130-$140 price range.

FULL DISCLOSURE: Chris Capre currently has no stock or option position in SPLK. If you’d like to learn more about Chris’s trades and positions, you can get access via the Trading Masterclass where he shares his live trades, further investment ideas and daily market analysis.